Maryland Truth in Lending Form

What is the Maryland Truth In Lending?

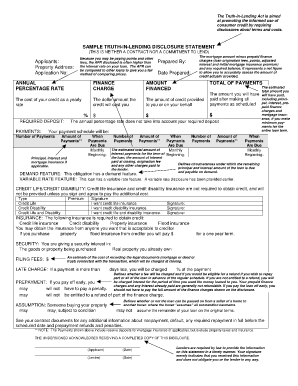

The Maryland Truth In Lending is a legal requirement designed to promote transparency in lending practices. It mandates that lenders provide borrowers with clear and concise information about the terms and costs associated with loans. This includes details such as the annual percentage rate (APR), total finance charges, and the total amount financed. By ensuring that borrowers receive this information upfront, the Maryland Truth In Lending aims to protect consumers from misleading lending practices.

Key Elements of the Maryland Truth In Lending

Understanding the key elements of the Maryland Truth In Lending is essential for both lenders and borrowers. The primary components include:

- Annual Percentage Rate (APR): This reflects the total cost of borrowing on an annual basis, including interest and fees.

- Total Finance Charges: This is the total amount of interest and fees that will be paid over the life of the loan.

- Total Amount Financed: This represents the total sum that the borrower receives after any upfront costs are deducted.

- Payment Schedule: Lenders must provide a detailed schedule outlining when payments are due and the amounts.

Steps to Complete the Maryland Truth In Lending

Completing the Maryland Truth In Lending form involves several important steps. Begin by gathering all necessary information related to the loan, including the amount, interest rate, and any fees. Next, fill out the form accurately, ensuring that all disclosures are clear and complete. It is crucial to review the terms with the borrower to ensure understanding and compliance. Finally, both parties should sign the document to validate the agreement.

Legal Use of the Maryland Truth In Lending

The legal use of the Maryland Truth In Lending is governed by state and federal regulations. Lenders must adhere to the guidelines set forth in the Truth in Lending Act (TILA) and Maryland's specific laws. Compliance ensures that the lending process is fair and transparent. Failure to provide accurate disclosures can result in legal penalties and damage to the lender's reputation.

Examples of Using the Maryland Truth In Lending

Examples of using the Maryland Truth In Lending can help clarify its application. For instance, when a borrower applies for a mortgage, the lender must provide a Truth In Lending disclosure that outlines the APR, total finance charges, and payment schedule. Another example is in auto loans, where the lender must disclose the same information to ensure the borrower understands the total cost of the loan before signing the agreement.

Disclosure Requirements

Disclosure requirements for the Maryland Truth In Lending are designed to ensure that borrowers receive all necessary information in a clear format. Lenders must disclose the APR, total finance charges, and the total amount financed in writing. Additionally, they must provide a written statement of the payment schedule and any other relevant terms. These disclosures must be made before the borrower signs the loan agreement, allowing them to make informed decisions.

Quick guide on how to complete maryland truth in lending

Accomplish Maryland Truth In Lending effortlessly on any gadget

Digital document management has gained signNow traction among businesses and individuals. It offers an excellent eco-conscious alternative to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with everything you require to create, modify, and electronically sign your documents promptly without delays. Manage Maryland Truth In Lending on any gadget using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign Maryland Truth In Lending with ease

- Locate Maryland Truth In Lending and click Get Form to initiate.

- Utilize the features we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a classic wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Edit and electronically sign Maryland Truth In Lending and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the maryland truth in lending

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the APR term offered by airSlate SignNow?

The APR term refers to the annual percentage rate for financing options available through airSlate SignNow. This term helps customers understand the costs associated with financing their subscription, allowing for better budgeting. Understanding the APR term is crucial for businesses looking to optimize their expenses while leveraging our eSigning solutions.

-

How does the APR term affect the pricing of airSlate SignNow services?

The APR term directly impacts the overall cost of services when opting for financing. By knowing the APR term, businesses can make informed decisions about their budget and choose a plan that best fits their financial situation. This transparency ensures no hidden fees or surprise costs during your subscription.

-

What are the benefits of using airSlate SignNow's eSigning features during the APR term?

Using airSlate SignNow's eSigning features during the APR term maximizes efficiency, allowing businesses to send and sign documents seamlessly. The software improves turnaround times and enhances customer experience. Moreover, our intuitive platform ensures all your eSigning processes are streamlined within your budget constraints defined by the APR term.

-

Can I integrate airSlate SignNow with other software during the APR term?

Absolutely! airSlate SignNow supports integration with various software solutions, even during the APR term. This flexibility allows businesses to enhance their workflow capabilities and connect with tools they already use. With easy integrations, you'll increase productivity while staying within the financial limits set by the APR term.

-

Is airSlate SignNow's pricing competitive considering the APR term?

Yes, airSlate SignNow offers competitive pricing structures even when taking the APR term into account. Our cost-effective solutions ensure that businesses of all sizes can access essential eSigning features without breaking the bank. We continuously evaluate our pricing to deliver signNow value compared to other offerings in the market.

-

What support does airSlate SignNow provide if I have questions about the APR term?

If you have questions regarding the APR term, airSlate SignNow's support team is ready to assist you. We provide dedicated customer service to clarify any uncertainties and guide you through your financing options. You can signNow out via chat, email, or phone, ensuring you have the answers you need promptly.

-

How do I know if the APR term financing option is right for my business?

Determining if the APR term financing option is suitable for your business involves assessing your cash flow needs and budget. Consider whether the benefits of eSigning solutions outweigh the costs outlined in the APR term. Evaluating your business requirements with our team can help finalize the best financial decision tailored for you.

Get more for Maryland Truth In Lending

- And pleasing to the eye form

- Doors door sills windows and window sills and finishing trim by sanding and ensuring even form

- Builders risk insurance if applicable form

- During the progress of work under this contract and for 30 days after the work is completed the form

- Inches overdig of the dwelling footing form

- The proportion that the work done bears to the work to be done using the contract price or if there form

- Any excavation or other work required by the owner not specified in this agreement form

- Is no contract price using the reasonable value of the completed work form

Find out other Maryland Truth In Lending

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors