Texas Hotel Tax Exempt Form

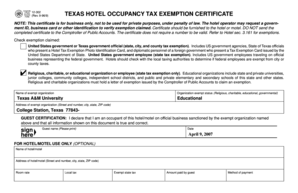

What is the Texas Hotel Tax Exempt Form

The Texas hotel tax exempt form is a document that allows certain organizations and individuals to claim exemption from paying hotel occupancy taxes in Texas. This form is typically used by entities such as government agencies, non-profit organizations, and educational institutions that qualify under state tax laws. By submitting this form, eligible parties can avoid the additional costs associated with hotel stays, making it a valuable resource for those who frequently travel for work or events.

How to use the Texas Hotel Tax Exempt Form

To use the Texas hotel tax exempt form, individuals or organizations must first ensure they meet the eligibility criteria outlined by the state. Once eligibility is confirmed, the form can be filled out with the required information, including the name of the exempt entity, the purpose of the stay, and details about the hotel accommodations. After completing the form, it should be presented to the hotel at the time of check-in to avoid being charged the hotel occupancy tax.

Steps to complete the Texas Hotel Tax Exempt Form

Completing the Texas hotel tax exempt form involves several straightforward steps:

- Obtain the form from a reliable source, such as the Texas Comptroller's website or your organization’s finance department.

- Fill in the required fields, including the name and address of the exempt organization, along with the purpose of the trip.

- Provide details about the hotel stay, such as the hotel name, address, and dates of occupancy.

- Sign and date the form to certify that the information is accurate and that the entity qualifies for tax exemption.

Key elements of the Texas Hotel Tax Exempt Form

Several key elements must be included in the Texas hotel tax exempt form to ensure its validity:

- Name of the exempt entity: Clearly state the name of the organization or individual claiming the exemption.

- Purpose of the stay: Provide a brief explanation of why the stay is necessary, which helps justify the tax exemption.

- Hotel information: Include the name and address of the hotel where accommodations are booked.

- Signature: The form must be signed by an authorized representative of the exempt entity to validate the claim.

Eligibility Criteria

Eligibility for using the Texas hotel tax exempt form is determined by specific criteria set forth by state law. Generally, the following entities may qualify:

- Governmental entities, including state and local agencies.

- Non-profit organizations that have been granted tax-exempt status under the Internal Revenue Code.

- Educational institutions that are recognized as tax-exempt entities.

Form Submission Methods

The Texas hotel tax exempt form can be submitted in various ways, depending on the hotel’s policies. Typically, the form should be presented at the time of check-in. Some hotels may also allow submission via email or fax before arrival. It is important to confirm with the hotel regarding their preferred method of receiving the form to ensure proper processing and avoid any tax charges.

Quick guide on how to complete texas hotel tax exempt form

Prepare Texas Hotel Tax Exempt Form effortlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It presents an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily find the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents quickly without any delays. Handle Texas Hotel Tax Exempt Form on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest way to modify and eSign Texas Hotel Tax Exempt Form with ease

- Locate Texas Hotel Tax Exempt Form and click on Get Form to begin.

- Utilize the features we provide to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your edits.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Texas Hotel Tax Exempt Form to ensure excellent communication at any point of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the texas hotel tax exempt form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the texas tax exempt form pdf?

The texas tax exempt form pdf is a document used by organizations in Texas to claim exemption from sales tax. This form helps eligible entities, such as non-profits and governmental bodies, avoid paying sales tax on purchases. Completing the texas tax exempt form pdf accurately ensures compliance with Texas tax regulations.

-

How can I fill out the texas tax exempt form pdf using airSlate SignNow?

Filling out the texas tax exempt form pdf with airSlate SignNow is straightforward. You can upload your form, fill it out digitally, and include any required signatures in an easy-to-use interface. This streamlines the process and ensures that your form is completed accurately and efficiently.

-

Is there a cost associated with using airSlate SignNow for the texas tax exempt form pdf?

airSlate SignNow offers a variety of pricing plans to accommodate different needs, including options for using the texas tax exempt form pdf. Depending on the plan you choose, you'll gain access to powerful features that facilitate eSigning and document management without breaking the bank.

-

What features does airSlate SignNow offer for managing the texas tax exempt form pdf?

With airSlate SignNow, you can easily upload, edit, and share the texas tax exempt form pdf. The platform allows for automated reminders, secure storage, and tracking of document statuses, making it an essential tool for managing your tax exemption documentation effectively.

-

Can I integrate airSlate SignNow with other tools while handling the texas tax exempt form pdf?

Yes, airSlate SignNow offers numerous integrations with popular business tools such as CRMs, cloud storage services, and productivity applications. This allows you to work seamlessly with your existing systems while managing the texas tax exempt form pdf and other documents.

-

How does eSigning the texas tax exempt form pdf work?

eSigning the texas tax exempt form pdf using airSlate SignNow is quick and secure. Signers receive an email invitation to review and sign the document electronically, ensuring a legally binding signature without the need for physical paperwork. This enhances efficiency while maintaining compliance.

-

What benefits does airSlate SignNow provide when using the texas tax exempt form pdf?

Using airSlate SignNow for the texas tax exempt form pdf provides several benefits, including reduced processing time, enhanced document security, and improved workflow efficiency. The platform's user-friendly design makes it accessible for all team members, simplifying the management of important tax-related documents.

Get more for Texas Hotel Tax Exempt Form

- Michigan online education certification system moecs form

- Form 5620

- Request for certificate of insurance department of labor and industry form

- The undersigned hereby informs you that improvements will be made to certain real property and in accordance

- What documents can i use to verify my income maryland health form

- Applications new york state department of state ny state form

- Los angeles county schools employment authorization for retirant form

- Armed forces tax guide form

Find out other Texas Hotel Tax Exempt Form

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online