It 255 Form

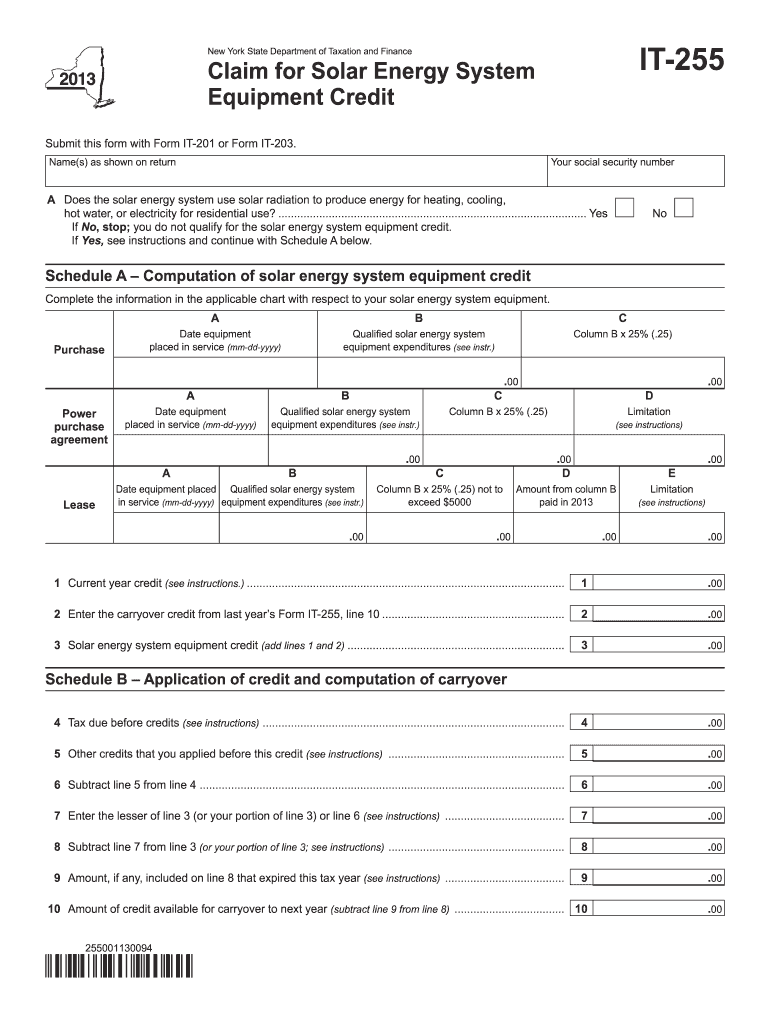

What is the It 255 Form

The It 255 form is a tax document used in New York State for claiming a credit for taxes paid to other jurisdictions. This form is essential for taxpayers who have income sourced from outside New York and wish to avoid double taxation. It allows individuals to report the amount of tax they have paid to other states, which can then be credited against their New York State tax liability. Understanding the purpose of the It 255 form is crucial for ensuring compliance and maximizing potential tax benefits.

How to obtain the It 255 Form

The It 255 form can be easily obtained through the New York State Department of Taxation and Finance website. Taxpayers can download the form in PDF format, which allows for easy printing and completion. Additionally, forms may be available at local tax offices or through tax preparation services. It is important to ensure that you are using the most current version of the form to comply with any changes in tax law.

Steps to complete the It 255 Form

Completing the It 255 form involves several key steps:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Report the income earned in other jurisdictions that is subject to tax.

- Calculate the total amount of tax paid to those jurisdictions.

- Transfer the appropriate amounts to the relevant sections of the form, ensuring accuracy in your calculations.

- Review the completed form for any errors before submission.

Taking care during the completion process can help prevent delays or issues with your tax filing.

Legal use of the It 255 Form

The It 255 form is legally recognized as a valid document for claiming tax credits in New York State. To ensure its legal standing, taxpayers must adhere to the guidelines set forth by the New York State Department of Taxation and Finance. This includes providing accurate information, maintaining supporting documentation for taxes paid to other states, and submitting the form by the established deadlines. Proper use of the It 255 form can help prevent complications with tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the It 255 form align with the general tax filing deadlines in New York State. Typically, individuals must file their state tax returns by April fifteenth of each year. However, it is important to check for any specific extensions or changes in deadlines that may apply. Missing the deadline can result in penalties or loss of credits, making it crucial to stay informed about any important dates related to the filing process.

Form Submission Methods (Online / Mail / In-Person)

The It 255 form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission through the New York State Department of Taxation and Finance e-filing system, which offers a convenient and secure way to file.

- Mailing a completed paper form to the appropriate tax office, ensuring that it is postmarked by the filing deadline.

- In-person submission at local tax offices, which may be beneficial for those needing assistance or clarification on the form.

Choosing the right submission method can enhance the efficiency of the filing process.

Quick guide on how to complete it 255 form

Complete It 255 Form seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage It 255 Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-based task today.

The easiest way to edit and electronically sign It 255 Form with ease

- Locate It 255 Form and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and then click on the Done button to save your adjustments.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign It 255 Form and ensure clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the it 255 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form it 255 and how does it relate to airSlate SignNow?

Form it 255 is a document that allows organizations to report tax information to the IRS. airSlate SignNow provides users with an efficient way to fill out, eSign, and securely send their form it 255, ensuring accuracy and compliance with IRS regulations.

-

How can I use airSlate SignNow to complete form it 255?

You can use airSlate SignNow to complete form it 255 by uploading your document, filling in required fields, and utilizing our eSignature features. Our platform offers templates and guidance to streamline the process, making it easier to submit form it 255 with confidence.

-

What are the pricing options for using airSlate SignNow with form it 255?

airSlate SignNow offers competitive pricing plans that suit various business needs. With options ranging from free trials to premium subscriptions, you'll find a plan that allows you to manage and eSign documents like form it 255 at an affordable rate.

-

What features does airSlate SignNow provide for managing form it 255 efficiently?

airSlate SignNow features templates, document tracking, automated workflows, and user-friendly editing tools to manage form it 255 effectively. These features enhance collaboration and ensure that your document is prepared and sent promptly.

-

Are there integrations available for airSlate SignNow to streamline form it 255 processes?

Yes, airSlate SignNow integrates seamlessly with various applications, including CRM and document management systems, to enhance your form it 255 process. These integrations allow for a more cohesive workflow and reduced data entry.

-

How does airSlate SignNow ensure the security of my form it 255?

Security is a top priority at airSlate SignNow. We use advanced encryption methods and secure servers to protect your form it 255 and sensitive data, ensuring that your documents are safe during storage and transmission.

-

Can I track the status of my submitted form it 255 through airSlate SignNow?

Absolutely! airSlate SignNow allows you to track the status of your submitted form it 255 through real-time notifications and a user-friendly dashboard. This feature keeps you informed about when your document is viewed, signed, and finalized.

Get more for It 255 Form

- Of rhode island to wit form

- Accordance with the applicable laws of the state of rhode island form

- Deemed to be part of their joint estates and considered their joint property form

- Accordance with the applicable laws of the state of rhode island and form

- Unto hereinafter grantee the following lands and property form

- Following lands and property together with all improvements located thereon lying in the county of form

- Control number ri 019 77 form

- Unmarried hereinafter grantees as form

Find out other It 255 Form

- How Can I Electronic signature Oklahoma Non disclosure agreement sample

- How To Electronic signature Tennessee Non disclosure agreement sample

- Can I Electronic signature Minnesota Mutual non-disclosure agreement

- Electronic signature Alabama Non-disclosure agreement PDF Safe

- Electronic signature Missouri Non-disclosure agreement PDF Myself

- How To Electronic signature New York Non-disclosure agreement PDF

- Electronic signature South Carolina Partnership agreements Online

- How Can I Electronic signature Florida Rental house lease agreement

- How Can I Electronic signature Texas Rental house lease agreement

- eSignature Alabama Trademark License Agreement Secure

- Electronic signature Maryland Rental agreement lease Myself

- How To Electronic signature Kentucky Rental lease agreement

- Can I Electronic signature New Hampshire Rental lease agreement forms

- Can I Electronic signature New Mexico Rental lease agreement forms

- How Can I Electronic signature Minnesota Rental lease agreement

- Electronic signature Arkansas Rental lease agreement template Computer

- Can I Electronic signature Mississippi Rental lease agreement

- Can I Electronic signature Missouri Rental lease contract

- Electronic signature New Jersey Rental lease agreement template Free

- Electronic signature New Jersey Rental lease agreement template Secure