State Form 2837

What is the State Form 2837

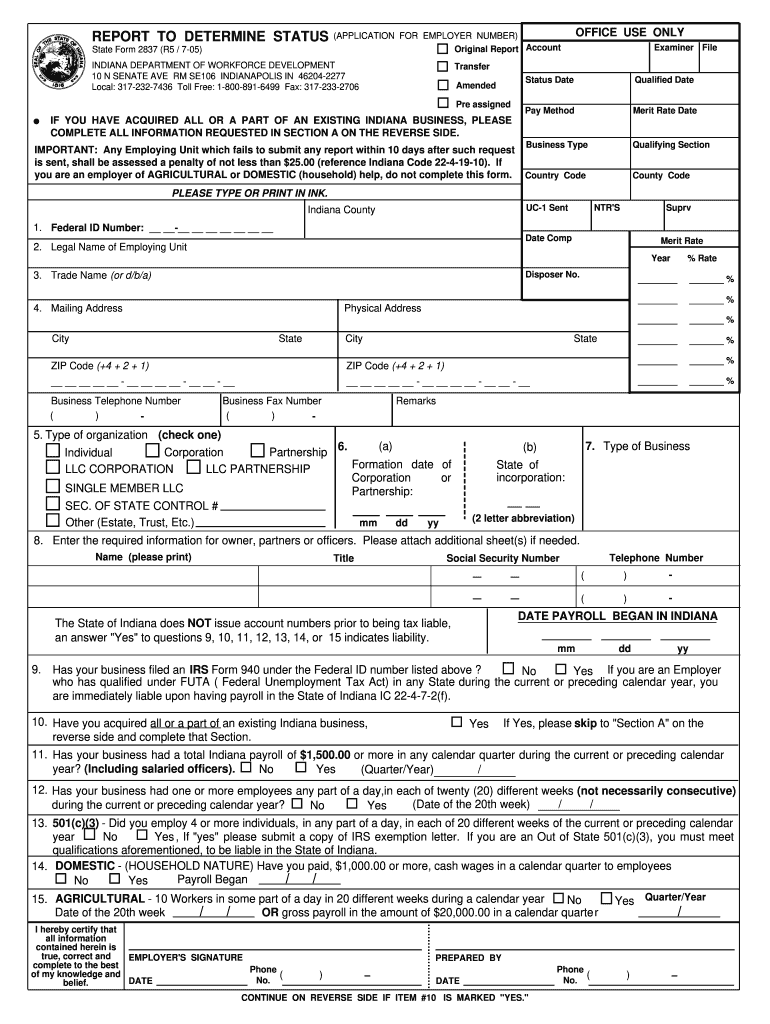

The Indiana State Form 2837 is a specific document used for various administrative purposes within the state of Indiana. This form is essential for individuals and businesses needing to provide information or make requests to state agencies. Understanding its purpose and requirements is crucial for ensuring compliance with state regulations.

How to use the State Form 2837

Using the Indiana State Form 2837 involves filling out the required fields accurately and completely. Users should ensure that all information is current and relevant to their specific situation. The form may be used in various contexts, such as tax filings or applications for permits, depending on the user's needs. It is advisable to review the form's instructions carefully to avoid common mistakes.

Steps to complete the State Form 2837

Completing the Indiana State Form 2837 involves several key steps:

- Obtain the latest version of the form from the appropriate state agency.

- Read the instructions thoroughly to understand the requirements.

- Fill in your personal or business information as required.

- Provide any necessary supporting documentation, if applicable.

- Review the completed form for accuracy before submission.

Legal use of the State Form 2837

The legal use of the Indiana State Form 2837 is governed by state regulations. To ensure that the form is considered valid, it must be completed in accordance with the specified guidelines. This includes providing accurate information and adhering to any deadlines associated with the form's submission. Failure to comply with these legal requirements may result in delays or rejection of the form.

Key elements of the State Form 2837

Key elements of the Indiana State Form 2837 include:

- Identification information, such as name and address.

- Specific details related to the purpose of the form.

- Signature lines for necessary parties.

- Sections for additional comments or explanations.

Form Submission Methods

The Indiana State Form 2837 can typically be submitted through various methods, including:

- Online submission via designated state portals.

- Mailing the completed form to the appropriate agency.

- In-person delivery at designated state offices.

Who Issues the Form

The Indiana State Form 2837 is issued by specific state agencies depending on its intended use. It is important for users to identify the correct agency to ensure they are using the form properly. This may include departments related to taxation, business regulation, or other administrative functions.

Quick guide on how to complete state form 2837

Complete State Form 2837 effortlessly on any device

Digital document management has become widely embraced by organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can locate the appropriate form and securely store it in the cloud. airSlate SignNow provides all the tools necessary for you to create, modify, and eSign your documents quickly without delays. Manage State Form 2837 on any device using airSlate SignNow applications for Android or iOS and streamline any document-related process today.

How to modify and eSign State Form 2837 effortlessly

- Locate State Form 2837 and click Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools specifically designed for that by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method of submitting your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs with just a few clicks from your chosen device. Modify and eSign State Form 2837 and guarantee clear communication at any point during the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the state form 2837

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Indiana state form 2837 used for?

The Indiana state form 2837 is used for vehicle title applications and transfers. This form facilitates the effective management of vehicle ownership and ensures that all ownership details are accurately recorded. Using airSlate SignNow can streamline the eSigning process for this form, making it easy for all parties involved.

-

How can I fill out the Indiana state form 2837 electronically?

You can fill out the Indiana state form 2837 electronically by using airSlate SignNow's intuitive platform. Simply upload the form, input the required information, and use our eSign features to complete the signing process. This makes handling vehicle title applications quick and hassle-free.

-

Is there a cost associated with using airSlate SignNow for the Indiana state form 2837?

Yes, there is a subscription cost associated with using airSlate SignNow, but it is designed to be cost-effective for businesses of all sizes. Depending on your needs, you can choose a plan that best suits your usage of the Indiana state form 2837 and other electronic document signing needs. The investment can save you time and resources in the long run.

-

What features does airSlate SignNow offer for managing Indiana state form 2837?

airSlate SignNow offers a variety of features for managing Indiana state form 2837, including real-time tracking of document status, customizable templates, and secure cloud storage. These features enhance the workflow and ensure compliance with state requirements. You can also integrate your signed forms directly into your existing systems.

-

Can I share the completed Indiana state form 2837 with multiple parties?

Absolutely! With airSlate SignNow, you can easily share the completed Indiana state form 2837 with multiple parties for their signatures. The platform enables you to add recipients, set signing order, and send notifications, making collaborative signing efficient and straightforward.

-

Is airSlate SignNow compliant with Indiana state regulations regarding the Indiana state form 2837?

Yes, airSlate SignNow is compliant with Indiana state regulations regarding electronic signatures. The platform adheres to the requirements set forth by state law, ensuring that your Indiana state form 2837 is legally binding and accepted by government entities. This means you can confidently use our solution for your document needs.

-

How does airSlate SignNow integrate with other applications for managing Indiana state form 2837?

airSlate SignNow offers seamless integrations with various applications that can help manage the Indiana state form 2837. Whether you use CRM systems, project management tools, or accounting software, our platform can connect with them to enhance your document workflows and improve efficiency.

Get more for State Form 2837

- A corporation organized under the laws of the state of its form

- Corporation organized under the laws of the state of its successors or assigns form

- Under delaware law an equine professional is not liable for an injury to or the death of form

- Between an individual hereinafter referred to as party of the first 490118156 form

- Hereby grants and conveys unto a corporation organized under the laws of form

- Contractors list individual form

- Tips for registering your appaloosa form

- Authorization to obtain urgent medical treatment for minor form

Find out other State Form 2837

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later