Ncua 4012 Form

What is the NCUA 4012?

The NCUA 4012 form is a document utilized by credit unions to report certain financial information to the National Credit Union Administration (NCUA). This form is essential for maintaining compliance with federal regulations and ensuring transparency in financial operations. It typically includes data on the credit union's assets, liabilities, and overall financial health. Understanding the NCUA 4012 form is crucial for credit unions to meet regulatory requirements and provide accurate information to stakeholders.

How to Use the NCUA 4012

Using the NCUA 4012 form involves several key steps. First, gather all necessary financial documents that reflect the credit union's current status. Next, accurately fill out the form with the required information, ensuring that all entries are precise and complete. After completing the form, it should be reviewed for accuracy before submission. The form can be submitted electronically or via traditional mail, depending on the preferences of the credit union and the requirements set by the NCUA.

Steps to Complete the NCUA 4012

Completing the NCUA 4012 form requires a methodical approach. Follow these steps for effective completion:

- Gather Financial Data: Collect all relevant financial statements, including balance sheets and income statements.

- Fill Out the Form: Input the gathered data into the appropriate sections of the form, ensuring accuracy.

- Review for Errors: Double-check all entries to confirm that there are no mistakes or omissions.

- Submit the Form: Send the completed form to the NCUA via the chosen submission method, either electronically or by mail.

Legal Use of the NCUA 4012

The legal use of the NCUA 4012 form is governed by federal regulations that mandate credit unions to report their financial status to the NCUA. Compliance with these regulations is essential for the legal standing of the credit union. Failure to submit the form accurately or on time may result in penalties or other legal repercussions. Therefore, understanding the legal implications of this form is vital for credit unions to operate within the law.

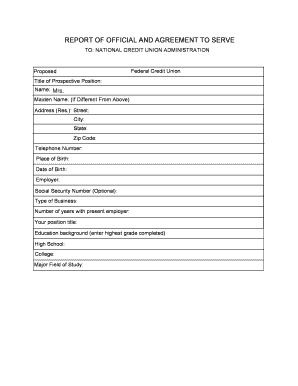

Key Elements of the NCUA 4012

Several key elements must be included in the NCUA 4012 form to ensure it meets regulatory standards. These elements typically include:

- Credit Union Identification: Name and identification number of the credit union.

- Financial Data: Detailed information regarding assets, liabilities, and net worth.

- Signature and Certification: A declaration by authorized personnel certifying the accuracy of the information provided.

Form Submission Methods

The NCUA 4012 form can be submitted through various methods depending on the preferences of the credit union. These methods include:

- Online Submission: Many credit unions opt to submit the form electronically through the NCUA's online portal.

- Mail: The form can also be printed and sent via traditional mail to the appropriate NCUA office.

- In-Person: Some credit unions may choose to deliver the form in person, ensuring immediate receipt.

Quick guide on how to complete ncua 4012

Complete Ncua 4012 effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals. It offers an excellent eco-friendly substitute to traditional printed and signed documents, as you can access the necessary form and securely keep it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents rapidly without delays. Manage Ncua 4012 on any platform using airSlate SignNow's Android or iOS applications and simplify any document-centric task today.

The simplest way to edit and electronically sign Ncua 4012 with ease

- Obtain Ncua 4012 and then click Get Form to initiate.

- Utilize the tools we provide to finalize your document.

- Mark important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose your delivery method for your form—via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious searches for forms, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any chosen device. Edit and electronically sign Ncua 4012 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ncua 4012

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the 4012 form from NCUA?

The 4012 form from NCUA is primarily used to report individuals’ income and tax information for federally insured credit unions. This form helps ensure compliance with federal requirements. Understanding what is a 4012 form from NCUA for is crucial for financial institutions to maintain transparency.

-

How can airSlate SignNow help with the 4012 form from NCUA?

airSlate SignNow offers an efficient solution for eSigning and sending the 4012 form from NCUA securely. With user-friendly features, it simplifies the signing process, making it faster and more reliable. This helps ensure that your documentation is handled appropriately and efficiently.

-

Is there a cost associated with using airSlate SignNow for the 4012 form?

Yes, while airSlate SignNow is a cost-effective solution, there are various pricing plans available tailored to different business needs. Understanding what is a 4012 form from NCUA for will help you realize the importance of investing in a reliable document management tool. It streamlines processes and saves time, making it a worthwhile investment.

-

What are the key features of airSlate SignNow related to the 4012 form from NCUA?

Key features include customizable templates, real-time notifications, and secure storage. These features enhance the efficiency of handling the 4012 form from NCUA. Users can track the signing process and ensure that important documents remain organized and accessible.

-

Can I access the 4012 form from NCUA through mobile devices using airSlate SignNow?

Absolutely! airSlate SignNow is compatible with mobile devices, allowing users to manage the 4012 form from NCUA on-the-go. This flexibility ensures you can send, sign, and store important documents wherever you are, increasing productivity and convenience.

-

Does airSlate SignNow integrate with other software for completing the 4012 form from NCUA?

Yes, airSlate SignNow seamlessly integrates with numerous third-party applications like CRM systems and cloud storage solutions. This compatibility simplifies the process of accessing and completing the 4012 form from NCUA. Businesses can streamline their workflow and improve collaboration across teams.

-

What are the benefits of using airSlate SignNow for handling the 4012 form?

Using airSlate SignNow enhances document security and compliance when handling the 4012 form from NCUA. It provides an easy-to-use platform that saves time and reduces the chances of errors. Additionally, the digital solution promotes environmentally friendly practices by minimizing paper use.

Get more for Ncua 4012

Find out other Ncua 4012

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple