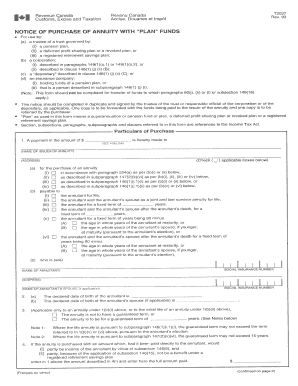

T2037 Form

What is the T2037?

The T2037 form, also known as the T2037 transfer form, is a document used in the context of transferring funds from a registered retirement savings plan (RRSP) to another financial institution or plan. This form is crucial for individuals looking to manage their retirement savings effectively while ensuring compliance with Canadian tax regulations. The T2037 form is specifically designed to facilitate the transfer of funds without triggering immediate tax consequences, allowing for a seamless transition between accounts.

How to use the T2037

Using the T2037 form involves several straightforward steps. First, ensure that you have the correct and complete version of the form, which can typically be obtained from financial institutions or downloaded online. Next, fill out the required information, including your personal details, the details of the transferring institution, and the amount to be transferred. Once completed, submit the form to the financial institution that will receive the funds. This ensures that the transfer is processed correctly and in accordance with tax regulations.

Steps to complete the T2037

Completing the T2037 form requires careful attention to detail. Follow these steps for a successful submission:

- Obtain the T2037 form from a reliable source.

- Fill in your personal information, including your name, address, and social security number.

- Provide details about the account from which you are transferring funds, including the account number and institution name.

- Indicate the amount you wish to transfer and specify the type of account receiving the funds.

- Review the completed form for accuracy and completeness.

- Submit the form to the receiving financial institution for processing.

Legal use of the T2037

The T2037 form is legally recognized when used in accordance with the regulations set forth by the Canada Revenue Agency (CRA). It is essential to ensure that the form is completed accurately to avoid any potential legal issues or tax liabilities. The use of this form allows individuals to transfer retirement funds while maintaining tax-deferred status, provided that all requirements are met. Failure to adhere to the legal stipulations may result in penalties or unexpected tax implications.

How to obtain the T2037

The T2037 form can be obtained through various channels. Most financial institutions provide the form directly to their clients, either in physical or digital format. Additionally, the form is available for download from official government websites, ensuring that users have access to the most current version. It is advisable to verify that the form is up to date to comply with any recent regulatory changes.

Required Documents

When completing the T2037 form, certain documents may be required to support the transfer process. These typically include:

- A copy of your identification, such as a driver's license or passport.

- Statements from both the transferring and receiving financial institutions.

- Any additional documentation requested by the receiving institution to verify your account details.

Quick guide on how to complete form t2037

Effortlessly Prepare form t2037 on Any Device

The management of online documents has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly and without delays. Handle t2037 seamlessly on any device using the airSlate SignNow apps for Android or iOS, and enhance any document-related process today.

An Easy Way to Modify and eSign t2037 transfer form

- Find ccra t2037 and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or blackout sensitive information using tools specifically provided by airSlate SignNow for this purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to share your form – via email, SMS, invite link, or download it to your computer.

Eliminate the concerns of lost or misplaced documents, tedious form searches, or mistakes that require reprinting new document versions. airSlate SignNow addresses all your document management needs with just a few clicks from your preferred device. Modify and eSign cra t2037 to guarantee excellent communication at every stage of the form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form t2037 notice of purchase of annuity with 'plan' funds

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask t2037 transfer form

-

What is t2037 and how does it relate to eSigning documents?

t2037 is a crucial document in the world of electronic signatures that provides guidelines for various forms. With airSlate SignNow, you can effortlessly handle t2037 documents, ensuring compliance and security while eSigning. Easily integrate these processes into your workflow for enhanced efficiency.

-

How does airSlate SignNow ensure the security of my t2037 documents?

AirSlate SignNow employs advanced encryption protocols to secure all your t2037 documents. We adhere to industry standards and regulations that help protect sensitive data from unauthorized access. You can trust our platform to keep your eSigned t2037 documents safe and secure.

-

What are the pricing options for using airSlate SignNow for t2037 document management?

AirSlate SignNow offers a variety of pricing plans tailored to meet different business needs for managing t2037 documents. Whether you’re a small business or a large enterprise, our cost-effective solutions enable you to optimize your eSigning processes without breaking the bank. Check our website for detailed pricing information and choose a plan that fits your requirements.

-

Can I integrate airSlate SignNow with other applications for managing t2037?

Yes, airSlate SignNow offers seamless integrations with multiple applications, allowing you to manage t2037 files within your existing workflow. Connect with popular tools like Google Workspace, Dropbox, and Salesforce to streamline your processes. This flexibility makes handling t2037 documents more convenient and efficient.

-

What features does airSlate SignNow provide for t2037 document eSigning?

AirSlate SignNow provides a range of features specifically designed for t2037 document eSigning, including customizable templates, automated reminders, and real-time tracking. These features make it easy to generate, send, and manage t2037 documents. The user-friendly interface simplifies the entire signing process for all parties involved.

-

What benefits can businesses expect when using airSlate SignNow for t2037 documents?

Using airSlate SignNow for t2037 documents offers numerous benefits, including improved efficiency, reduced paper usage, and faster turnaround times. You’ll experience enhanced collaboration and flexibility as your team can eSign t2037 documents from anywhere at any time. This leads to better productivity and streamlined business operations.

-

Is training available for using airSlate SignNow with t2037 documents?

Absolutely! AirSlate SignNow provides comprehensive training resources and customer support to help you understand the nuances of handling t2037 documents. Our extensive knowledge base, tutorials, and responsive support team ensure you can make the most of our platform and its features.

Get more for ccra t2037

Find out other cra t2037

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe