Brevard County Property Appraiser Original Application for Ad Valorem Tax Exemption 2025-2026

What is the Brevard County Property Appraiser Original Application For Ad Valorem Tax Exemption

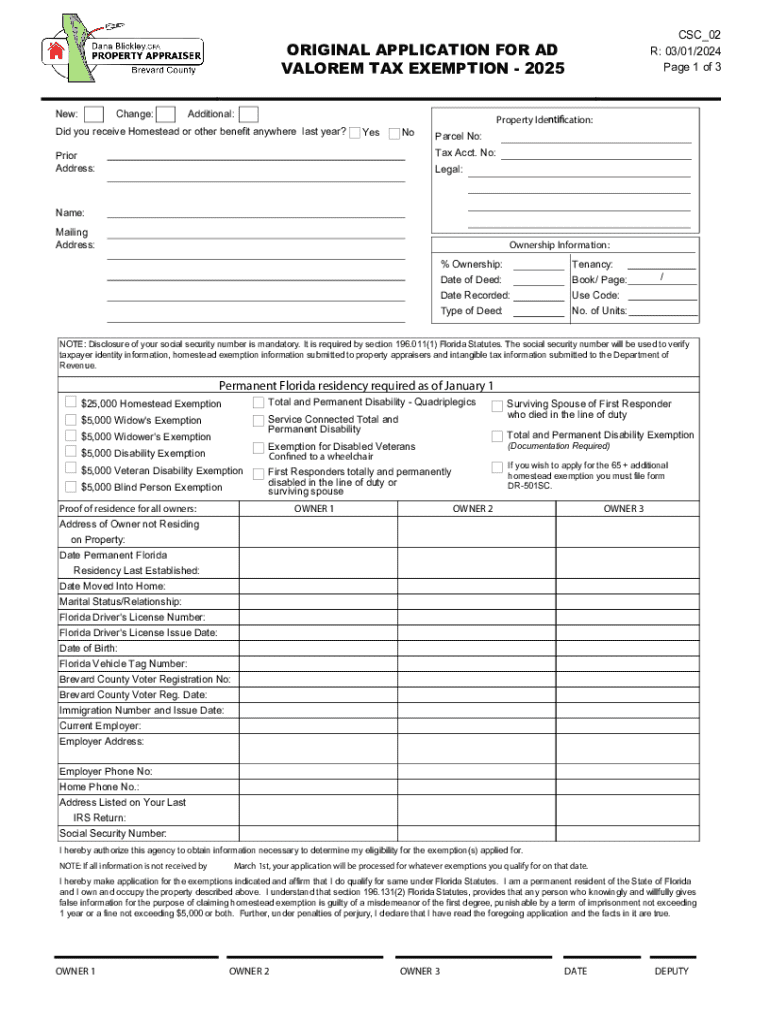

The Brevard County Property Appraiser Original Application For Ad Valorem Tax Exemption is a formal request submitted by property owners seeking an exemption from ad valorem taxes. This application is crucial for individuals who qualify for various tax exemptions, such as homestead exemptions or exemptions for senior citizens and disabled individuals. By completing this form, applicants can potentially reduce their property tax liability, making homeownership more affordable.

Steps to complete the Brevard County Property Appraiser Original Application For Ad Valorem Tax Exemption

Completing the Brevard County Property Appraiser Original Application For Ad Valorem Tax Exemption involves several key steps:

- Gather necessary documentation, including proof of ownership, identification, and any supporting documents that demonstrate eligibility for the exemption.

- Fill out the application form accurately, ensuring all required fields are completed.

- Review the application for any errors or omissions before submission.

- Submit the completed application to the Brevard County Property Appraiser's office by the specified deadline.

Eligibility Criteria

To qualify for the Brevard County Property Appraiser Original Application For Ad Valorem Tax Exemption, applicants must meet specific eligibility criteria. Generally, these criteria include:

- Ownership of the property for which the exemption is being sought.

- Permanent residency in the property as the primary residence.

- Meeting age or disability requirements for certain exemptions.

- Filing the application within the designated time frame.

Required Documents

When submitting the Brevard County Property Appraiser Original Application For Ad Valorem Tax Exemption, applicants must provide several supporting documents. These may include:

- Proof of identity, such as a driver's license or state ID.

- Documentation proving ownership of the property, like a deed or tax bill.

- Income verification, if applicable, for certain exemption types.

- Any additional documents that support the claim for exemption.

Form Submission Methods

The Brevard County Property Appraiser Original Application For Ad Valorem Tax Exemption can be submitted through various methods to accommodate applicants' preferences:

- Online submission via the Brevard County Property Appraiser's official website.

- Mailing the completed form to the appropriate office address.

- In-person submission at the local Property Appraiser's office.

Filing Deadlines / Important Dates

It is essential for applicants to be aware of the filing deadlines associated with the Brevard County Property Appraiser Original Application For Ad Valorem Tax Exemption. Typically, applications must be submitted by March first of the tax year for which the exemption is being requested. Late applications may not be considered, so timely submission is crucial.

Create this form in 5 minutes or less

Find and fill out the correct brevard county property appraiser original application for ad valorem tax exemption

Create this form in 5 minutes!

How to create an eSignature for the brevard county property appraiser original application for ad valorem tax exemption

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Brevard County Property Appraiser Original Application For Ad Valorem Tax Exemption?

The Brevard County Property Appraiser Original Application For Ad Valorem Tax Exemption is a form that property owners in Brevard County must complete to apply for tax exemptions on their properties. This application helps reduce the taxable value of your property, potentially lowering your tax bill. Understanding this application is crucial for homeowners seeking financial relief.

-

How can airSlate SignNow assist with the Brevard County Property Appraiser Original Application For Ad Valorem Tax Exemption?

airSlate SignNow provides an efficient platform for completing and eSigning the Brevard County Property Appraiser Original Application For Ad Valorem Tax Exemption. Our user-friendly interface allows you to fill out the application digitally, ensuring accuracy and saving time. Additionally, you can securely send the completed application directly to the relevant authorities.

-

What are the benefits of using airSlate SignNow for my application?

Using airSlate SignNow for your Brevard County Property Appraiser Original Application For Ad Valorem Tax Exemption offers numerous benefits, including ease of use, cost-effectiveness, and enhanced security. You can track the status of your application in real-time and receive notifications when it has been signed and submitted. This streamlines the process and reduces the risk of errors.

-

Is there a cost associated with using airSlate SignNow for my application?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs, including a free trial for new users. The cost-effective solutions ensure that you can manage your Brevard County Property Appraiser Original Application For Ad Valorem Tax Exemption without breaking the bank. Check our website for detailed pricing information and choose the plan that best fits your requirements.

-

Can I integrate airSlate SignNow with other applications?

Absolutely! airSlate SignNow seamlessly integrates with various applications, enhancing your workflow when completing the Brevard County Property Appraiser Original Application For Ad Valorem Tax Exemption. Whether you use CRM systems, cloud storage, or other document management tools, our integrations help streamline your processes and improve efficiency.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow offers a range of features designed to simplify document management, including customizable templates, automated workflows, and secure cloud storage. These features are particularly useful when handling the Brevard County Property Appraiser Original Application For Ad Valorem Tax Exemption, ensuring that you can manage your documents effectively and securely.

-

How secure is my information when using airSlate SignNow?

Security is a top priority at airSlate SignNow. When you use our platform for the Brevard County Property Appraiser Original Application For Ad Valorem Tax Exemption, your information is protected with advanced encryption and secure access controls. We comply with industry standards to ensure that your data remains confidential and secure throughout the process.

Get more for Brevard County Property Appraiser Original Application For Ad Valorem Tax Exemption

- Release agreements jail release court orders form

- Criminal history f 7 form

- Residence history update f 4u residence history update form

- Pdf examining the scriptures dailyallan cooley form

- Wwwpdffillercom516543434 certificate offillable online certificate of release of fax email print form

- Trial setting instructions revd 2 4 19 form

- Ca demurring party fill online printable fillable form

- Assignment of contract for deed and quit claim form

Find out other Brevard County Property Appraiser Original Application For Ad Valorem Tax Exemption

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online