Idaho Income Tax Form 40 Tax Idaho

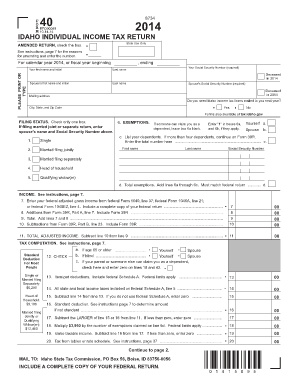

What is the Idaho Income Tax Form 40?

The Idaho Income Tax Form 40 is the primary document used by residents to report their income and calculate their state income tax liability. This form is essential for individuals who earn income in Idaho, as it allows them to detail their earnings, claim deductions, and determine the amount of tax owed to the state. The form is designed for single filers and married couples filing jointly, making it a crucial tool for tax compliance in Idaho.

Steps to Complete the Idaho Income Tax Form 40

Completing the Idaho Income Tax Form 40 involves several key steps:

- Gather necessary documents: Collect your W-2s, 1099s, and any other income statements.

- Fill out personal information: Enter your name, address, and Social Security number at the top of the form.

- Report your income: List all sources of income, including wages, interest, and dividends.

- Claim deductions: Identify and apply any eligible deductions, such as those for student loan interest or mortgage interest.

- Calculate your tax: Use the provided tax tables or software to determine your tax liability based on your taxable income.

- Sign and date the form: Ensure that you sign the form, as an unsigned form is considered invalid.

Legal Use of the Idaho Income Tax Form 40

The Idaho Income Tax Form 40 is legally binding when completed accurately and submitted on time. To ensure its validity, taxpayers must comply with state regulations regarding eSignatures and document submission. Using a secure platform for electronic filing can enhance the legal standing of the form, as it adheres to the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA).

Required Documents for Filing

When preparing to file the Idaho Income Tax Form 40, taxpayers must gather several key documents:

- W-2 forms from employers

- 1099 forms for additional income

- Records of any deductions or credits claimed

- Previous year’s tax return for reference

Having these documents ready can streamline the filing process and help ensure accuracy.

Form Submission Methods

Taxpayers in Idaho can submit the Income Tax Form 40 through various methods:

- Online: Many taxpayers choose to file electronically using approved e-filing software.

- By mail: Printed forms can be mailed to the Idaho State Tax Commission.

- In-person: Taxpayers may also visit local tax offices for assistance and to submit forms directly.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the Idaho Income Tax Form 40 to avoid penalties:

- The standard filing deadline is April 15 for most taxpayers.

- Extensions may be available, but they must be requested before the original deadline.

Late submissions can result in penalties and interest on unpaid taxes, making timely filing essential.

Quick guide on how to complete idaho income tax form 40 tax idaho

Prepare Idaho Income Tax Form 40 Tax Idaho effortlessly on any device

Digital document management has become increasingly popular among firms and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and eSign your documents swiftly without delays. Manage Idaho Income Tax Form 40 Tax Idaho on any device with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Idaho Income Tax Form 40 Tax Idaho with ease

- Locate Idaho Income Tax Form 40 Tax Idaho and click Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Emphasize relevant parts of the documents or obscure sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature with the Sign function, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you wish to submit your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Idaho Income Tax Form 40 Tax Idaho and ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the idaho income tax form 40 tax idaho

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Idaho income tax?

Idaho income tax is a state tax levied on the income earned by residents and non-residents within Idaho. It is important for anyone conducting business in Idaho to understand how this tax applies to their income. Proper management of Idaho income tax obligations can help businesses avoid penalties or unnecessary costs.

-

How can airSlate SignNow help with Idaho income tax documentation?

airSlate SignNow streamlines the process of sending and signing essential documents for Idaho income tax filings. With our platform, you can securely send tax documents for eSignature, making compliance easier and more efficient. This reduces the time you spend managing paperwork so you can focus on your business.

-

What are the pricing plans for airSlate SignNow?

airSlate SignNow offers a variety of pricing plans designed to fit different business needs. Each plan includes features to help users manage their Idaho income tax documents effectively. Our competitive pricing ensures that you receive top-quality eSignature services without breaking the bank.

-

What features does airSlate SignNow provide for managing Idaho income tax documents?

airSlate SignNow provides features such as document eSigning, templates for tax forms, and secure cloud storage. These features are tailored to make handling your Idaho income tax documents straightforward. Users can customize their workflows to ensure all documents are compliant with Idaho regulations.

-

Can I integrate airSlate SignNow with my accounting software for Idaho income tax?

Yes, airSlate SignNow integrates seamlessly with various accounting software, making it easier to manage your Idaho income tax documents. These integrations help automate data entry and keep your tax information organized. By using our platform, you can enhance your workflow efficiency and accuracy.

-

What are the benefits of using airSlate SignNow for Idaho income tax management?

Using airSlate SignNow for Idaho income tax management provides several benefits, including enhanced efficiency, improved document tracking, and reduced processing time. By digitizing your processes, you can minimize errors often associated with manual handling of tax documents. This leads to quicker and more compliant tax filing in Idaho.

-

Is airSlate SignNow secure for handling sensitive Idaho income tax documents?

Absolutely! airSlate SignNow employs advanced security protocols to ensure that your Idaho income tax documents are safe and confidential. We utilize encryption and secure cloud storage to protect sensitive information throughout the signing process. You can trust us to handle your tax documents with the utmost security.

Get more for Idaho Income Tax Form 40 Tax Idaho

- Order for involuntary hospitalization due to court forms

- Mh 907h form

- Mental hygienethe wv young lawyers section form

- Inv 26 20120608 form

- Compilation of significant decisions and legislation from form

- Flow chart of involuntary commitment process form

- When patients with dementia become combative theres often form

- Information sheet civil case defendant

Find out other Idaho Income Tax Form 40 Tax Idaho

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast