Form Nyc 210 for

What is the Form NYC 210 For

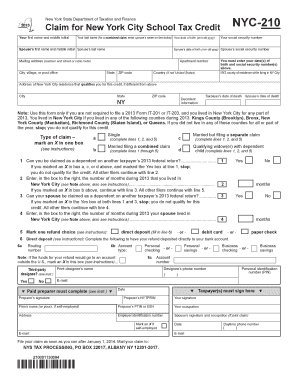

The NYC 210 form is a crucial document used primarily for tax purposes in New York City. It serves to report various financial activities, including income and deductions, and is essential for both individuals and businesses operating within the city. The form is designed to ensure compliance with local tax regulations and facilitate accurate tax assessments. By providing detailed information about income sources, expenses, and other financial data, the NYC 210 helps taxpayers fulfill their obligations while potentially minimizing their tax liabilities.

How to Use the Form NYC 210 For

Using the NYC 210 form involves several key steps. First, gather all necessary financial documents, such as W-2s, 1099s, and receipts for deductible expenses. Next, accurately fill out the form, ensuring all required fields are completed. It is important to double-check the information for accuracy, as errors can lead to delays or penalties. Once completed, the form can be submitted electronically or via mail, depending on the taxpayer's preference and the specific requirements of the New York City Department of Finance.

Steps to Complete the Form NYC 210 For

Completing the NYC 210 form requires careful attention to detail. Follow these steps:

- Gather all relevant financial documents, including income statements and expense receipts.

- Begin filling out the form by entering personal information, such as name, address, and Social Security number.

- Report all sources of income accurately, including wages, self-employment income, and any other earnings.

- Detail any deductions you qualify for, such as business expenses or educational costs.

- Review the completed form for accuracy and completeness, ensuring all calculations are correct.

- Submit the form electronically through the appropriate channels or mail it to the designated address.

Legal Use of the Form NYC 210 For

The NYC 210 form is legally binding when completed and submitted according to the guidelines set forth by the New York City Department of Finance. To ensure the legal validity of the form, it must be filled out truthfully and accurately. Misrepresentation or failure to disclose relevant information can result in penalties, including fines or audits. It is essential to maintain compliance with all applicable tax laws to avoid legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the NYC 210 form are critical to ensure compliance and avoid penalties. Typically, the form must be submitted by April fifteenth of each year for individual taxpayers. For businesses, deadlines may vary based on the type of entity and fiscal year. It is advisable to check the New York City Department of Finance website for specific dates and any extensions that may apply. Keeping track of these deadlines helps ensure timely submission and compliance with local tax regulations.

Form Submission Methods (Online / Mail / In-Person)

The NYC 210 form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online Submission: Taxpayers can file electronically through the New York City Department of Finance's online portal, which offers a streamlined process.

- Mail Submission: Completed forms can be mailed to the designated address provided by the Department of Finance. Ensure that sufficient postage is applied.

- In-Person Submission: Taxpayers may also choose to submit the form in person at local tax offices, where assistance may be available.

Quick guide on how to complete form nyc 210 for

Effortlessly Prepare Form Nyc 210 For on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, edit, and eSign your documents promptly and without complications. Manage Form Nyc 210 For across any platform using airSlate SignNow Android or iOS applications and simplify your document-based tasks today.

How to Edit and eSign Form Nyc 210 For with Ease

- Find Form Nyc 210 For and click Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize important sections of your documents or redact sensitive information using tools specifically offered by airSlate SignNow for this purpose.

- Create your signature with the Sign tool, which only takes a few seconds and carries the same legal significance as a traditional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how to submit your form, whether by email, SMS, invitation link, or download it directly to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes requiring new document prints. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign Form Nyc 210 For and ensure effective communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form nyc 210 for

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is NYC 210 and how does it relate to airSlate SignNow?

NYC 210 refers to a specific regulatory requirement that businesses in New York City must adhere to. airSlate SignNow simplifies compliance with NYC 210 by providing a secure platform for electronic signatures, ensuring your documents are signed legally and efficiently.

-

How much does airSlate SignNow cost for NYC 210 compliance?

Pricing for airSlate SignNow varies based on the features you need for NYC 210 compliance. We offer flexible pricing plans designed to accommodate businesses of all sizes, ensuring you get the best value while meeting the requirements of NYC 210.

-

What features does airSlate SignNow offer to assist with NYC 210?

airSlate SignNow offers features like customizable templates, secure cloud storage, and robust authentication options, all tailored to help meet NYC 210 requirements. These features make it easy for businesses to streamline their document processes and maintain compliance with local regulations.

-

Can airSlate SignNow integrate with other tools to support NYC 210?

Yes, airSlate SignNow seamlessly integrates with various applications and platforms, enhancing your workflow while ensuring compliance with NYC 210. Popular integrations include CRMs, document management systems, and productivity tools, making it easier to manage your documents.

-

What are the benefits of using airSlate SignNow for NYC 210?

Using airSlate SignNow for NYC 210 compliance brings numerous benefits, including improved efficiency, reduced paperwork, and enhanced security for your documents. The platform's user-friendly interface allows teams to collaborate effectively while ensuring that all signatures meet the requirements of NYC 210.

-

Is airSlate SignNow compliant with NYC 210 regulations?

Absolutely. airSlate SignNow adheres to all necessary regulations, including NYC 210, ensuring that your electronic signatures are valid and enforceable. Our commitment to compliance means you can trust our platform for all your document management needs.

-

How does airSlate SignNow ensure the security of documents related to NYC 210?

Security is a top priority for airSlate SignNow, especially when dealing with sensitive documents under NYC 210. We implement advanced encryption and secure access protocols to protect your data, ensuring that all documents are secure throughout the signing process.

Get more for Form Nyc 210 For

- Protecting your claim on california public works projects form

- Individual as direct contractor form

- How to file probate in sacramento countya peoples choice form

- Control number ca 025 78 form

- Notice of intent to file 10 day stop work notice form

- Notice of cancellation of 10 day stop work form

- Exhibit o 3 form modification documents hamstreetnet

- Amended and restated deed of trust securing a debt between individuals form

Find out other Form Nyc 210 For

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself