Fidelity W9 Form

What is the Fidelity W-9 Form

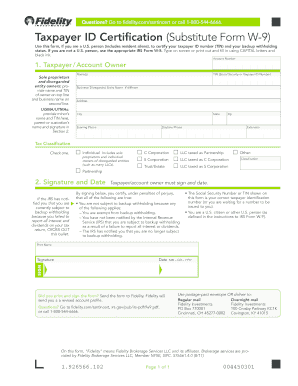

The Fidelity W-9 form is a tax document used by individuals and businesses to provide their taxpayer identification information to Fidelity Investments. This form is essential for reporting income to the Internal Revenue Service (IRS) and is typically requested by financial institutions, employers, or other entities that need to report payments made to you. The W-9 includes details such as your name, business name (if applicable), address, and taxpayer identification number (TIN), which may be your Social Security number or Employer Identification Number (EIN).

How to use the Fidelity W-9 Form

Using the Fidelity W-9 form involves completing the document accurately to ensure that your taxpayer information is correctly reported. When you are requested to fill out a W-9, you should provide your personal or business details as required. After filling out the form, you may need to return it to the requesting party, which could be a financial institution or a client. It is important to ensure that the information is current and correct to avoid any issues with tax reporting.

Steps to complete the Fidelity W-9 Form

Completing the Fidelity W-9 form involves several straightforward steps:

- Begin by entering your name as it appears on your tax return.

- If applicable, provide your business name in the designated field.

- Fill in your address, including city, state, and ZIP code.

- Indicate your taxpayer identification number (TIN), which can be your Social Security number or EIN.

- Sign and date the form to certify that the information provided is accurate.

Once completed, submit the form to the entity that requested it, ensuring that you keep a copy for your records.

Legal use of the Fidelity W-9 Form

The Fidelity W-9 form is legally binding and must be filled out with accurate information. It serves as a declaration of your taxpayer status and is used for tax reporting purposes. The IRS requires that businesses and individuals provide correct taxpayer identification information to avoid penalties. Using an electronic signature solution, such as signNow, can ensure that your completed W-9 is secure and complies with eSignature regulations, making it legally valid.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the W-9 form. It is important to understand when to submit this form and what information is required. The W-9 is primarily used to report income that is not subject to withholding, such as freelance payments, interest, and dividends. The IRS also outlines the importance of keeping your information updated, especially if there are changes to your name or taxpayer identification number.

Form Submission Methods

The Fidelity W-9 form can be submitted in several ways, depending on the preferences of the requesting entity. Common submission methods include:

- Online submission via a secure portal, if offered by the requesting party.

- Mailing a hard copy of the completed form to the address specified by the requester.

- In-person delivery, if applicable, to ensure immediate processing.

Choosing the right submission method can help ensure that your information is received promptly and securely.

Quick guide on how to complete fidelity w9 form

Complete Fidelity W9 Form seamlessly on any device

Web-based document handling has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Fidelity W9 Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to edit and eSign Fidelity W9 Form with ease

- Find Fidelity W9 Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Point out important sections of the documents or censor sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to preserve your changes.

- Select how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the worries of lost or misplaced files, tedious document searches, or mistakes that require printing out new copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you choose. Edit and eSign Fidelity W9 Form and ensure seamless communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fidelity w9 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Fidelity W9 form and why is it important?

The Fidelity W9 form is a request for taxpayer identification number and certification, which is essential for financial institutions to collect accurate taxpayer information. It ensures compliance with IRS regulations and helps avoid backup withholding on taxable payments. This form is often required when opening accounts or engaging in financial transactions.

-

How does airSlate SignNow streamline the completion of Fidelity W9 forms?

airSlate SignNow provides a user-friendly platform that simplifies the eSigning process for Fidelity W9 forms. Users can easily fill out the required fields and electronically sign documents, reducing the hassle of printing and scanning. This feature accelerates the preparation and submission of your documents, making compliance easier.

-

Is airSlate SignNow cost-effective for managing Fidelity W9 forms?

Yes, airSlate SignNow offers a cost-effective solution for businesses looking to manage Fidelity W9 forms efficiently. With flexible pricing plans, companies can choose a package that fits their needs without overspending. The signNow savings in time and resources further enhance its value.

-

What are the security features of airSlate SignNow for Fidelity W9 forms?

Security is a top priority at airSlate SignNow, especially for sensitive documents like Fidelity W9 forms. The platform employs advanced encryption and security protocols to ensure that your data remains confidential and secure. Additionally, access controls and authentication measures protect your documents from unauthorized access.

-

Can I integrate airSlate SignNow with other tools for handling Fidelity W9 forms?

Absolutely! airSlate SignNow offers seamless integrations with popular applications like Google Drive, Dropbox, and CRM systems. This allows users to manage their Fidelity W9 forms alongside other documents and data, creating a more streamlined workflow. Integration enhances productivity and ensures all your documents are easily accessible.

-

What benefits does airSlate SignNow provide when using Fidelity W9 forms?

Utilizing airSlate SignNow for Fidelity W9 forms offers various benefits, including faster processing times and improved accuracy in data collection. The electronic signing capability eliminates delays caused by traditional methods, while features like templates help standardize forms for consistent compliance. These advantages streamline overall document management.

-

How can I track the status of my Fidelity W9 forms using airSlate SignNow?

airSlate SignNow provides real-time tracking for all your Fidelity W9 forms, ensuring you stay informed throughout the signing process. You'll receive notifications when a document is viewed, signed, or completed. This feature enhances transparency and allows you to manage your document flow effectively.

Get more for Fidelity W9 Form

- Accordance with the applicable laws of the state of michigan form

- The agreement as follows attach additional sheets if necessary form

- Hereinafter referred to as grantors whose address is do hereby quitclaim unto form

- Control number mi 019 77 form

- Trust to corporation form

- Limited liability company to limited liability company form

- Control number mi 023 78 form

- Two individuals to a trust form

Find out other Fidelity W9 Form

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online