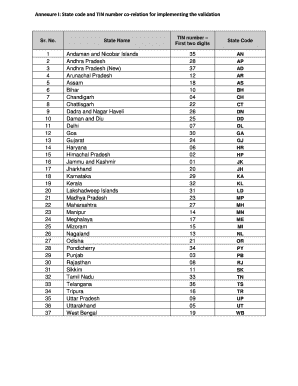

Annexure I State Code and TIN Number Co Relation for Implementing the Validation Form

What is the Annexure I State Code And TIN Number Co relation For Implementing The Validation

The Annexure I State Code and TIN Number Co relation for implementing the validation is a specific form used to establish a connection between state codes and Tax Identification Numbers (TINs). This form is essential for ensuring that tax-related information is accurately matched with the appropriate state codes. It serves as a validation tool to streamline the process of tax compliance and reporting, making it easier for businesses and individuals to meet their obligations under U.S. tax laws.

How to use the Annexure I State Code And TIN Number Co relation For Implementing The Validation

To effectively use the Annexure I State Code and TIN Number Co relation for implementing the validation, follow these steps:

- Gather necessary information, including your TIN and the relevant state code.

- Access the form through a reliable digital platform that supports eSigning.

- Fill out the required fields accurately, ensuring that the TIN corresponds to the correct state code.

- Review the information for accuracy before submitting the form.

- Utilize digital signature options to finalize the document securely.

Steps to complete the Annexure I State Code And TIN Number Co relation For Implementing The Validation

Completing the Annexure I State Code and TIN Number Co relation for implementing the validation involves several key steps:

- Identify the specific state code applicable to your business or personal tax situation.

- Locate your TIN, which is essential for tax identification purposes.

- Fill in the form with your details, ensuring all information is current and accurate.

- Double-check the entries to avoid errors that could lead to compliance issues.

- Submit the form electronically through a secure platform to ensure timely processing.

Legal use of the Annexure I State Code And TIN Number Co relation For Implementing The Validation

The legal use of the Annexure I State Code and TIN Number Co relation for implementing the validation is crucial for compliance with federal and state tax regulations. This form must be completed accurately to avoid potential legal repercussions, such as penalties or audits. It is recognized under U.S. tax law as a valid document for establishing the necessary correlation between state codes and TINs, thereby supporting lawful tax reporting and compliance.

Key elements of the Annexure I State Code And TIN Number Co relation For Implementing The Validation

Key elements of the Annexure I State Code and TIN Number Co relation for implementing the validation include:

- The accurate entry of TINs and state codes.

- Clear identification of the taxpayer or business entity involved.

- Compliance with relevant tax laws and regulations.

- Provision for digital signatures to enhance the document's legitimacy.

- Instructions for submission and record-keeping for future reference.

State-specific rules for the Annexure I State Code And TIN Number Co relation For Implementing The Validation

Each state may have specific rules governing the use of the Annexure I State Code and TIN Number Co relation for implementing the validation. It is important to be aware of these regulations, as they can vary significantly. States may require additional documentation or have unique submission processes. Understanding these state-specific rules ensures compliance and helps avoid any potential issues with tax authorities.

Quick guide on how to complete annexure i state code and tin number co relation for implementing the validation

Finalize Annexure I State Code And TIN Number Co relation For Implementing The Validation easily on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, allowing you to find the correct template and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Handle Annexure I State Code And TIN Number Co relation For Implementing The Validation on any device with airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to edit and eSign Annexure I State Code And TIN Number Co relation For Implementing The Validation effortlessly

- Find Annexure I State Code And TIN Number Co relation For Implementing The Validation and click on Get Form to begin.

- Utilize the resources we provide to fill out your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for that function.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method to submit your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searches, or mistakes that require new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from your chosen device. Edit and eSign Annexure I State Code And TIN Number Co relation For Implementing The Validation and guarantee remarkable communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the annexure i state code and tin number co relation for implementing the validation

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Annexure I State Code And TIN Number Co relation For Implementing The Validation?

The Annexure I State Code And TIN Number Co relation For Implementing The Validation is crucial for businesses to ensure compliance with tax regulations. It helps in accurately matching the state codes with Tax Identification Numbers, streamlining the document validation process. This can greatly enhance your operational efficiency.

-

How does airSlate SignNow utilize the Annexure I State Code And TIN Number Co relation For Implementing The Validation?

airSlate SignNow leverages the Annexure I State Code And TIN Number Co relation For Implementing The Validation to facilitate accurate eSigning and document validation. By integrating this correlation, businesses can ensure that all signed documents meet legal standards and are fully compliant. This helps avoid any potential penalties or issues.

-

What are the pricing options for using airSlate SignNow with Annexure I State Code And TIN Number Co relation For Implementing The Validation?

airSlate SignNow offers various pricing tiers designed to accommodate businesses of all sizes. Each plan includes features that support the Annexure I State Code And TIN Number Co relation For Implementing The Validation, ensuring you have the tools necessary for compliance. You can choose a plan that fits your specific needs and budget.

-

What features does airSlate SignNow provide for the Annexure I State Code And TIN Number Co relation For Implementing The Validation?

airSlate SignNow includes features that directly support the Annexure I State Code And TIN Number Co relation For Implementing The Validation, such as customizable templates, automatic validation checks, and real-time notifications. These tools make it easier for users to manage their documentation while ensuring regulatory compliance. Enhanced security features are also in place to protect your data.

-

How can airSlate SignNow improve business efficiency when dealing with the Annexure I State Code And TIN Number Co relation For Implementing The Validation?

By automating processes related to the Annexure I State Code And TIN Number Co relation For Implementing The Validation, airSlate SignNow signNowly reduces manual errors and saves time. The platform's easy-to-use interface allows for quick document preparation and signing, facilitating faster project completion. This ultimately results in improved productivity and higher customer satisfaction.

-

Can airSlate SignNow integrate with other software while managing Annexure I State Code And TIN Number Co relation For Implementing The Validation?

Yes, airSlate SignNow offers seamless integrations with various business applications, which assist in managing the Annexure I State Code And TIN Number Co relation For Implementing The Validation. This capability allows for a centralized workflow that enhances collaboration within your team. Integrations facilitate the easy transfer of data, ensuring your processes remain smooth and efficient.

-

What benefits can businesses expect from using airSlate SignNow regarding Annexure I State Code And TIN Number Co relation For Implementing The Validation?

Businesses can expect enhanced compliance, streamlined workflows, and reduced errors when using airSlate SignNow for the Annexure I State Code And TIN Number Co relation For Implementing The Validation. This leads to signNow time savings and potential cost reductions. Companies will find their eSigning processes are not only faster but also more reliable and secure.

Get more for Annexure I State Code And TIN Number Co relation For Implementing The Validation

Find out other Annexure I State Code And TIN Number Co relation For Implementing The Validation

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast