Eritrean Embassy Tax Form

What is the Eritrean Embassy Tax Form

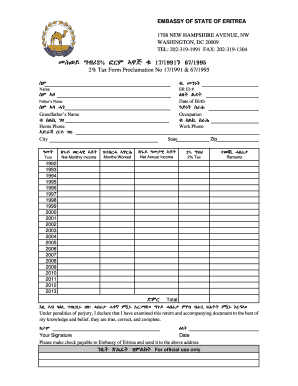

The Eritrean Embassy Tax Form is a document required by the Embassy of Eritrea for various tax-related purposes. This form is essential for Eritrean citizens living in the United States who need to report their income, claim benefits, or fulfill other tax obligations related to their Eritrean citizenship. It is crucial for individuals to understand the specific requirements and implications of this form to ensure compliance with both Eritrean and U.S. tax laws.

How to obtain the Eritrean Embassy Tax Form

To obtain the Eritrean Embassy Tax Form, individuals can visit the official website of the Eritrean Embassy in Washington, D.C. Alternatively, the form may be available directly at the embassy. It is advisable to contact the embassy beforehand to confirm the availability of the form and any specific requirements for obtaining it. In some cases, the form may also be requested via mail or email, depending on the embassy's policies.

Steps to complete the Eritrean Embassy Tax Form

Completing the Eritrean Embassy Tax Form involves several key steps:

- Gather all necessary documents, including identification and financial records.

- Carefully read the instructions provided with the form to understand the requirements.

- Fill out the form accurately, ensuring all information is complete and correct.

- Review the form for any errors or omissions before submission.

- Sign and date the form as required.

Legal use of the Eritrean Embassy Tax Form

The Eritrean Embassy Tax Form is legally binding when completed and submitted according to the guidelines set forth by the embassy. It is important to ensure that all information provided is truthful and accurate to avoid potential legal issues. Misrepresentation or failure to comply with the form's requirements may lead to penalties or complications with tax obligations.

Required Documents

When filling out the Eritrean Embassy Tax Form, applicants typically need to provide several supporting documents, including:

- A valid Eritrean passport or national identification card.

- Proof of residence in the United States, such as a utility bill or lease agreement.

- Financial documents, including income statements or tax returns.

- Any previous correspondence with the Eritrean Embassy regarding tax matters.

Form Submission Methods

The Eritrean Embassy Tax Form can be submitted through various methods, depending on the embassy's guidelines. Common submission methods include:

- In-person submission at the Eritrean Embassy in Washington, D.C.

- Mailing the completed form to the embassy's designated address.

- Submitting the form electronically, if the embassy offers this option.

Quick guide on how to complete eritrean embassy tax form

Prepare Eritrean Embassy Tax Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals alike. It delivers a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without any delays. Manage Eritrean Embassy Tax Form on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to modify and eSign Eritrean Embassy Tax Form without any hassle

- Locate Eritrean Embassy Tax Form and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information using tools specifically offered by airSlate SignNow for that purpose.

- Generate your signature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Select your preferred method to share your form: via email, SMS, or invite link, or download it to your computer.

Eliminate concerns over missing or misplaced files, tedious form searches, or errors that require new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and eSign Eritrean Embassy Tax Form to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the eritrean embassy tax form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Eritrean embassy tax form, and why is it important?

The Eritrean embassy tax form is a document required for tax-related matters involving Eritrean nationals. It is important because it helps ensure compliance with Eritrean tax laws and regulations, facilitating smooth transactions and interactions with the embassy. Completing this form accurately can avoid potential legal complications.

-

How can airSlate SignNow assist with filling out the Eritrean embassy tax form?

airSlate SignNow provides a user-friendly platform to help you fill out the Eritrean embassy tax form electronically. With its intuitive tools, you can easily input information, save drafts, and make modifications as needed. This ensures that your form is both accurate and promptly completed.

-

What are the pricing options for using airSlate SignNow to manage the Eritrean embassy tax form?

airSlate SignNow offers various pricing plans to suit different needs, from individual users to businesses. Pricing is cost-effective, ensuring that you receive the best value for managing your documents, including the Eritrean embassy tax form. You can choose a plan that fits your budget and frequency of use.

-

Are there any integrations available for using the Eritrean embassy tax form?

Yes, airSlate SignNow integrates seamlessly with numerous applications, allowing you to manage the Eritrean embassy tax form within your preferred software ecosystem. Popular integrations include Google Drive, Dropbox, and various CRM systems, streamlining your document management processes.

-

What features does airSlate SignNow offer for the Eritrean embassy tax form?

AirSlate SignNow includes features such as document templates, electronic signatures, and secure storage, tailored for completing the Eritrean embassy tax form. The platform ensures that your documents are compliant and easily accessible, enhancing your overall efficiency in handling important paperwork.

-

Can I track the status of my Eritrean embassy tax form using airSlate SignNow?

Yes, airSlate SignNow provides document tracking features that allow you to monitor the status of your Eritrean embassy tax form. You can receive notifications when the form is opened, signed, or completed, giving you peace of mind and keeping you informed throughout the process.

-

Is airSlate SignNow secure for handling sensitive information on the Eritrean embassy tax form?

Absolutely, airSlate SignNow prioritizes security with advanced encryption and compliance with regulatory standards. Your sensitive information on the Eritrean embassy tax form is protected, ensuring that all data is safely transmitted and stored. Trust in our platform for secure document handling.

Get more for Eritrean Embassy Tax Form

- This is my authorization for walton county form

- Residential condominium conversion packet city of berkeley form

- Notice of termination of a ucc sales agreement form

- Notice of termination or cancellation of a ucc sales form

- Acknowledged receipt of goods templateword ampampamp pdfby form

- Thank you for your condolences form

- Buying and selling lawreader form

- Notice to buyer repudiating the existence of an oral sales agreement form

Find out other Eritrean Embassy Tax Form

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer