W9 2109 Form

What is the W-9 2109?

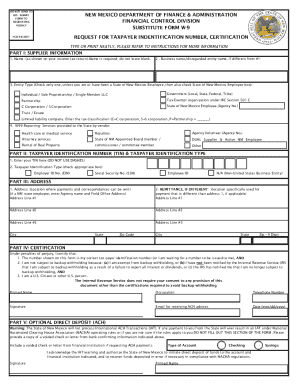

The W-9 2109 form is a tax document used in the United States by individuals and businesses to provide their taxpayer identification information to entities that will report income paid to them. This form is essential for freelancers, contractors, and other non-employees who receive payments that require tax reporting. By completing the W-9 2109, you certify your taxpayer status and provide your Social Security Number (SSN) or Employer Identification Number (EIN) to the requester, ensuring compliance with IRS regulations.

Steps to complete the W-9 2109

Completing the W-9 2109 form involves several straightforward steps:

- Provide your name as it appears on your tax return.

- Enter your business name if applicable.

- Indicate your federal tax classification, such as individual, corporation, or partnership.

- Fill in your address, including city, state, and ZIP code.

- Input your taxpayer identification number, either your SSN or EIN.

- Sign and date the form to certify the information provided is accurate.

Ensure that all information is correct to avoid delays in processing payments or tax reporting.

Legal use of the W-9 2109

The W-9 2109 form is legally binding when properly completed and submitted. It serves as a declaration of your taxpayer status and is used by the requester to prepare necessary tax documents, such as Form 1099. The accuracy of the information on this form is crucial, as incorrect details can lead to penalties from the IRS. By using a reliable electronic signature solution, you can ensure that your submission is compliant with regulations, such as the ESIGN Act and UETA, which govern the legality of electronic signatures.

How to obtain the W-9 2109

You can easily obtain the W-9 2109 form from the IRS website or through various tax preparation software. The form is available for download in PDF format, allowing you to print and fill it out manually or complete it electronically using a trusted eSignature platform. Ensure you are using the most current version of the form to comply with IRS requirements.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the W-9 2109 form. It is essential to follow these instructions carefully to ensure compliance. The IRS requires that the information provided is accurate and up-to-date. If any of your details change, such as your name or taxpayer identification number, you should submit a new W-9 2109 form to the requesting entity. Failure to comply with IRS guidelines may result in backup withholding on payments made to you.

Examples of using the W-9 2109

The W-9 2109 form is commonly used in various scenarios, including:

- Freelancers providing services to businesses.

- Independent contractors working on short-term projects.

- Real estate transactions where the seller must provide their taxpayer information.

- Consultants hired by companies for advisory services.

In each case, the W-9 2109 ensures that the entity making payments has the necessary information to report income accurately to the IRS.

Quick guide on how to complete w9 2109

Effortlessly Prepare W9 2109 on Any Device

The management of documents online has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage W9 2109 on any platform with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The Simplest Method to Edit and eSign W9 2109 with Ease

- Locate W9 2109 and select Get Form to begin.

- Use the tools we provide to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for those tasks.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional ink signature.

- Review all the information and press the Done button to save your modifications.

- Select your preferred delivery method for your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors requiring new document prints. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign W9 2109 and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the w9 2109

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the w9 2109 form and why is it important?

The w9 2109 form is used by businesses to request taxpayer identification information from contractors and vendors. Understanding and using this form correctly is crucial to ensure compliance with IRS regulations and facilitate accurate tax reporting.

-

How does airSlate SignNow help with managing the w9 2109?

airSlate SignNow simplifies the process of managing the w9 2109 form by allowing users to send, sign, and store it securely online. This electronic solution saves time, reduces paperwork, and ensures that your w9 2109 forms are organized and easily accessible.

-

Is there a cost associated with using airSlate SignNow for the w9 2109?

AirSlate SignNow offers a variety of pricing plans, making it cost-effective for individuals and businesses needing to manage the w9 2109 form efficiently. You can select a plan that suits your volume and feature requirements, ensuring you only pay for what you need.

-

What features does airSlate SignNow offer for the w9 2109?

Among the features that airSlate SignNow offers for the w9 2109 form are customizable templates, electronic signatures, secure storage, and advanced tracking options. These tools help streamline your document workflow and enhance productivity.

-

Can I integrate airSlate SignNow with other software for my w9 2109 needs?

Yes, airSlate SignNow integrates seamlessly with popular software solutions such as Google Drive, Salesforce, and Dropbox. This functionality allows you to manage your w9 2109 forms alongside other critical business applications, improving overall efficiency.

-

What are the benefits of using airSlate SignNow for the w9 2109?

Using airSlate SignNow for the w9 2109 provides numerous benefits, including time savings, enhanced security, and reduced administrative burdens. Its user-friendly interface ensures that managing your forms is a hassle-free experience.

-

Is airSlate SignNow secure for handling the w9 2109 form?

Absolutely, airSlate SignNow prioritizes security and employs industry-standard measures to protect your w9 2109 forms. Data encryption, secure access controls, and compliance with legal regulations ensure that your information remains safe.

Get more for W9 2109

- Heres what companies really do with your exit interview info form

- Name of company principal responsible form

- Forbearance agreement with release provision form

- Amended franchise rule faqsfederal trade commission form

- 16 things you should remove from your resume the ladders form

- Enclosed herewith please find a copy of a note which form

- Sample responses david j reed form

- Safe and responsible use of the internet form

Find out other W9 2109

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later