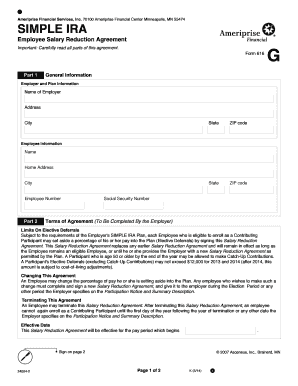

SIMPLE IRA Employee Salary Reduction Agreement Ameriprise Form

What is the SIMPLE IRA Employee Salary Reduction Agreement?

The SIMPLE IRA Employee Salary Reduction Agreement is a document that allows employees to elect to have a portion of their salary contributed to a SIMPLE IRA retirement account. This agreement is essential for both employers and employees, as it outlines the terms of salary deferral and ensures compliance with IRS regulations. By participating in a SIMPLE IRA, employees can save for retirement while benefiting from tax advantages, making it a valuable option for many individuals.

Steps to Complete the SIMPLE IRA Employee Salary Reduction Agreement

Completing the SIMPLE IRA Employee Salary Reduction Agreement involves several straightforward steps:

- Obtain the form from your employer or financial institution.

- Fill out your personal information, including your name, address, and Social Security number.

- Indicate the percentage or dollar amount you wish to defer from your salary.

- Review the agreement for accuracy and ensure you understand the terms.

- Sign and date the form to confirm your election.

- Submit the completed form to your employer's payroll department.

Key Elements of the SIMPLE IRA Employee Salary Reduction Agreement

When filling out the SIMPLE IRA Employee Salary Reduction Agreement, several key elements must be included:

- Employee Information: Full name, address, and Social Security number.

- Contribution Amount: Specify the percentage or fixed dollar amount to be deducted from your salary.

- Effective Date: The date when the salary reduction will begin.

- Employer Information: The name and contact details of the employer.

- Signature: The employee's signature and date to validate the agreement.

Legal Use of the SIMPLE IRA Employee Salary Reduction Agreement

The SIMPLE IRA Employee Salary Reduction Agreement is legally binding once signed by both the employee and the employer. It must comply with IRS guidelines to ensure that contributions are made correctly and that the plan remains qualified. Employers are responsible for maintaining records of these agreements and ensuring that contributions are made in accordance with the agreed terms. Failure to comply with these regulations can lead to penalties and disqualification of the SIMPLE IRA plan.

IRS Guidelines

The IRS provides specific guidelines regarding the SIMPLE IRA Employee Salary Reduction Agreement. These include limits on contribution amounts, eligibility criteria for employees, and the requirement for employers to provide a summary of the plan to employees. It is crucial for both employers and employees to familiarize themselves with these guidelines to ensure compliance and maximize the benefits of the SIMPLE IRA.

Form Submission Methods

Once the SIMPLE IRA Employee Salary Reduction Agreement is completed, it can typically be submitted through various methods:

- Online: Many employers offer electronic submission options through payroll systems.

- Mail: The completed form can be sent to the employer’s payroll department via postal service.

- In-Person: Employees may also choose to deliver the form directly to their HR or payroll department.

Quick guide on how to complete simple ira employee salary reduction agreement ameriprise

Effortlessly Prepare SIMPLE IRA Employee Salary Reduction Agreement Ameriprise on Any Device

Managing documents online has gained signNow traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to find the correct form and securely save it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents swiftly and without delays. Handle SIMPLE IRA Employee Salary Reduction Agreement Ameriprise on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The Easiest Way to Modify and eSign SIMPLE IRA Employee Salary Reduction Agreement Ameriprise with Ease

- Find SIMPLE IRA Employee Salary Reduction Agreement Ameriprise and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow specifically supplies for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or disorganized documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign SIMPLE IRA Employee Salary Reduction Agreement Ameriprise to ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the simple ira employee salary reduction agreement ameriprise

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a simple IRA form?

A simple IRA form is a document used to establish a Savings Incentive Match Plan for Employees (SIMPLE) IRA. This form outlines how employees can contribute to their retirement and the employer's matching contributions. Completing the simple IRA form is essential for compliance and to ensure all parties understand their responsibilities.

-

How do I complete a simple IRA form using airSlate SignNow?

To complete a simple IRA form using airSlate SignNow, simply upload the document to our platform. You can then use our easy editing tools to fill in the required fields and collect eSignatures. This streamlines the process, making it quick and efficient for both employers and employees.

-

What are the benefits of using airSlate SignNow for simple IRA forms?

Using airSlate SignNow for simple IRA forms provides numerous benefits, including time savings and enhanced document security. Our platform allows for seamless eSigning, which accelerates the approval process. Additionally, you can easily track the status of your documents, ensuring everything is handled promptly.

-

Is airSlate SignNow affordable for small businesses handling simple IRA forms?

Yes, airSlate SignNow offers cost-effective solutions tailored for small businesses managing simple IRA forms. Our pricing plans are designed to fit various budgets, ensuring that every business can afford to streamline its document workflow without breaking the bank. You can enjoy all the essential features at a competitive price.

-

Can I integrate airSlate SignNow with other software for managing simple IRA forms?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, allowing you to manage simple IRA forms more efficiently. This integration can enhance your payroll, HR systems, or any other applications you may use, creating a unified platform for document management and eSigning.

-

How secure is airSlate SignNow when handling simple IRA forms?

Security is a top priority at airSlate SignNow, especially for sensitive documents like simple IRA forms. Our platform uses advanced encryption and multi-factor authentication to protect your information. Users can trust that their data is safe and compliant with industry standards.

-

What types of businesses can benefit from using simple IRA forms through airSlate SignNow?

Various types of businesses, from startups to established companies, can benefit from using simple IRA forms through airSlate SignNow. Any employer looking to provide retirement benefits to their employees can utilize our platform for efficient document management and eSigning. This flexible solution is perfect for companies of all sizes.

Get more for SIMPLE IRA Employee Salary Reduction Agreement Ameriprise

- State of south carolina civil case number form

- Solicitors officecommunity service charleston county form

- Charges were disposed of in the court indicated below form

- Sc inc cr form

- State of south carolina secretary of state conversion of a form

- Serial number if any 490216632 form

- 120 marine form

- Sworn and subscribed before me form

Find out other SIMPLE IRA Employee Salary Reduction Agreement Ameriprise

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple