Ksrevenueorgpdfunder21pdf Form

What is the Ksrevenueorgpdfunder21pdf Form

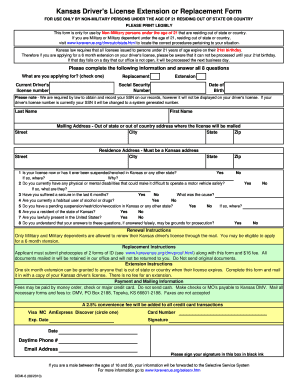

The Ksrevenueorgpdfunder21pdf form is a specific document used primarily for tax purposes in the United States. This form is designed for individuals under the age of twenty-one who need to report income or claim certain tax benefits. Understanding the purpose of this form is essential for eligible individuals to ensure compliance with tax regulations.

How to use the Ksrevenueorgpdfunder21pdf Form

Using the Ksrevenueorgpdfunder21pdf form involves several steps. First, ensure that you have the correct version of the form, which can typically be obtained from official state or federal resources. Next, gather all necessary information, including personal identification details and any relevant financial data. Once you have filled out the form accurately, you can submit it either electronically or by mail, depending on the submission guidelines provided.

Steps to complete the Ksrevenueorgpdfunder21pdf Form

Completing the Ksrevenueorgpdfunder21pdf form requires careful attention to detail. Follow these steps for accurate completion:

- Download the latest version of the form from a reliable source.

- Read the instructions carefully to understand the requirements.

- Fill in your personal information, ensuring accuracy in names and identification numbers.

- Provide details of your income or any deductions you are claiming.

- Review the completed form for any errors before submission.

Legal use of the Ksrevenueorgpdfunder21pdf Form

The legal use of the Ksrevenueorgpdfunder21pdf form is governed by federal and state tax laws. It is crucial for individuals to understand that submitting this form incorrectly or failing to submit it when required can result in penalties. Moreover, the form must be filled out truthfully to avoid legal repercussions, such as audits or fines.

Required Documents

When completing the Ksrevenueorgpdfunder21pdf form, certain documents may be required to support your claims. These typically include:

- Proof of identity, such as a driver's license or Social Security card.

- Documentation of income, such as W-2 forms or 1099 statements.

- Any relevant tax documents that may affect your filing.

Form Submission Methods

The Ksrevenueorgpdfunder21pdf form can be submitted through various methods, depending on the specific guidelines provided by the issuing authority. Common submission methods include:

- Online submission through a designated government portal.

- Mailing the completed form to the appropriate tax office.

- In-person submission at local tax offices, if applicable.

Quick guide on how to complete ksrevenueorgpdfunder21pdf form 266502

Effortlessly prepare Ksrevenueorgpdfunder21pdf Form on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and efficiently. Manage Ksrevenueorgpdfunder21pdf Form on any device with airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

The easiest method to modify and electronically sign Ksrevenueorgpdfunder21pdf Form without effort

- Locate Ksrevenueorgpdfunder21pdf Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred delivery method for your form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate the issues of lost or misdirected documents, tedious form retrieval, or mistakes that require printing additional document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Alter and electronically sign Ksrevenueorgpdfunder21pdf Form while ensuring seamless communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ksrevenueorgpdfunder21pdf form 266502

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ksrevenueorgpdfunder21pdf Form?

The Ksrevenueorgpdfunder21pdf Form is a specific document required for certain tax-related processes in Kansas. It is crucial for individuals under 21 to ensure compliance with state regulations. With airSlate SignNow, you can easily manage and eSign this form, streamlining your submission process.

-

How can I eSign the Ksrevenueorgpdfunder21pdf Form using airSlate SignNow?

To eSign the Ksrevenueorgpdfunder21pdf Form using airSlate SignNow, simply upload your document to the platform. You can then add your signature and other necessary information effortlessly. This feature ensures you complete your forms quickly and securely.

-

Is there a cost associated with using airSlate SignNow for the Ksrevenueorgpdfunder21pdf Form?

Yes, airSlate SignNow offers various pricing plans that cater to different needs, including pay-as-you-go options. You can find a plan that suits your budget while efficiently handling the Ksrevenueorgpdfunder21pdf Form. This makes signing documents affordable and accessible.

-

What are the key benefits of using airSlate SignNow for the Ksrevenueorgpdfunder21pdf Form?

Using airSlate SignNow for the Ksrevenueorgpdfunder21pdf Form provides numerous benefits, such as time-saving, enhanced organization, and improved security. The platform allows easy tracking of signed documents and reduces the risks associated with paper forms. Overall, it transforms your signing experience.

-

Can I integrate airSlate SignNow with other applications for handling the Ksrevenueorgpdfunder21pdf Form?

Yes, airSlate SignNow offers integrations with various applications like Google Drive, Dropbox, and CRM platforms. This means you can seamlessly manage the Ksrevenueorgpdfunder21pdf Form and other documents across multiple tools you already use. Integration enhances your workflow efficiency.

-

How securely does airSlate SignNow handle the Ksrevenueorgpdfunder21pdf Form?

airSlate SignNow prioritizes your security by using encryption and compliant storage options for documents like the Ksrevenueorgpdfunder21pdf Form. Rest assured that your sensitive information is protected throughout the signing process. This makes it a safe choice for managing important forms.

-

What features does airSlate SignNow offer for managing the Ksrevenueorgpdfunder21pdf Form?

airSlate SignNow offers several features for managing the Ksrevenueorgpdfunder21pdf Form, including customizable templates, reminders, and real-time status updates. These features make it easier to track progress and ensure timely submissions. The user-friendly interface adds to the overall experience.

Get more for Ksrevenueorgpdfunder21pdf Form

- Organized pursuant to the laws of the state of nevada hereinafter quotcorporationquot form

- Of nevada relating to corporations form

- Fillable online pursuant to nrs 88 fax email print form

- Instructions for nonprofit form

- Company articles of organization form

- The superior court of california nevada county form

- Grantor does hereby bargain sell and convey unto and form

- All the right title and interest in and to the following lands and property together with all improvements form

Find out other Ksrevenueorgpdfunder21pdf Form

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document