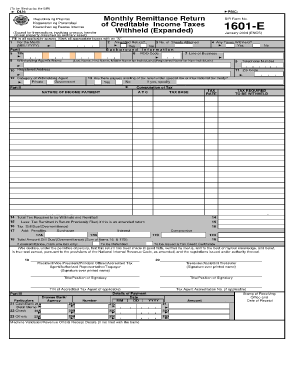

1601 E PDF Form

What is the 1601 E PDF

The 1601 E PDF is a specific form utilized primarily for tax-related purposes within the United States. It is designed to facilitate the reporting of certain financial information to the Internal Revenue Service (IRS). This form is essential for individuals and businesses alike, ensuring compliance with federal tax regulations. Understanding the purpose and requirements of the 1601 E PDF is crucial for accurate tax filing.

How to use the 1601 E PDF

Using the 1601 E PDF involves several key steps to ensure that the information provided is accurate and complete. First, download the form from a reliable source. Next, carefully read the instructions accompanying the form to understand the specific information required. Fill out the form with the necessary details, ensuring that all entries are clear and legible. Once completed, review the form for any errors before submission.

Steps to complete the 1601 E PDF

Completing the 1601 E PDF requires attention to detail. Follow these steps:

- Download the form from an official source.

- Read the instructions thoroughly to understand the requirements.

- Fill in your personal and financial information accurately.

- Check for any additional documentation needed to support your entries.

- Review the completed form for accuracy and completeness.

- Submit the form as per the guidelines provided.

Legal use of the 1601 E PDF

The legal use of the 1601 E PDF is paramount for ensuring compliance with tax laws. This form must be filled out accurately and submitted within the specified deadlines to avoid penalties. The information provided on the form is subject to verification by the IRS, making it essential to maintain honesty and transparency in reporting financial data. Proper use of the form can protect individuals and businesses from legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the 1601 E PDF are critical to avoid penalties. Typically, the IRS sets specific dates each year for when forms must be submitted. It is important to stay informed about these deadlines, as late submissions can lead to fines or other legal consequences. Marking these dates on your calendar can help ensure timely filing and compliance with federal regulations.

Required Documents

Completing the 1601 E PDF may require several supporting documents. These can include:

- Proof of income, such as W-2 or 1099 forms.

- Documentation of deductions or credits being claimed.

- Identification information, including Social Security numbers.

Gathering these documents in advance can streamline the completion process and help ensure accuracy.

Form Submission Methods (Online / Mail / In-Person)

The 1601 E PDF can be submitted through various methods, depending on the preferences of the filer. Options include:

- Online submission through the IRS e-filing system.

- Mailing the completed form to the designated IRS address.

- In-person submission at local IRS offices, if applicable.

Choosing the right submission method can affect processing times and overall convenience.

Quick guide on how to complete 1601 e pdf

Effortlessly prepare 1601 E PDF on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute to conventional printed and signed documents, allowing you to access the appropriate format and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and without hassle. Manage 1601 E PDF across any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and eSign 1601 E PDF effortlessly

- Find 1601 E PDF and click on Get Form to initiate the process.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive information using the tools provided by airSlate SignNow designed specifically for this purpose.

- Generate your electronic signature with the Sign feature, which only takes a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form—by email, text message (SMS), invitation link, or download it straight to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign 1601 E PDF and guarantee seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1601 e pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1601 E PDF and how can it be used with airSlate SignNow?

The 1601 E PDF is a specific document format used for electronic signatures. With airSlate SignNow, you can easily upload, sign, and send a 1601 E PDF, streamlining your document management process and enhancing productivity.

-

How does airSlate SignNow ensure the security of my 1601 E PDF documents?

airSlate SignNow prioritizes security by using encryption and secure storage for all documents, including your 1601 E PDF files. This ensures that your sensitive information remains protected while being shared and signed electronically.

-

What are the pricing plans for using airSlate SignNow with 1601 E PDF?

airSlate SignNow offers several pricing plans to cater to different business needs when using 1601 E PDF documents. Each plan includes features that facilitate document signing and management, making it a cost-effective solution for any organization.

-

Can I integrate airSlate SignNow with other applications to manage my 1601 E PDF files?

Yes, airSlate SignNow provides integration options with various third-party applications which can help you manage your 1601 E PDF files more efficiently. This includes popular CRM and project management tools to enhance your workflow.

-

What features does airSlate SignNow provide for editing 1601 E PDF documents?

airSlate SignNow offers a range of features for editing 1601 E PDF documents, including easy annotation, form filling, and text editing capabilities. These features simplify the process of preparing documents for e-signature, making your workflow seamless.

-

How can I track the status of my 1601 E PDF documents in airSlate SignNow?

With airSlate SignNow, you can easily track the status of your 1601 E PDF documents. The platform provides real-time notifications and tracking features, allowing you to know when a document is viewed, signed, or completed.

-

Is there a mobile app available for signing 1601 E PDF documents with airSlate SignNow?

Yes, airSlate SignNow offers a mobile app that enables you to sign 1601 E PDF documents on the go. The app provides the same user-friendly interface, allowing you to manage your documents easily from your mobile device.

Get more for 1601 E PDF

- Appointment as personal representative i delivered or mailed in accordance with the requirements of ars form

- Petition for family allowance form

- I am the personal representative of this estate and i make these statements under oath form

- Final accounting of form

- Petition for discharge of form

- And petition for form

- Summary administration form

- Petitioner has the following interest in the estate form

Find out other 1601 E PDF

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe