Print Wisconsin Form Eic a

What is the Print Wisconsin Form EIC A

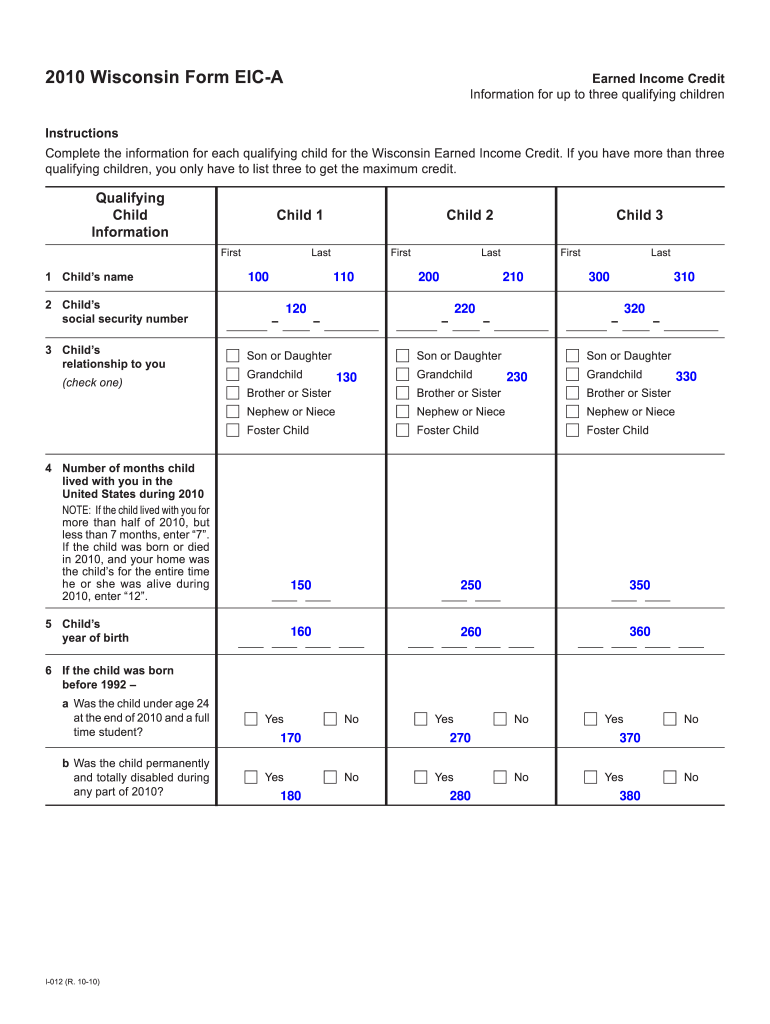

The Print Wisconsin Form EIC A is a tax form used by eligible taxpayers in Wisconsin to claim the Earned Income Credit (EIC). This credit is designed to provide financial relief to low- to moderate-income individuals and families, helping to reduce their tax burden. The form captures essential information about the taxpayer's income, filing status, and qualifying children, allowing for accurate calculation of the credit amount. Understanding the purpose and requirements of this form is crucial for maximizing potential tax benefits.

How to use the Print Wisconsin Form EIC A

Using the Print Wisconsin Form EIC A involves several steps to ensure accurate completion and submission. First, gather all necessary documents, including income statements and Social Security numbers for qualifying children. Next, carefully fill out the form, ensuring that all information is accurate and complete. Once the form is filled out, it can be submitted either electronically or by mail, depending on the taxpayer's preference. Utilizing a reliable eSignature platform can streamline this process, ensuring that the form is signed and submitted securely.

Steps to complete the Print Wisconsin Form EIC A

Completing the Print Wisconsin Form EIC A requires careful attention to detail. Follow these steps for proper completion:

- Gather required documents, including W-2 forms and other income statements.

- Provide personal information, including name, address, and Social Security number.

- List qualifying children, including their names, Social Security numbers, and relationship to you.

- Calculate your earned income and adjust it as needed based on the instructions provided.

- Review the form for accuracy and completeness before submission.

Eligibility Criteria

To qualify for the Earned Income Credit using the Print Wisconsin Form EIC A, taxpayers must meet specific eligibility criteria. These include:

- Filing status: Must be single, married filing jointly, or head of household.

- Income limits: Must have earned income below certain thresholds, which vary based on filing status and number of qualifying children.

- Qualifying children: Must have one or more qualifying children who meet age, residency, and relationship requirements.

Form Submission Methods

The Print Wisconsin Form EIC A can be submitted through various methods, providing flexibility for taxpayers. These methods include:

- Online submission: Many taxpayers choose to file electronically through tax software that supports e-filing.

- Mail: The completed form can be printed and mailed to the appropriate tax authority address.

- In-person: Some individuals may opt to submit the form in person at local tax offices or assistance centers.

Key elements of the Print Wisconsin Form EIC A

Understanding the key elements of the Print Wisconsin Form EIC A is essential for accurate completion. The form typically includes sections for personal information, income details, and information about qualifying children. Each section is designed to collect specific data necessary for calculating the Earned Income Credit. Additionally, the form includes instructions for completion and submission, which are crucial for ensuring compliance with tax regulations.

Quick guide on how to complete print wisconsin form eic a

Complete Print Wisconsin Form Eic A effortlessly on any device

Digital document management has gained popularity among companies and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without any hold-ups. Manage Print Wisconsin Form Eic A on any device using the airSlate SignNow apps for Android or iOS and enhance any document-focused operation today.

The easiest way to adjust and eSign Print Wisconsin Form Eic A with minimal effort

- Locate Print Wisconsin Form Eic A and click Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive details with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or disorganized documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign Print Wisconsin Form Eic A and guarantee excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the print wisconsin form eic a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Wisconsin Form EIC A?

The Wisconsin Form EIC A is a tax form used to claim the Earned Income Credit for eligible residents. This form helps individuals claim a refundable tax credit based on their income, family size, and filing status. Using airSlate SignNow, you can easily eSign and submit the Wisconsin Form EIC A electronically.

-

How can airSlate SignNow help with the Wisconsin Form EIC A?

AirSlate SignNow streamlines the process of filling out, signing, and submitting the Wisconsin Form EIC A. Our easy-to-use platform allows you to quickly eSign documents and manage your forms securely. This enhances efficiency and ensures you meet all filing deadlines.

-

What are the pricing options for airSlate SignNow?

AirSlate SignNow offers various pricing plans to accommodate different needs, making it easy to choose the right option for managing the Wisconsin Form EIC A. Our plans are competitive and designed to be cost-effective for individuals and businesses alike. Visit our pricing page to find the plan that best suits your requirements.

-

Is airSlate SignNow secure for submitting documents like the Wisconsin Form EIC A?

Yes, airSlate SignNow employs industry-leading security measures to ensure that your documents, including the Wisconsin Form EIC A, are protected. We use encryption, secure servers, and compliance with privacy standards to safeguard your information. You can trust us with your personal and financial documents.

-

Can I integrate airSlate SignNow with other applications for handling the Wisconsin Form EIC A?

Absolutely! airSlate SignNow offers integrations with various applications and services, making it easy to manage your workflow for the Wisconsin Form EIC A. Whether you use accounting software or customer relationship management tools, our platform can seamlessly connect and enhance your document management process.

-

What features does airSlate SignNow offer for managing forms like the Wisconsin Form EIC A?

AirSlate SignNow provides features such as customizable templates, electronic signatures, and real-time tracking for managing documents like the Wisconsin Form EIC A. You can also automate reminders for signatures and collaborate with team members efficiently. These features help simplify the overall process of handling your tax documents.

-

Can I use airSlate SignNow on mobile devices for the Wisconsin Form EIC A?

Yes, airSlate SignNow is fully compatible with mobile devices, allowing you to access and manage the Wisconsin Form EIC A on the go. Our mobile app provides a user-friendly interface for eSigning and sharing documents anytime, anywhere. Stay connected and handle your tax forms conveniently from your smartphone or tablet.

Get more for Print Wisconsin Form Eic A

- Trust agreement made this day of 1989 form

- Form 10 k for american vanguard corporation

- Drafting and enforcing complex indemnification provisions form

- Proxy statementsstrategy amp forms

- Governing law state of california agreements contracts form

- Exhibit 109 form indemnification agreement

- Enpro industries inc form 10 12ba received 05162002

- Proxy disclosure recommendations harvard university form

Find out other Print Wisconsin Form Eic A

- eSign Iowa Standard rental agreement Free

- eSignature Florida Profit Sharing Agreement Template Online

- eSignature Florida Profit Sharing Agreement Template Myself

- eSign Massachusetts Simple rental agreement form Free

- eSign Nebraska Standard residential lease agreement Now

- eSign West Virginia Standard residential lease agreement Mobile

- Can I eSign New Hampshire Tenant lease agreement

- eSign Arkansas Commercial real estate contract Online

- eSign Hawaii Contract Easy

- How Do I eSign Texas Contract

- How To eSign Vermont Digital contracts

- eSign Vermont Digital contracts Now

- eSign Vermont Digital contracts Later

- How Can I eSign New Jersey Contract of employment

- eSignature Kansas Travel Agency Agreement Now

- How Can I eSign Texas Contract of employment

- eSignature Tennessee Travel Agency Agreement Mobile

- eSignature Oregon Amendment to an LLC Operating Agreement Free

- Can I eSign Hawaii Managed services contract template

- How Do I eSign Iowa Managed services contract template