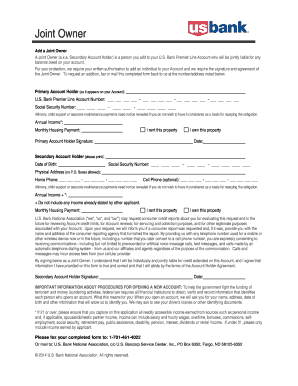

U S Bank Add Joint Owner to Checking Account Form

What is the U S Bank Add Joint Owner To Checking Account

The U S Bank add joint owner to checking account process allows account holders to include another individual as a co-owner on their checking account. This facilitates shared access to funds and account management. Joint owners have equal rights to the account, meaning both parties can deposit, withdraw, and manage the funds without restrictions. This arrangement is commonly used by couples, family members, or business partners who wish to streamline their financial transactions and responsibilities.

Steps to Complete the U S Bank Add Joint Owner To Checking Account

To add a joint owner to your U S Bank checking account, follow these steps:

- Gather necessary information about the new joint owner, including their full name, date of birth, Social Security number, and contact information.

- Visit a U S Bank branch or log into your online banking account.

- If using online banking, navigate to the account management section and look for the option to add a joint owner. If visiting a branch, request assistance from a bank representative.

- Complete the required forms, ensuring all information is accurate and up to date.

- Submit the forms and any identification documents as requested by the bank.

- Wait for confirmation from U S Bank regarding the successful addition of the joint owner.

Legal Use of the U S Bank Add Joint Owner To Checking Account

When adding a joint owner to a U S Bank checking account, it is essential to understand the legal implications. Both parties must agree to the terms of the account, and the addition must comply with banking regulations. Joint owners share equal responsibility for the account, including any debts or overdrafts incurred. This legal framework ensures that both parties have the right to access and manage the account, which can be beneficial for transparency and financial planning.

Required Documents

To successfully add a joint owner to your U S Bank checking account, you will need to provide specific documents. These typically include:

- Identification for both the primary account holder and the new joint owner, such as a driver’s license or passport.

- Proof of address, which can be a utility bill or lease agreement.

- Social Security numbers for both parties.

Having these documents ready will help streamline the process and ensure compliance with U S Bank’s requirements.

Eligibility Criteria

To add a joint owner to a U S Bank checking account, both individuals must meet certain eligibility criteria. Generally, the following conditions apply:

- Both parties must be at least eighteen years old.

- Each individual must possess a valid Social Security number or Individual Taxpayer Identification Number.

- Both parties should provide valid identification and proof of address.

Meeting these criteria is essential for a smooth addition of a joint owner to the account.

Form Submission Methods

When adding a joint owner to your U S Bank checking account, you can submit the necessary forms through various methods:

- In-person at a local U S Bank branch, where a representative can assist you with the process.

- Online through the U S Bank website, if you have online banking access.

- By mail, if you prefer to send the completed forms directly to the bank.

Choosing the method that best suits your needs can help facilitate the process.

Quick guide on how to complete u s bank add joint owner to checking account

Complete U S Bank Add Joint Owner To Checking Account seamlessly on any device

Managing documents online has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the necessary form and securely archive it online. airSlate SignNow equips you with all the resources required to produce, modify, and electronically sign your documents swiftly without delays. Handle U S Bank Add Joint Owner To Checking Account on any device using airSlate SignNow's Android or iOS applications and simplify your document-centric tasks today.

How to modify and eSign U S Bank Add Joint Owner To Checking Account effortlessly

- Locate U S Bank Add Joint Owner To Checking Account and click Get Form to commence.

- Utilize the tools we offer to fill out your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes seconds and carries the same legal authority as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate worries about lost or mislaid documents, tedious form hunting, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign U S Bank Add Joint Owner To Checking Account and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the u s bank add joint owner to checking account

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

How can I u s bank add joint owner to checking account using airSlate SignNow?

To u s bank add joint owner to checking account, you can use airSlate SignNow to facilitate the process. Simply create an electronic form for joint ownership and send it to the required parties for eSigning. This method ensures a quick and compliant transaction without the need for physical presence.

-

What documents are needed to u s bank add joint owner to checking account?

When you u s bank add joint owner to checking account, you typically need identification documents for both account holders. This may include government-issued IDs and proof of address. airSlate SignNow helps you collect and manage these documents digitally, making the process seamless.

-

Is there a fee to u s bank add joint owner to checking account?

While the process of adding a joint owner may vary by bank, airSlate SignNow does not charge for the eSigning service you use to facilitate this action. Be sure to check with U.S. Bank directly regarding any potential fees for account changes.

-

What are the benefits of using airSlate SignNow to u s bank add joint owner to checking account?

Using airSlate SignNow to u s bank add joint owner to checking account provides a secure and efficient method for document signing. It eliminates the hassle of paper forms and in-person visits, allowing for real-time tracking and management of the signing process.

-

Can airSlate SignNow integrate with my U.S. Bank account for document management?

Yes, airSlate SignNow offers integrations with various banking and financial management systems, making it easier to manage documents related to your U.S. Bank account. You can streamline your processes by linking your accounts and using eSigning features to u s bank add joint owner to checking account.

-

How long does it take to u s bank add joint owner to checking account with airSlate SignNow?

The time it takes to u s bank add joint owner to checking account using airSlate SignNow can vary but is typically much faster than traditional methods. Once all required parties have eSigned the document, the change is processed rapidly, often within a few business days, depending on bank processing times.

-

Is airSlate SignNow secure for sensitive banking information?

Absolutely! airSlate SignNow employs industry-leading security measures to protect your sensitive banking information. When you u s bank add joint owner to checking account, you can trust that all data will remain confidential and secure throughout the process.

Get more for U S Bank Add Joint Owner To Checking Account

- In the matter of the estate of name 490232544 form

- Range form

- Suspended to deactivated shut case help for new sellers form

- Please be advised that our firm represents name and any parental or sponsor guarantor form

- Chapter 155 zoning code city of inkster form

- Enclosed herewith please find the original and one copy a waiver of process in the above form

- Sample cps appeal letter interacademy form

- Name division cause no form

Find out other U S Bank Add Joint Owner To Checking Account

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF