Vat 3a Schedules Form

What is the Vat 3a Schedules

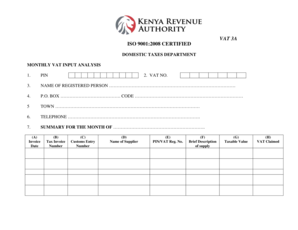

The Vat 3a schedules form is a specific document used for reporting and managing value-added tax (VAT) obligations. This form is essential for businesses that need to declare their VAT liabilities and entitlements. It provides a structured format for detailing sales, purchases, and the corresponding VAT amounts. Understanding this form is crucial for compliance with tax regulations and for ensuring accurate financial reporting.

How to use the Vat 3a Schedules

Using the Vat 3a schedules involves several steps to ensure accurate completion. First, gather all necessary financial records, including invoices and receipts that pertain to sales and purchases. Next, input the relevant figures into the appropriate sections of the form, ensuring that all calculations are correct. It is important to review the completed form for any errors before submission. Utilizing digital tools can streamline this process, making it easier to fill out and eSign the form securely.

Steps to complete the Vat 3a Schedules

Completing the Vat 3a schedules requires careful attention to detail. Follow these steps:

- Collect all sales and purchase records.

- Identify the relevant VAT rates applicable to your transactions.

- Fill in the form sections accurately, detailing sales, purchases, and VAT amounts.

- Double-check all entries for accuracy.

- Sign the completed form electronically or by hand, depending on your submission method.

Legal use of the Vat 3a Schedules

The Vat 3a schedules form is legally binding when completed and submitted according to established regulations. It must be filled out accurately to reflect true financial activities. Compliance with eSignature laws ensures that the electronic submission of this form is recognized legally. Using a reliable electronic signing solution can enhance the legitimacy of the form and protect against disputes regarding its authenticity.

Filing Deadlines / Important Dates

Timely filing of the Vat 3a schedules is critical to avoid penalties. Each jurisdiction may have specific deadlines for submission, often aligned with quarterly or annual reporting periods. It is advisable to mark these dates on your calendar and prepare the form in advance to ensure compliance. Regularly checking for updates on filing deadlines can help prevent missed submissions.

Required Documents

To complete the Vat 3a schedules, several documents are necessary. These typically include:

- Sales invoices detailing VAT charged.

- Purchase invoices showing VAT paid.

- Previous VAT returns for reference.

- Any additional documentation required by state regulations.

Examples of using the Vat 3a Schedules

Examples of using the Vat 3a schedules can help clarify its application. For instance, a small business may use the form to report quarterly VAT collected from sales to customers. Similarly, a company that purchases goods from suppliers can use the form to claim back VAT paid. These examples illustrate the form's role in managing VAT obligations effectively and ensuring compliance with tax laws.

Quick guide on how to complete vat 3a schedules

Complete Vat 3a Schedules effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed forms, since you can easily find the necessary document and securely store it online. airSlate SignNow provides you with all the resources needed to create, modify, and eSign your documents swiftly without delays. Manage Vat 3a Schedules on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Vat 3a Schedules without any hassle

- Locate Vat 3a Schedules and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Vat 3a Schedules and ensure effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vat 3a schedules

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are VAT 3A schedules in the context of airSlate SignNow?

VAT 3A schedules refer to the structured documentation required for Value Added Tax reporting. Within airSlate SignNow, these schedules can be efficiently managed and signed electronically, ensuring compliance and accuracy in your tax-related processes.

-

How does airSlate SignNow simplify the management of VAT 3A schedules?

airSlate SignNow streamlines the creation, sending, and signing of VAT 3A schedules through its user-friendly interface. Users can easily customize templates, track document status, and receive notifications, reducing the time spent on administrative tasks.

-

What features does airSlate SignNow offer for handling VAT 3A schedules?

Key features for managing VAT 3A schedules include document templates, eSigning capabilities, integration with other accounting software, and robust security measures. These features enhance accuracy and efficiency in handling tax documentation.

-

Is airSlate SignNow a cost-effective solution for managing VAT 3A schedules?

Yes, airSlate SignNow is known for its competitive pricing that offers excellent value for businesses managing VAT 3A schedules. With flexible pricing plans, companies can choose the option that best fits their budget while enjoying powerful document management tools.

-

Can airSlate SignNow integrate with other software for VAT 3A schedules?

Absolutely! airSlate SignNow offers integrations with popular accounting and ERP systems, allowing for seamless data transfer and management of VAT 3A schedules. This connectivity helps maintain accurate financial records while saving time on data entry.

-

What are the benefits of using airSlate SignNow for VAT 3A schedules?

Using airSlate SignNow for VAT 3A schedules ensures faster processing times, reduces paperwork, and enhances compliance. Moreover, the electronic signing feature allows for quick approval, thus accelerating your tax filing process.

-

How secure is airSlate SignNow when dealing with VAT 3A schedules?

Security is a top priority for airSlate SignNow. The platform employs advanced encryption and compliance with major security standards to protect sensitive information related to VAT 3A schedules, giving you peace of mind about your document safety.

Get more for Vat 3a Schedules

Find out other Vat 3a Schedules

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA