B&O Tax Report City of Shelton Form

What is the B&O Tax Report City Of Shelton

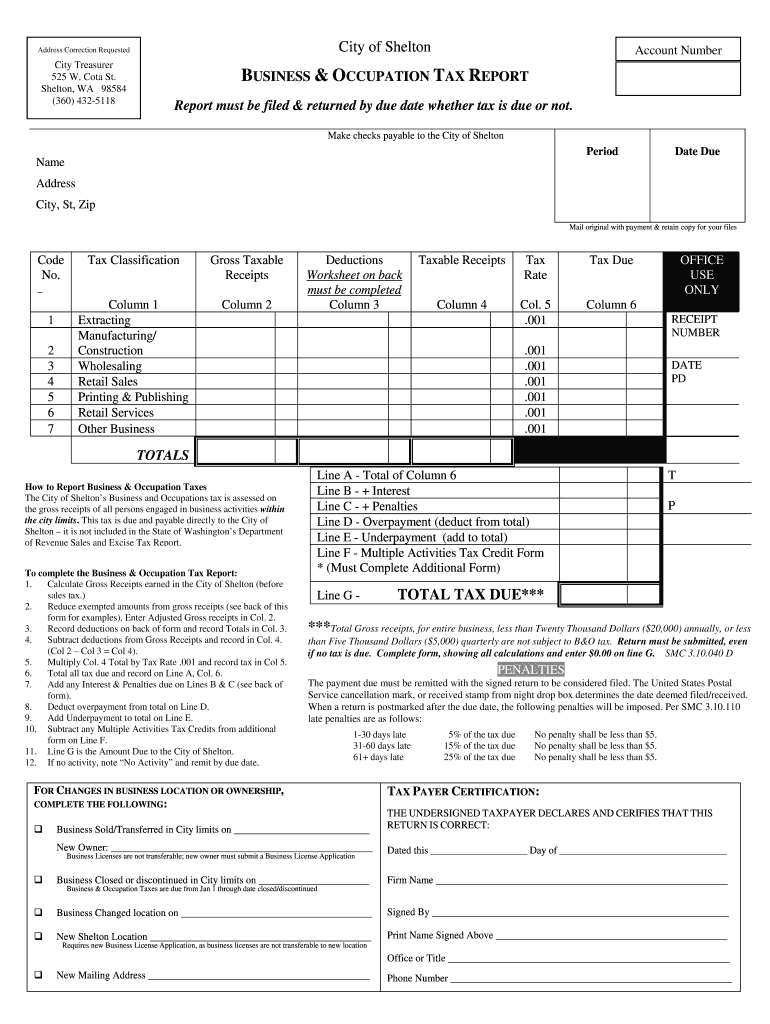

The B&O Tax Report for the City of Shelton is a document that businesses must file to report their business and occupation tax obligations. This tax is assessed on the gross receipts of businesses operating within the city limits. The report provides a detailed account of the income generated by the business, which is used to calculate the tax owed to the city. Understanding this form is essential for compliance with local tax regulations and to avoid penalties.

Steps to complete the B&O Tax Report City Of Shelton

Completing the B&O Tax Report for the City of Shelton involves several key steps:

- Gather necessary financial records, including income statements and receipts.

- Determine the total gross receipts for the reporting period.

- Fill out the B&O Tax Report form accurately, ensuring all sections are completed.

- Calculate the tax owed based on the applicable rates for your business type.

- Review the completed form for accuracy before submission.

How to obtain the B&O Tax Report City Of Shelton

Businesses can obtain the B&O Tax Report for the City of Shelton through the city’s official website or by visiting the local tax office. The form is typically available in both digital and paper formats. For ease of access, many businesses prefer to download the form online, allowing for electronic completion and submission.

Legal use of the B&O Tax Report City Of Shelton

The B&O Tax Report is legally required for all businesses operating within Shelton. Filing this report ensures compliance with local tax laws and regulations. Failure to submit the report can result in penalties, including fines or interest on unpaid taxes. It is important for businesses to file the report accurately and on time to maintain good standing with the city.

Form Submission Methods (Online / Mail / In-Person)

Businesses have several options for submitting the B&O Tax Report for the City of Shelton:

- Online Submission: Many businesses choose to file electronically through the city’s online portal, which simplifies the process and allows for quicker processing.

- Mail: The completed form can be printed and mailed to the city’s tax office. Ensure that it is sent well before the deadline to avoid late fees.

- In-Person: Businesses can also submit the form in person at the local tax office, where staff can assist with any questions or concerns.

Filing Deadlines / Important Dates

It is crucial for businesses to be aware of the filing deadlines for the B&O Tax Report. Typically, the report is due on a quarterly or annual basis, depending on the business's revenue. Missing the deadline can lead to penalties, so businesses should mark their calendars and prepare their reports in advance to ensure timely submission.

Quick guide on how to complete bampo tax report city of shelton

Handle B&O Tax Report City Of Shelton effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents quickly and without delays. Manage B&O Tax Report City Of Shelton on any device with airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

The easiest way to modify and electronically sign B&O Tax Report City Of Shelton seamlessly

- Obtain B&O Tax Report City Of Shelton and click Get Form to begin.

- Use the tools we provide to fill out your document.

- Emphasize important sections of your documents or conceal sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click the Done button to finalize your changes.

- Choose how you wish to deliver your form—via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign B&O Tax Report City Of Shelton to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the bampo tax report city of shelton

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the B&O Tax Report for the City of Shelton?

The B&O Tax Report for the City of Shelton is a tax form that businesses must file to report their business and occupation taxes. This report calculates the tax owed based on business revenue generated within the city. Utilizing airSlate SignNow can streamline this process by allowing you to eSign and submit documents quickly and efficiently.

-

How can airSlate SignNow help with the B&O Tax Report for the City of Shelton?

airSlate SignNow simplifies the preparation of the B&O Tax Report for the City of Shelton by providing a user-friendly interface for document management and eSigning. This can save time and reduce stress associated with tax filing, allowing businesses to focus on core operations while ensuring compliance with local tax regulations.

-

What are the pricing options for using airSlate SignNow for the B&O Tax Report?

airSlate SignNow offers a range of pricing plans to suit various business needs, making it an affordable choice for eSigning the B&O Tax Report for the City of Shelton. Plans may vary based on features, and businesses can choose a plan that aligns with their document handling requirements and budget.

-

Does airSlate SignNow support integrations for filing the B&O Tax Report for the City of Shelton?

Yes, airSlate SignNow supports various integrations that can enhance the efficiency of filing the B&O Tax Report for the City of Shelton. Users can connect with accounting software, workflow tools, and CRM systems, enabling seamless document submissions and improving overall business processes.

-

What features does airSlate SignNow offer for managing the B&O Tax Report?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking, which are essential for effectively managing the B&O Tax Report for the City of Shelton. These tools help ensure accuracy and provide an audit trail for compliance and record-keeping purposes.

-

Is airSlate SignNow compliant with local regulations regarding the B&O Tax Report?

Yes, airSlate SignNow ensures that its platform is compliant with local regulations, including those pertaining to the B&O Tax Report for the City of Shelton. This compliance helps businesses meet legal requirements while minimizing the risk of errors in their tax filings.

-

Can I use airSlate SignNow on mobile devices for the B&O Tax Report?

Absolutely! airSlate SignNow is accessible on mobile devices, allowing users to complete and eSign the B&O Tax Report for the City of Shelton on the go. This flexibility ensures that you can manage your tax documents anytime, anywhere, contributing to a more efficient workflow.

Get more for B&O Tax Report City Of Shelton

- Interview cheat sheetmonstercom form

- We are unable to offer you position at the present time form

- 1010 richards street form

- Iacigaingov form

- Document contents snl form

- State license search franchise michigan form

- Chapter 233 mn laws minnesota office of the revisor of form

- Rhode island uniform franchise registration application

Find out other B&O Tax Report City Of Shelton

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter