Fyi Income 25 Form

What is the publication fyi income 25?

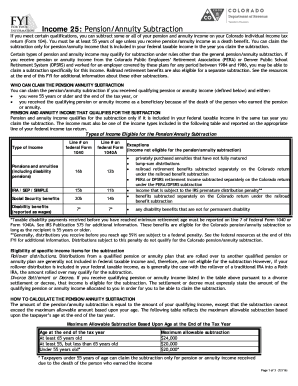

The publication fyi income 25 is a tax document issued by the Colorado Department of Revenue. It provides guidance on various aspects of income tax for residents and businesses in Colorado. This publication outlines how to report income, deductions, and credits, ensuring taxpayers have a clear understanding of their obligations under Colorado tax law. It serves as a crucial resource for individuals preparing their state income tax returns, helping them navigate the complexities of state tax regulations.

How to use the publication fyi income 25

Using the publication fyi income 25 involves several steps to ensure compliance with Colorado tax requirements. Taxpayers should first obtain the publication, which can be accessed online through the Colorado Department of Revenue's website. Once in possession of the document, individuals should review the sections relevant to their income situation, including instructions on reporting various types of income and applicable deductions. It is essential to follow the guidelines closely to avoid errors that could lead to penalties or delays in processing tax returns.

Steps to complete the publication fyi income 25

Completing the publication fyi income 25 requires careful attention to detail. Here are the key steps:

- Gather all necessary financial documents, including W-2s, 1099s, and any other income statements.

- Review the publication for specific instructions related to your income type.

- Fill out the relevant sections accurately, ensuring all income and deductions are reported.

- Double-check your entries for accuracy before submission.

- Submit your completed tax return by the designated deadline to avoid penalties.

Legal use of the publication fyi income 25

The legal use of the publication fyi income 25 is essential for ensuring compliance with Colorado tax laws. Taxpayers must adhere to the guidelines set forth in the publication to avoid potential legal issues. This includes accurately reporting income, claiming eligible deductions, and maintaining proper documentation. The publication serves as an official reference, and using it correctly can help prevent disputes with the Colorado Department of Revenue regarding tax liabilities.

Key elements of the publication fyi income 25

Several key elements are integral to the publication fyi income 25. These include:

- Definitions of various income types, such as wages, self-employment income, and investment income.

- Instructions on allowable deductions, including business expenses and personal exemptions.

- Information on tax credits available to Colorado taxpayers.

- Details on filing methods, including electronic submission options.

Filing deadlines for the publication fyi income 25

Filing deadlines for the publication fyi income 25 are crucial for compliance. Typically, Colorado state income tax returns are due on April fifteenth of each year. However, taxpayers should check for any specific extensions or changes to deadlines that may apply. Filing on time is essential to avoid penalties and interest on unpaid taxes. It is advisable to mark the deadline on your calendar and prepare your tax return well in advance to ensure timely submission.

Quick guide on how to complete fyi income 25

Effortlessly Prepare Fyi Income 25 on Any Device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the features required to create, edit, and electronically sign your documents promptly without issues. Manage Fyi Income 25 on any device utilizing airSlate SignNow's Android or iOS applications and streamline any document-related processes today.

Edit and eSign Fyi Income 25 with Ease

- Obtain Fyi Income 25 and click on Get Form to begin.

- Utilize the tools at your disposal to complete your document.

- Emphasize essential sections of your documents or obscure sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Choose your preferred method to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, time-consuming form searches, or errors necessitating the printing of new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Fyi Income 25 while ensuring seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fyi income 25

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the publication fyi income 25 feature in airSlate SignNow?

The publication fyi income 25 feature in airSlate SignNow enables users to manage and track income-related documents efficiently. It simplifies the process of eSigning and sharing essential income documentation, ensuring that you can comply with all necessary regulations and timelines.

-

How does airSlate SignNow support the publication fyi income 25?

airSlate SignNow supports the publication fyi income 25 by providing customizable templates and workflows tailored to income documents. Users can quickly create, send, and obtain eSignatures on these crucial documents, making the process seamless and time-efficient.

-

Is there a cost associated with using the publication fyi income 25 feature?

Yes, there is a cost associated with using airSlate SignNow, which offers various pricing plans to accommodate different needs. The value of the publication fyi income 25 feature is evident in the time saved and efficiency gained in managing income-related documents.

-

What are the benefits of using airSlate SignNow for publication fyi income 25?

Using airSlate SignNow for publication fyi income 25 provides signNow benefits, including improved document security, increased workflow efficiency, and reduced paper usage. These features not only streamline the signing process but also contribute to cost savings for your business.

-

Can I integrate airSlate SignNow with other tools for publication fyi income 25?

Yes, airSlate SignNow can be integrated with various third-party applications to enhance the publication fyi income 25 processes. Popular integrations include CRM systems, cloud storage solutions, and accounting software, allowing for a more cohesive workflow.

-

How does airSlate SignNow ensure the security of publication fyi income 25 documents?

airSlate SignNow ensures the security of publication fyi income 25 documents by implementing advanced encryption and compliance with industry standards. This provides peace of mind for users, knowing that their sensitive income documents are protected.

-

Is it easy to use airSlate SignNow for the publication fyi income 25?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making the publication fyi income 25 process straightforward for users of all tech skill levels. The intuitive interface allows for quick document generation and eSigning without needing extensive training.

Get more for Fyi Income 25

- Deephaven parking permit form

- Mass earned sick time form

- Church budget request form 258402252

- Plumbing installation checklist form

- Form gst reg 06

- 25 fillable 03 breakout audio visual form

- Texas lottery electronic funds transfer authorization form txbingo

- State of arizona affidavit of shared residence form

Find out other Fyi Income 25

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation