Worksheet to See If You Should Fill in Form 6251

Understanding the Worksheet to See If You Should Fill In Form 6251

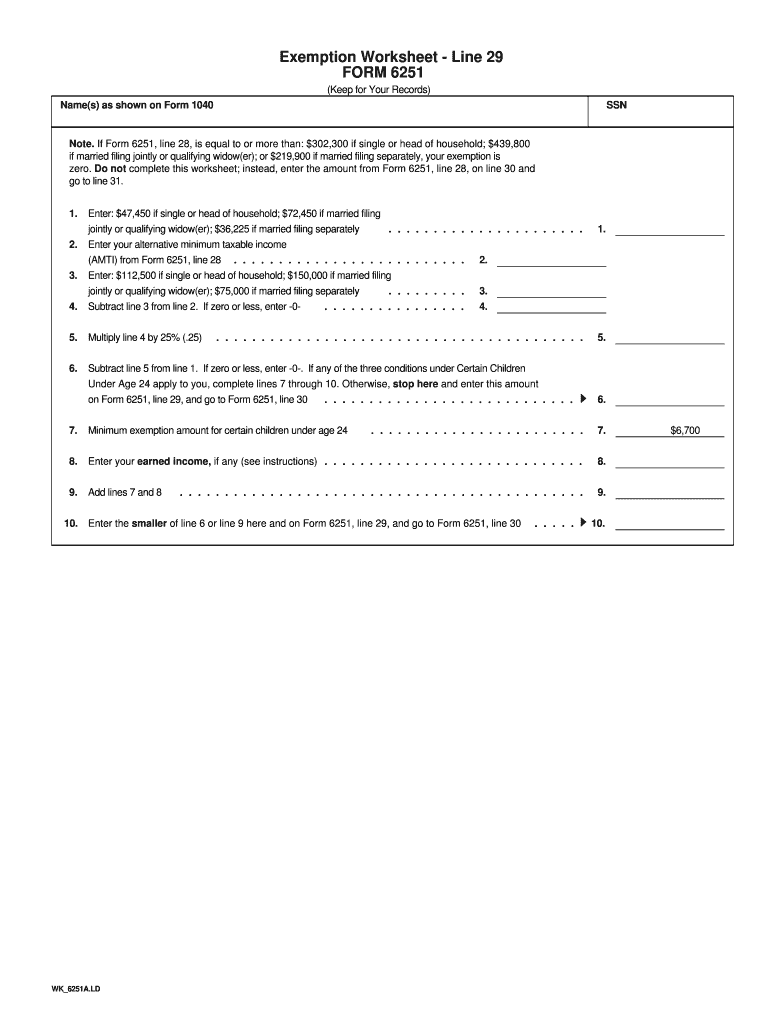

The Worksheet to See If You Should Fill In Form 6251 is a crucial tool for taxpayers who may be subject to the alternative minimum tax (AMT). This worksheet helps determine whether you need to complete Form 6251, which is essential for calculating your AMT liability. The worksheet guides you through various income and deduction scenarios, allowing you to assess your tax situation accurately. By following the worksheet, you can identify if your income exceeds the AMT exemption thresholds and if you need to take any further action.

Steps to Complete the Worksheet to See If You Should Fill In Form 6251

Completing the Worksheet to See If You Should Fill In Form 6251 involves several straightforward steps:

- Begin by gathering your financial documents, including income statements and deduction records.

- Follow the instructions on the worksheet, which will guide you through specific income and deduction questions.

- Calculate your total income and any adjustments as outlined in the worksheet.

- Determine if your income exceeds the AMT exemption amount based on your filing status.

- Review the results to see if you need to complete Form 6251.

By carefully following these steps, you can ensure that you accurately assess your need to fill out Form 6251.

Legal Use of the Worksheet to See If You Should Fill In Form 6251

The Worksheet to See If You Should Fill In Form 6251 is designed to comply with IRS regulations, ensuring that taxpayers can assess their AMT liability legally. Utilizing this worksheet is important for maintaining compliance with tax laws, as it provides a structured method for determining your tax obligations. Proper usage of this worksheet can help avoid penalties associated with underreporting income or failing to file necessary forms.

IRS Guidelines for the Worksheet to See If You Should Fill In Form 6251

The IRS provides specific guidelines regarding the use of the Worksheet to See If You Should Fill In Form 6251. It is essential to refer to the most current IRS instructions to ensure that you are using the correct version of the worksheet. The IRS outlines eligibility criteria, necessary calculations, and any updates to the AMT exemption amounts. Staying informed about these guidelines will help you complete the worksheet accurately and in compliance with federal tax regulations.

Examples of Using the Worksheet to See If You Should Fill In Form 6251

Understanding how to use the Worksheet to See If You Should Fill In Form 6251 can be enhanced through examples. For instance, if a taxpayer has significant deductions that may trigger AMT, the worksheet will help them evaluate whether their income level necessitates completing Form 6251. Another example includes a taxpayer with multiple income sources who needs to assess their overall tax liability. These scenarios illustrate the practical application of the worksheet in real-life tax situations.

Obtaining the Worksheet to See If You Should Fill In Form 6251

The Worksheet to See If You Should Fill In Form 6251 can be obtained directly from the IRS website or through tax preparation software that includes IRS forms. It is important to ensure you are using the most recent version of the worksheet to reflect current tax laws and regulations. Accessing the worksheet online allows for easy printing and completion, whether you choose to fill it out manually or digitally.

Quick guide on how to complete worksheet to see if you should fill in form 6251

Complete Worksheet To See If You Should Fill In Form 6251 effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals alike. It offers a perfect eco-friendly substitute for conventional printed and signed documents, enabling you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools you need to create, edit, and eSign your documents swiftly without holdups. Manage Worksheet To See If You Should Fill In Form 6251 on any device with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Worksheet To See If You Should Fill In Form 6251 effortlessly

- Find Worksheet To See If You Should Fill In Form 6251 and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes moments and carries the same legal validity as a traditional handwritten signature.

- Review the details and then hit the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tiring form searches, or errors requiring new document prints. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign Worksheet To See If You Should Fill In Form 6251 and ensure excellent communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the worksheet to see if you should fill in form 6251

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the worksheet to see if you should fill in form 6251?

The worksheet to see if you should fill in form 6251 is a tool that helps taxpayers determine if they need to complete IRS Form 6251 for alternative minimum tax. By following the worksheet, you can assess your financial situation and identify whether specific income adjustments apply to you.

-

How can airSlate SignNow assist with the worksheet to see if you should fill in form 6251?

airSlate SignNow simplifies the process by allowing you to sign and send completed forms, including those related to the worksheet to see if you should fill in form 6251. Our platform provides an easy-to-use interface that streamlines your document management and eSignature needs.

-

Is there a cost associated with using the worksheet to see if you should fill in form 6251 on airSlate SignNow?

Using airSlate SignNow to manage documents related to the worksheet to see if you should fill in form 6251 is affordable, with flexible pricing plans to meet diverse business needs. We offer plans that cater to both individuals and organizations, allowing you to choose the best option for you.

-

What features does airSlate SignNow offer for the worksheet to see if you should fill in form 6251?

airSlate SignNow includes features such as customizable templates, secure eSignatures, and automated workflows that enhance the efficiency of handling documents like the worksheet to see if you should fill in form 6251. Our robust toolset allows users to manage, review, and sign documents all in one place.

-

Can I integrate airSlate SignNow with other applications while using the worksheet to see if you should fill in form 6251?

Yes, airSlate SignNow offers integration with various applications, allowing you to seamlessly utilize the worksheet to see if you should fill in form 6251 alongside your existing tools. This flexibility helps streamline your document management processes and enhance productivity.

-

What are the benefits of using airSlate SignNow for the worksheet to see if you should fill in form 6251?

By using airSlate SignNow, you can efficiently manage the worksheet to see if you should fill in form 6251 with features that enable quick document turnaround and secure eSignatures. This platform not only saves time but also ensures compliance with legal requirements, giving you peace of mind.

-

How does airSlate SignNow ensure security when handling the worksheet to see if you should fill in form 6251?

airSlate SignNow prioritizes the security of your documents, including the worksheet to see if you should fill in form 6251, with advanced security measures such as encryption and secure access controls. Our commitment to protecting sensitive information allows you to use our platform with confidence.

Get more for Worksheet To See If You Should Fill In Form 6251

- Quit claim deed business entity to individual 1034 form

- Top 3 inches reserved for recording data minnesota form

- Being first duly sworn on oath says that form

- Warranty deed business entity to joint tenants form

- Receipt and waiver of mechanics lien rights title services inc form

- Affidavit by an initial transferee by business entity 100 form

- Transfer on death deed statutory form 1084pdf fpdf

- Download modern real estate acquisition and disposition forms

Find out other Worksheet To See If You Should Fill In Form 6251

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online