Insurance Endorsement Example Form

What is the insurance endorsement example

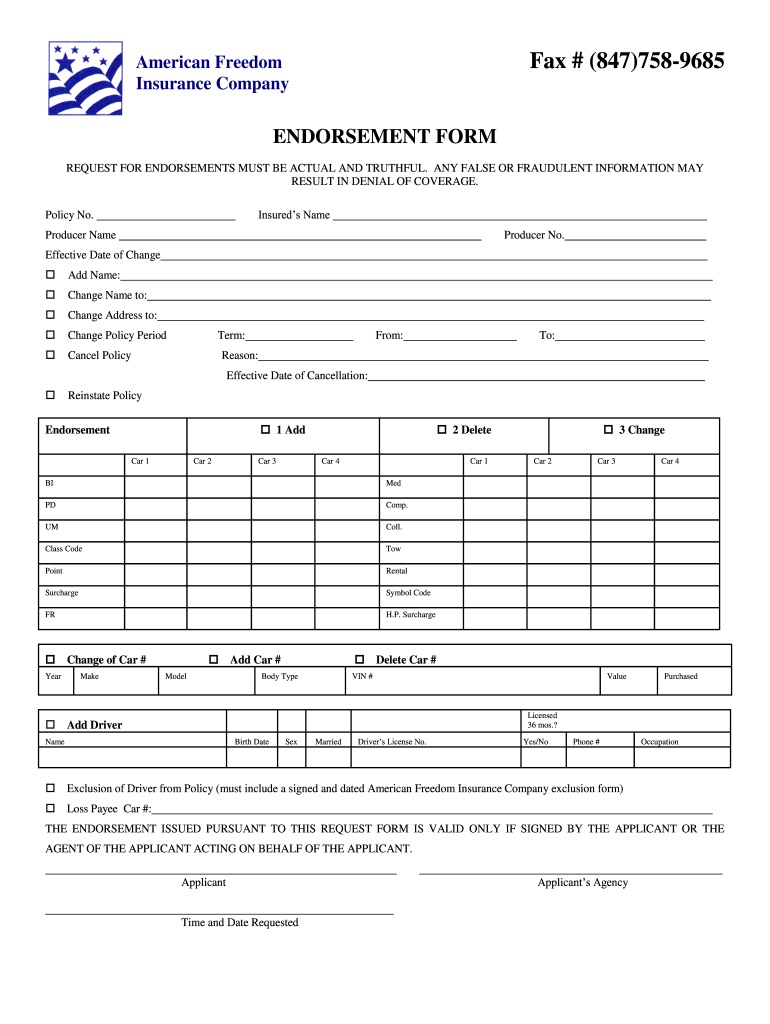

An insurance endorsement example refers to a modification or addition made to an existing insurance policy. This endorsement alters the terms of the policy, providing additional coverage, removing certain exclusions, or changing the limits of coverage. It is essential for policyholders to understand that endorsements can significantly impact their coverage and obligations under the policy. For instance, a common endorsement might add coverage for a newly acquired property or adjust the liability limits for a specific event.

How to use the insurance endorsement example

Using an insurance endorsement example involves several steps to ensure that the changes made to the policy are correctly documented and legally binding. First, review the current policy to identify the areas that require modification. Next, obtain the appropriate endorsement form from your insurance provider. Complete the form by providing necessary details, such as the policy number and specific changes requested. After filling out the form, submit it to your insurance company for approval. It is crucial to keep a copy of the endorsement for your records once it is processed.

Key elements of the insurance endorsement example

Several key elements are critical in an insurance endorsement example. These include:

- Policy number: The unique identifier for the insurance policy being modified.

- Effective date: The date when the endorsement takes effect, which can differ from the policy's original effective date.

- Description of changes: A clear explanation of what modifications are being made, such as added coverage or exclusions.

- Signatures: Required signatures from both the policyholder and the insurance company to validate the endorsement.

Steps to complete the insurance endorsement example

Completing an insurance endorsement example involves a systematic approach. Follow these steps:

- Review your existing policy and determine the necessary changes.

- Obtain the endorsement form from your insurance provider.

- Fill out the form with accurate information, including your policy number and the changes requested.

- Submit the completed form to your insurance company, either online or via mail.

- Keep a copy of the submitted endorsement for your records.

Legal use of the insurance endorsement example

The legal use of an insurance endorsement example is governed by various regulations and guidelines. Endorsements must comply with state insurance laws and must be documented properly to be enforceable. It is essential to ensure that the endorsement does not conflict with the original policy terms. Additionally, both parties must agree to the changes, typically indicated by signatures on the endorsement form. This legal acknowledgment helps protect the rights of both the insurer and the insured.

Examples of using the insurance endorsement example

Examples of using an insurance endorsement example can vary widely based on individual needs. For instance, a homeowner may add an endorsement to cover personal property that exceeds the standard policy limits. Another example is a business owner who may need to endorse their liability policy to include coverage for a new service offered. Each example illustrates how endorsements can tailor insurance policies to better fit the specific requirements of the policyholder.

Quick guide on how to complete insurance endorsement example

Prepare Insurance Endorsement Example effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow offers you all the resources required to create, modify, and eSign your documents swiftly without delays. Manage Insurance Endorsement Example on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and eSign Insurance Endorsement Example with ease

- Locate Insurance Endorsement Example and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the files or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign feature, which takes seconds and has the same legal validity as a conventional ink signature.

- Review the details and then click on the Done button to save your modifications.

- Select how you wish to send your document—by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Modify and eSign Insurance Endorsement Example and ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the insurance endorsement example

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is endorsement insurance and how does it work?

Endorsement insurance is an additional coverage option that modifies an existing insurance policy. A common endorsement insurance example involves adding coverage for specific items or risks that are not included in the standard policy. This allows businesses to customize their insurance to better fit their needs and protect against unique exposures.

-

What types of endorsements can be added to an insurance policy?

There are several types of endorsements, including personal property, water damage, and liability coverage. For instance, an endorsement insurance example might include a rider for valuable artwork, providing extra protection beyond the basic policy limit. Evaluating your needs can help determine the best endorsements for your situation.

-

How does endorsement insurance impact policy pricing?

Adding endorsements to an insurance policy typically affects the premium amount. For example, including more extensive coverage in your endorsement insurance example can result in higher costs due to the increased risk covered. It's important to evaluate the cost versus the potential benefits to ensure you're getting appropriate coverage.

-

What are the benefits of using an endorsement insurance example?

One of the main benefits of endorsement insurance is the flexibility it offers, allowing you to tailor your coverage to specific needs. For example, if you own unique equipment that requires special coverage, an endorsement insurance example can ensure you’re protected. This customization leads to enhanced peace of mind when it comes to safeguarding your assets.

-

Can endorsements be added to any type of insurance policy?

Most insurance policies can accommodate endorsements, though the options available may vary by provider. For example, endorsements for liability coverage can often be added to general liability policies. It's advisable to consult with your insurance agent to explore which endorsements are best suited to your particular policy.

-

How do I choose the right endorsements for my insurance policy?

Choosing the right endorsements involves assessing your unique risks and needs. An endorsement insurance example might include specific coverage for equipment or liability that is critical to your operations. Consulting with an insurance professional can help clarify which endorsements will provide the best value for your business.

-

What integrations does airSlate SignNow offer for insurance documentation?

AirSlate SignNow offers seamless integrations with popular tools such as Google Workspace, Salesforce, and more, which can streamline your insurance documentation process. Using airSlate SignNow for your endorsement insurance example documentation ensures efficient management of policy changes and endorsements. This can enhance overall productivity and reduce turnaround time.

Get more for Insurance Endorsement Example

- Terms and conditions of monthly vehicle parking license form

- I am in receipt of your letter dated form

- Sample letters for credit bureau to update information

- Kansas small estate affidavit formaffidavit transferring

- Debt management program agreement form

- Is marriage counseling covered by insurance and what to form

- Independent contractors agreement referee heartland form

- Ccg 0500 3 23 09 cook county clerk of the circuit court form

Find out other Insurance Endorsement Example

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free