Brevard Homestead Exemption 2012

What is the Brevard Homestead Exemption

The Brevard County homestead exemption is a property tax benefit available to eligible homeowners in Florida. This exemption reduces the taxable value of a primary residence, which can lead to significant savings on property taxes. Homeowners must meet specific criteria to qualify, including residency requirements and ownership of the property. The exemption is designed to provide financial relief and encourage homeownership within the community.

How to Obtain the Brevard Homestead Exemption

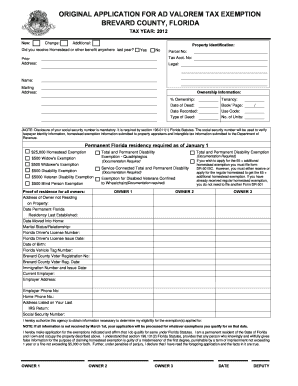

To obtain the Brevard homestead exemption, homeowners must complete the Brevard County homestead exemption application. This application can typically be submitted online, by mail, or in person at the local property appraiser's office. Homeowners need to provide proof of residency, such as a Florida driver's license or state ID, and documentation that verifies ownership of the property. It's essential to ensure all required documents are submitted to avoid delays in processing.

Steps to Complete the Brevard Homestead Exemption

Completing the Brevard County homestead exemption application involves several straightforward steps:

- Gather necessary documents, including proof of identity and ownership.

- Access the homestead exemption application through the Brevard County property appraiser's website.

- Fill out the application form with accurate information regarding the property and the homeowner.

- Submit the application online, or print it out to mail or deliver in person.

- Keep a copy of the submitted application for your records.

Eligibility Criteria

Eligibility for the Brevard County homestead exemption requires that the applicant must be a permanent resident of Florida and the property must be their primary home. Additionally, the homeowner must not have claimed a homestead exemption on any other property in Florida. Certain exemptions may also be available for specific groups, such as seniors, disabled individuals, or veterans, which can further reduce property taxes.

Required Documents

When applying for the Brevard homestead exemption, homeowners must provide several key documents, including:

- A valid Florida driver's license or state ID showing the property address.

- Proof of ownership, such as a deed or tax bill.

- Social Security numbers for all owners of the property.

- Any additional documentation that may support eligibility, such as proof of disability for disabled applicants.

Filing Deadlines / Important Dates

Homeowners must be aware of specific deadlines to ensure their application for the Brevard County homestead exemption is considered. Typically, applications must be submitted by March first of the tax year for which the exemption is sought. Late applications may be accepted under certain circumstances, but it is advisable to submit all paperwork on time to avoid complications.

Quick guide on how to complete brevard homestead exemption

Easily Prepare Brevard Homestead Exemption on Any Device

Managing documents online has become increasingly popular among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the suitable template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly and without delays. Handle Brevard Homestead Exemption on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to Modify and eSign Brevard Homestead Exemption with Ease

- Obtain Brevard Homestead Exemption and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or redact sensitive information using tools specifically designed for this purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click the Done button to finalize your changes.

- Select your preferred method of delivering your form via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, time-consuming searches for forms, or errors that require printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any preferred device. Modify and eSign Brevard Homestead Exemption to ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct brevard homestead exemption

Create this form in 5 minutes!

How to create an eSignature for the brevard homestead exemption

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the homestead exemption brevard county?

The homestead exemption brevard county allows eligible homeowners to reduce their property taxes by lowering the assessed value of their primary residence. To qualify, you must meet certain criteria, including residency requirements and property value limits. This exemption provides signNow financial relief, especially for first-time homeowners.

-

How can I apply for the homestead exemption brevard county?

To apply for the homestead exemption brevard county, you need to submit an application to the Brevard County Property Appraiser’s office. Applications are typically accepted from January 1 to March 1 of each year, so it’s essential to apply within this timeframe. You can apply online or visit the office in person, ensuring you have the necessary documentation ready.

-

Are there any deadlines for applying for the homestead exemption brevard county?

Yes, the deadline for applying for the homestead exemption brevard county is March 1st of each year. Applications submitted after this date will not be considered for the current tax year. It’s crucial to keep track of this deadline to ensure you don’t miss out on tax savings.

-

What benefits do I get from the homestead exemption brevard county?

The primary benefit of the homestead exemption brevard county is a reduction in property taxes, which can save homeowners a signNow amount each year. Additionally, this exemption can protect your property from being seized by creditors in certain circumstances. It also provides tax benefits related to portability, allowing you to transfer your exemption benefits when moving to a new home.

-

Can I combine the homestead exemption brevard county with other exemptions?

Yes, the homestead exemption brevard county can often be combined with other exemptions, such as those for seniors, veterans, or individuals with disabilities. This combination can lead to even greater tax savings. It’s essential to check the specific eligibility requirements for each exemption to maximize your benefits.

-

What happens if I sell my home and move to a new property in brevard county?

If you sell your home and move to a new property in brevard county, you may be eligible to transfer your homestead exemption benefits under Florida's portability rules. This means you can carry over some of your tax savings to your new home, providing you meet the necessary criteria. Be sure to contact the property appraiser’s office for guidance on this process.

-

How does the homestead exemption brevard county impact my estate planning?

The homestead exemption brevard county can play a signNow role in estate planning by protecting your home equity from creditors and ensuring it passes to your heirs with tax benefits intact. This exemption can help facilitate smoother transitions for your beneficiaries, potentially reducing their tax liabilities. It's advisable to consult with an estate planning attorney to understand its implications fully.

Get more for Brevard Homestead Exemption

- Certificate of re notice of ex parte hearing form

- Order granting preliminary injunction form

- Notice of motion for order compeling answers at deposition and form

- Habeas corpus local rulesunited states district court form

- Notice of motion for order compelling answers to form

- Notice of motion for order compelling further answers to form

- Notice of motion for order that truth of matters form

- Notice of motion to compel further answers to requests form

Find out other Brevard Homestead Exemption

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer