Form 426 Missouri

What is the Form 426 Missouri

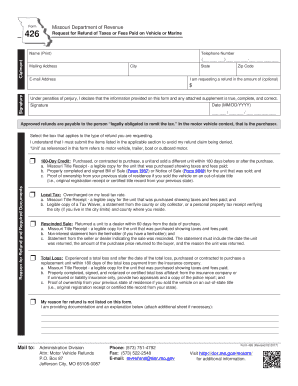

The Missouri Form 426 is a tax document used to apply for a 180-day sales tax credit extension. This form is essential for businesses and individuals seeking to extend their sales tax credit eligibility in Missouri. It is specifically designed for taxpayers who may need additional time to utilize their sales tax credits effectively, ensuring compliance with state tax regulations.

How to use the Form 426 Missouri

To use the Missouri Form 426, taxpayers must complete the form accurately, providing all required information regarding their sales tax credits. This includes details about the business, the nature of the tax credits, and any relevant financial data. Once filled out, the form must be submitted to the Missouri Department of Revenue for processing. Utilizing electronic methods for submission can streamline the process and enhance efficiency.

Steps to complete the Form 426 Missouri

Completing the Missouri Form 426 involves several key steps:

- Gather necessary information, including your business details and sales tax credit data.

- Fill out the form accurately, ensuring all sections are completed.

- Review the form for any errors or omissions.

- Submit the form electronically or by mail to the Missouri Department of Revenue.

Legal use of the Form 426 Missouri

The legal use of the Missouri Form 426 is governed by state tax laws. To ensure that the form is considered valid, it must be completed in accordance with the guidelines set forth by the Missouri Department of Revenue. This includes adhering to deadlines and providing accurate information. Electronic submissions are legally recognized, provided they meet the necessary compliance standards.

Key elements of the Form 426 Missouri

Key elements of the Missouri Form 426 include:

- Taxpayer identification information, such as name and address.

- Details regarding the sales tax credits being claimed.

- Signature of the taxpayer or authorized representative.

- Date of submission.

Filing Deadlines / Important Dates

Filing deadlines for the Missouri Form 426 are crucial for maintaining compliance. Taxpayers should be aware of the specific dates set by the Missouri Department of Revenue for submitting the form to avoid penalties. It is advisable to check the department's official resources for the most current deadlines and any changes that may occur.

Form Submission Methods (Online / Mail / In-Person)

The Missouri Form 426 can be submitted through various methods:

- Online submission via the Missouri Department of Revenue's electronic filing system.

- Mailing the completed form to the appropriate department address.

- In-person submission at designated state revenue offices.

Quick guide on how to complete form 426 missouri

Effortlessly Prepare Form 426 Missouri on Any Device

Managing documents online has become increasingly favored by companies and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the proper template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, revise, and electronically sign your documents swiftly without delays. Handle Form 426 Missouri on any device using the airSlate SignNow apps available for Android or iOS, and simplify any document-related tasks today.

The Easiest Way to Edit and eSign Form 426 Missouri Effortlessly

- Find Form 426 Missouri and click Get Form to begin.

- Utilize our tools to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes just seconds and carries the same legal authority as a handwritten signature.

- Review all the details and click the Done button to save your updates.

- Choose how you wish to share your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 426 Missouri to guarantee effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 426 missouri

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Missouri Form 426?

The Missouri Form 426 is a legal document used for specific administrative processes in the state of Missouri. Understanding how to fill out this form is crucial for businesses and individuals to comply with local regulations.

-

How can airSlate SignNow help with Missouri Form 426?

airSlate SignNow simplifies the process of completing and signing the Missouri Form 426. Our platform allows users to electronically fill out, sign, and send this form efficiently, ensuring compliance and saving time.

-

Is there a cost associated with using airSlate SignNow for Missouri Form 426?

Yes, airSlate SignNow offers various pricing plans that cater to different needs. Users can choose a plan that best fits their requirements for processing the Missouri Form 426 and other documents.

-

What features does airSlate SignNow offer for signing Missouri Form 426?

airSlate SignNow provides features such as secure electronic signatures, document templates, and progress tracking specifically designed for documents like the Missouri Form 426. These tools enhance efficiency and ensure a smooth signing experience.

-

Can I send the Missouri Form 426 to multiple recipients?

Absolutely! airSlate SignNow allows users to send the Missouri Form 426 to multiple recipients simultaneously. This feature is particularly beneficial for team collaborations or when multiple signatures are required.

-

Are there integrations available with airSlate SignNow for Missouri Form 426?

Yes, airSlate SignNow integrates seamlessly with various applications such as CRM and document management systems. This functionality helps streamline the workflow involved in processing the Missouri Form 426 and enhances overall productivity.

-

How secure is using airSlate SignNow for my Missouri Form 426?

airSlate SignNow prioritizes the security of your documents, including the Missouri Form 426. Our platform utilizes encryption and advanced security protocols to protect your sensitive information during the signing process.

Get more for Form 426 Missouri

- The petitioner respectfully states form

- To be filedwith your county clerkampamprecorders office form

- Shareholders and board of directors of form

- Bylaws templates form

- How to form your own corporation with forms pdf free

- O civil cover sheet eastern district court of virginia form

- Lessee name and address form

- Landlord rental forms real estate legal contract

Find out other Form 426 Missouri

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy