Va Form 10 0003l 2002-2026

What is the VA Form 10-0003L?

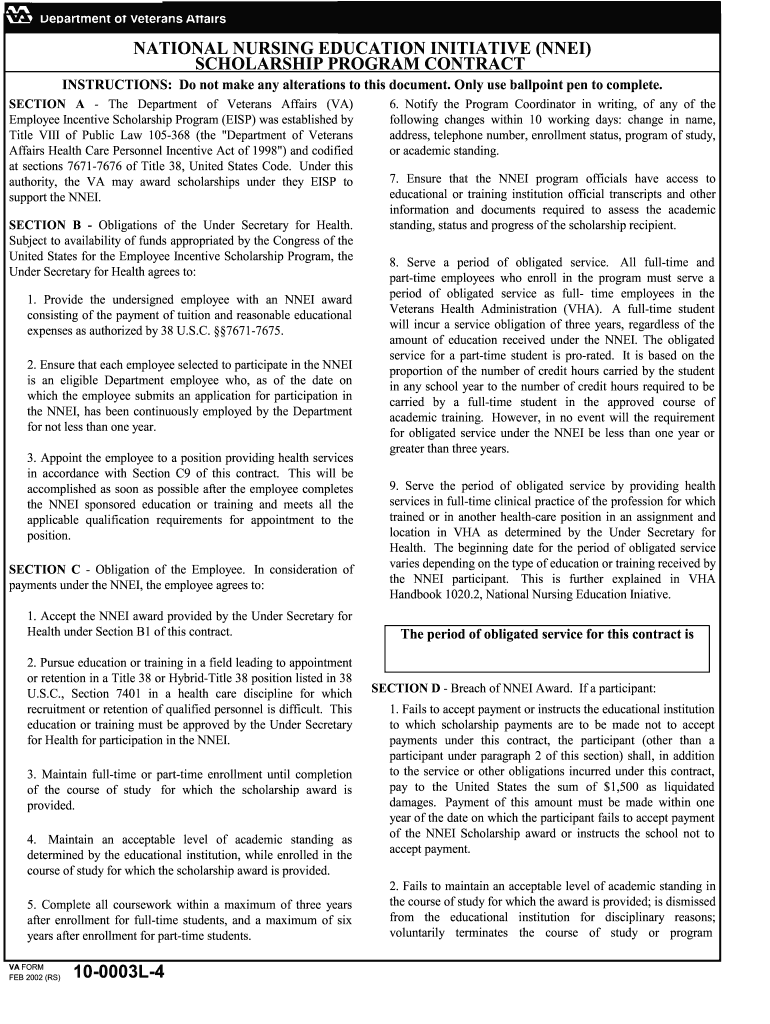

The VA Form 10-0003L is a specific document used within the U.S. Department of Veterans Affairs (VA) system. This form is primarily associated with the National Nursing Education Initiative (NNEI) program, which aims to support nursing education for veterans and their families. The form collects essential information needed to assess eligibility for various educational benefits and scholarships available through the VA. Understanding the purpose and requirements of this form is crucial for applicants seeking financial assistance in their nursing education journey.

How to Use the VA Form 10-0003L

Utilizing the VA Form 10-0003L involves several straightforward steps. First, ensure you have the most current version of the form, as outdated versions may not be accepted. Fill in the required fields accurately, providing detailed information about your educational background and service history. It is essential to review the form for completeness and accuracy before submission. Once completed, the form can be submitted according to the guidelines provided by the VA, which may include online submission or mailing it to the appropriate office.

Steps to Complete the VA Form 10-0003L

Completing the VA Form 10-0003L requires careful attention to detail. Follow these steps:

- Obtain the latest version of the form from the VA website.

- Read the instructions thoroughly to understand the information required.

- Fill in personal information, including your name, contact details, and VA service number.

- Provide details about your educational program and institution.

- Attach any required documentation, such as proof of service and prior education.

- Review the form for any errors or omissions.

- Submit the form as per the VA's submission guidelines.

Key Elements of the VA Form 10-0003L

The VA Form 10-0003L includes several critical components that applicants must complete. Key elements consist of personal identification information, educational program details, and financial information relevant to the scholarship application. Additionally, the form may require information about previous educational experiences and any other relevant qualifications. Ensuring that all key elements are filled out accurately is vital for the processing of the application.

Eligibility Criteria for the VA Form 10-0003L

Eligibility for the benefits associated with the VA Form 10-0003L typically includes criteria such as veteran status, enrollment in an accredited nursing program, and meeting specific educational requirements set by the VA. Applicants must also provide documentation that verifies their eligibility, which may include military discharge papers and proof of enrollment in a nursing program. Understanding these criteria is essential for a successful application process.

Form Submission Methods

The VA Form 10-0003L can be submitted using various methods, depending on the preferences of the applicant and the guidelines set by the VA. Common submission methods include:

- Online submission through the VA's official website, where applicants can fill out and submit the form electronically.

- Mailing a completed paper form to the designated VA office, ensuring that it is sent to the correct address.

- In-person submission at a local VA office, where applicants can receive assistance if needed.

Quick guide on how to complete nnei contract form 10 0003l 4

Uncover the most efficient method to complete and endorse your Va Form 10 0003l

Are you still squandering time preparing your official documents on paper instead of handling them online? airSlate SignNow provides an improved way to finalize and endorse your Va Form 10 0003l and associated forms for public services. Our intelligent electronic signature solution equips you with all the necessary tools to manage documents swiftly and in compliance with official standards - comprehensive PDF editing, handling, safeguarding, signing, and sharing capabilities readily accessible within an intuitive interface.

Only a few steps are necessary to finalize and endorse your Va Form 10 0003l:

- Upload the fillable template to the editor using the Get Form button.

- Verify what information you need to present in your Va Form 10 0003l.

- Navigate through the fields using the Next option to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to fill in the blanks with your information.

- Modify the content with Text boxes or Images from the top toolbar.

- Emphasize what is truly signNow or Obscure areas that are no longer relevant.

- Click on Sign to create a legally valid electronic signature using any method you prefer.

- Add the Date next to your signature and conclude your work with the Done button.

Store your completed Va Form 10 0003l in the Documents directory within your profile, download it, or transfer it to your preferred cloud storage. Our solution also provides flexible form sharing options. There’s no need to print your forms when you need to submit them to the appropriate public office - send them via email, fax, or by requesting a USPS “snail mail” delivery from your account. Experience it now!

Create this form in 5 minutes or less

FAQs

-

How do I fill out a W-4 form?

The main thing you need to put on your W-4 besides your name, address and social security number is whether you are married or single and the number of exemptions you wish to take to lower the amount of money with held for taxes from your paycheck. The number of exemptions refers to how many people you support, i. e. children. Say you are single and have 3 children, you can put down 4 exemptions, 1 for your self and 1 for each child. This means you will have more pay to take home because you aren’t having it with held from your paycheck. If you are single and have no children, you can either take 1 or 0 exemptions. If you make decent money, take 0 deductions, if you are barely making it you could probably take 1 exemption. Just realize that if you take exemptions, and not enough money is taken out of your check to pay your taxes, you will be liable for it come April 15th.If you are married and have no children and you make decent money, take 0 deductions. If you have children, only one spouse should take them as exemptions and it should be the one who makes the most money. For example, say your spouse is the major bread winner and you have 2 children, your spouse could take 4 exemptions (one for each member of the family) and then you would take 0 exemptions.Usually, it’s best to err on the side of caution and take the smaller amount of deductions so that you won’t owe a lot of money come tax time. If you’ve had too much with held it will come back to you as a refund.

-

How do I fill out the SS-4 form for a new Delaware C-Corp to get an EIN?

You indicate this is a Delaware C Corp so check corporation and you will file Form 1120.Check that you are starting a new corporation.Date business started is the date you actually started the business. Typically you would look on the paperwork from Delaware and put the date of incorporation.December is the standard closing month for most corporations. Unless you have a signNow business reason to pick a different month use Dec.If you plan to pay yourself wages put one. If you don't know put zero.Unless you are fairly sure you will owe payroll taxes the first year check that you will not have payroll or check that your liability will be less than $1,000. Anything else and the IRS will expect you to file quarterly payroll tax returns.Indicate the type of SaaS services you will offer.

-

How do I fill up the ITR 4 form?

Guidance to File ITR 4Below are mentioned few common guidelines to consider while filing your ITR 4 form:If any schedule is not relevant/applicable to you, just strike it out and write —NA— across itIf any item/particular is not applicable/relevant to you, just write NA against itIndicate nil figures by writing “Nil” across it.Kindly, put a “-” sign prior to any negative figure.All figures shall be rounded off to the nearest one rupee except figures for total income/loss and tax payable. Those shall be rounded off to the nearest multiple of ten.If you are an Employer individual, then you must mark Government if you are a Central/State Government employee. You should tick PSU if you are working in a public sector company of the Central/State Government.Sequence to fill ITR 4 formThe easiest way to fill out your ITR-4 Form is to follow this order:Part AAll the schedulesPart BVerificationModes to file ITR 4 FormYou can submit your ITR-4 Form either online or offline. It is compulsory to file ITR in India electronically (either through Mode 3 or Mode 4) for the following assesses:Those whose earning exceeds Rs. 5 lakhs per yearThose possessing any assets outside the boundary of India (including financial interest in any entity) or signing authority in any account outside India.Those claiming relief under Section 90/90A/91 to whom Schedule FSI and Schedule TR applyOffline:By furnishing a return in a tangible l paper formBy furnishing a bar-coded returnThe Income Tax Department will issue you an acknowledgment as a form of response/reply at the time of submission of your tangible paper return.Online/Electronically:By furnishing the return electronically using digital signature certificate.By sending the data electronically and then submitting the confirmation of the return in Return Form ITR-VIf you submit your ITR-4 Form by electronic means under digital signature, the acknowledgment/response will be sent to your registered email id. You can even download it manually from the official income tax website. For this, you are first required to sign it and send it to the Income Tax Department’s CPC office in Bangalore within 120 days of e-filing.Keep in mind that ITR-4 is an annexure-less form. It means you don’t have to attach any documents when you send it.TaxRaahi is your income tax return filing online companion. Get complete assistance and tax saving tips from experts.

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

Why did my employer give me a W-9 Form to fill out instead of a W-4 Form?

I wrote about the independent-contractor-vs-employee issue last year, see http://nctaxpro.wordpress.com/20...Broadly speaking, you are an employee when someone else - AKA the employer - has control over when and where you work and the processes by which you perform the work that you do for that individual. A DJ or bartender under some circumstances, I suppose, might qualify as an independent contractor at a restaurant, but the waitstaff, bus help, hosts, kitchen aides, etc. almost certainly would not.There's always risk in confronting an employer when faced with a situation like yours - my experience is that most employers know full well that they are violating the law when they treat employees as independent contractors, and for that reason they don't tolerate questions about that policy very well - so you definitely should tread cautiously if you want to keep this position. Nonetheless, I think you owe it to yourself to ask whether or not the restaurant intends to withhold federal taxes from your checks - if for no other reason than you don't want to get caught short when it comes to filing your own return, even if you don't intend to challenge the policy.

-

What is the time period to fill out form 10?

Well its a huge mission if you’re going to use a printer forget about it :)I’ve tried all the products and a lot of them you struggle with the mouse cursor to find the space to complete. So I think people can sometimes just get annoyed and use a printer.But the best is Paperjet. Go Paperless which uses field detection and makes the form fillable online immediately.No doubt the easiest and quickest way imho.

-

Do un-contracted workers have to fill out IRS W4 form?

I have no idea what an “un-contracted worker” is. I am not familiar with that term.Employees working in the U.S. complete a Form W-4.Independent contractors in the U.S. do not. Instead, they usually complete a Form W-9.If unclear on the difference between an employee or an independent contractor, see Independent Contractor Self Employed or Employee

-

How should I fill out my w-2 or w-4 form?

To calculate how much you should withhold you need to calculate two things. Step 1 - Estimate your TaxFirst go to Intuit's TaxCaster (Link -> TurboTax® TaxCaster, Free Tax Calculator, Free Tax Refund Estimator) and put in your family's information and income (estimate what you'll make in 2016 before taxes and put zero for federal and state taxes withheld, don't worry that the TaxCaster is for 2015, you're just trying to get a general number). Once you enter in your correct information it will tell you what you would owe to the federal government.Step 2 - Estimate your Tax Withholding Based on Allowances ClaimedSecond go to Paycheck City (Link -> Salary Paycheck Calculator | Payroll Calculator | Paycheck City) select the correct state, enter in your pay information. Select married filing jointly then try putting in 3 or 4 for withholdings. Once you calculate it will tell you how much taxes are being withheld. Set the pay frequency to annual instead of bi-monthly or bi-weekly since you need a total number for the year. Try changing the Federal withholding allowance until you have enough Federal taxes withheld to cover the amount calculated in the TaxCaster. The Federal withholding allowance number that covers all taxes owed should be the number claimed on your W-4.Don't worry too much about your state. If you claim the same as Federal what will usually happen is you might get a small refund for Federal and owe a small amount for State. I usually end up getting a Federal refund for ~$100 and owing state for just over $100. In the end I net owing state $20-40.Remember, the more details you can put into the TaxCaster and Paycheck City the more accurate your tax estimate will be.

Create this form in 5 minutes!

How to create an eSignature for the nnei contract form 10 0003l 4

How to make an eSignature for the Nnei Contract Form 10 0003l 4 in the online mode

How to make an eSignature for the Nnei Contract Form 10 0003l 4 in Chrome

How to make an electronic signature for signing the Nnei Contract Form 10 0003l 4 in Gmail

How to make an electronic signature for the Nnei Contract Form 10 0003l 4 right from your mobile device

How to create an eSignature for the Nnei Contract Form 10 0003l 4 on iOS devices

How to create an eSignature for the Nnei Contract Form 10 0003l 4 on Android

People also ask

-

What is the VA 10 NNEI Scholarship Program?

The VA 10 NNEI Scholarship Program provides financial assistance to veterans seeking education in fields related to healthcare. It aims to promote the development of qualified health professionals who can serve veterans and improve care standards. Through this scholarship, participants can access valuable resources for their academic journey.

-

Who is eligible for the VA 10 NNEI Scholarship Program?

Eligibility for the VA 10 NNEI Scholarship Program typically includes veterans who have a desire to further their education in healthcare-related programs. Applicants must also meet specific criteria set forth by the program to ensure they align with the scholarship's goals. It is essential to review the eligibility requirements thoroughly before applying.

-

How can I apply for the VA 10 NNEI Scholarship Program?

To apply for the VA 10 NNEI Scholarship Program, visit the official scholarship website where you will find application guidelines and necessary forms. Ensure your application highlights your experiences and intentions toward advancing in the healthcare field. Follow the instructions carefully to increase your chances of receiving the scholarship.

-

What benefits does the VA 10 NNEI Scholarship Program offer?

The VA 10 NNEI Scholarship Program offers signNow financial support for education in healthcare, allowing veterans to pursue their academic goals without the burden of excessive debt. Additionally, recipients may gain access to mentorship and networking opportunities within the field. This program ultimately enriches the educational experience for those committed to serving veterans.

-

Are there any costs associated with the VA 10 NNEI Scholarship Program?

The VA 10 NNEI Scholarship Program does not charge an application fee, making it accessible for eligible veterans. However, recipients should consider the costs of their education not fully covered by the scholarship. The program aims to alleviate financial burdens associated with educational pursuits in the healthcare sector.

-

Can the VA 10 NNEI Scholarship Program be combined with other financial aid?

Yes, the VA 10 NNEI Scholarship Program can often be combined with other forms of financial aid, such as federal loans and grants. Recipients are encouraged to explore various financial assistance options to fully support their education. It is advisable to consult the financial aid office of your educational institution for guidance on combining aids.

-

How does the VA 10 NNEI Scholarship Program support career growth?

The VA 10 NNEI Scholarship Program not only provides financial assistance but also fosters career growth opportunities for veterans in healthcare. Participants gain access to valuable training and additional resources that enhance their skills and employability in the field. This support ultimately leads to a more competent workforce dedicated to serving veterans.

Get more for Va Form 10 0003l

Find out other Va Form 10 0003l

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself