Form 945

What is the Form 945

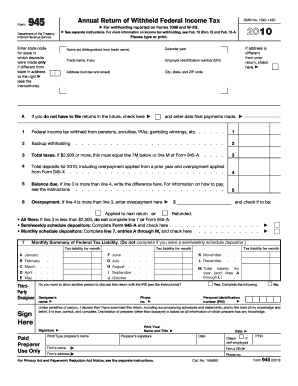

The Form 945, officially known as the Annual Return of Withheld Federal Income Tax, is a tax form used by businesses in the United States to report withheld federal income tax from nonpayroll payments. This includes payments made to independent contractors, freelancers, and other non-employees. The form is essential for ensuring that the IRS receives accurate information about the taxes withheld throughout the year, allowing for proper accounting and compliance with federal tax laws.

How to use the Form 945

To effectively use the Form 945, businesses must first gather all relevant financial data concerning nonpayroll payments made during the tax year. This includes amounts withheld from payments made to contractors and other non-employees. Once the data is compiled, the form can be completed by entering the total amount of federal income tax withheld in the appropriate sections. It is crucial to ensure that all figures are accurate to avoid penalties or issues with the IRS.

Steps to complete the Form 945

Completing the Form 945 involves several key steps:

- Gather all necessary financial records related to nonpayroll payments.

- Fill out the identifying information, including the business name, address, and Employer Identification Number (EIN).

- Report the total amount of federal income tax withheld from nonpayroll payments in the designated fields.

- Review the completed form for accuracy to ensure compliance with IRS requirements.

- Sign and date the form before submitting it to the IRS.

Legal use of the Form 945

The legal use of the Form 945 is governed by IRS regulations, which require businesses to accurately report any federal income tax withheld. Failure to comply with these regulations can result in penalties, including fines and interest on unpaid taxes. It is essential for businesses to maintain accurate records and submit the form by the designated deadlines to avoid any legal issues.

Filing Deadlines / Important Dates

The filing deadline for Form 945 is typically January 31 of the year following the tax year for which the form is being filed. If this date falls on a weekend or holiday, the deadline is extended to the next business day. Businesses should also be aware of any changes to deadlines that may occur due to IRS announcements or changes in tax law.

Form Submission Methods (Online / Mail / In-Person)

Businesses can submit Form 945 through various methods. The form can be filed electronically using IRS-approved e-filing software, which is often the preferred method for its speed and efficiency. Alternatively, businesses may choose to mail the completed form to the appropriate IRS address based on their location. In-person submissions are generally not accepted for this form, making electronic and mail submissions the primary options.

Quick guide on how to complete form 945

Complete Form 945 effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It serves as a perfect eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without delays. Handle Form 945 on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related processes today.

How to alter and eSign Form 945 with ease

- Locate Form 945 and click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize important sections of your documents or obscure sensitive information with features that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose your preferred method to share your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 945 to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 945

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 945 and why is it important?

Form 945 is the annual information return that businesses must file to report nonpayroll amounts, such as backup withholding and federal tax withholding on certain payments. Understanding Form 945 is crucial for compliance with IRS regulations and to avoid penalties when filing taxes.

-

How does airSlate SignNow facilitate the signing of Form 945?

With airSlate SignNow, users can easily prepare, send, and eSign Form 945 securely online. The platform streamlines the signing process, ensuring that businesses can submit their forms promptly and efficiently, without the hassle of printing or mailing.

-

Is airSlate SignNow compliant with e-signature laws for Form 945?

Yes, airSlate SignNow complies with the ESIGN Act and UETA, ensuring that eSignatures on Form 945 are legally binding. This compliance provides businesses peace of mind when signing important tax documents electronically.

-

What features does airSlate SignNow offer for managing Form 945?

airSlate SignNow offers features such as customizable templates for Form 945, document tracking, and in-app notifications. These tools help businesses manage their forms efficiently and ensure they meet deadlines with ease.

-

How much does airSlate SignNow cost for signing Form 945?

airSlate SignNow offers several pricing plans to accommodate various business needs. Each plan includes features that can assist with signing important documents like Form 945, making it a cost-effective solution for most organizations.

-

Can I integrate airSlate SignNow with other tools for filing Form 945?

Yes, airSlate SignNow integrates seamlessly with various applications, such as CRMs and document management systems. This means you can streamline your workflow when preparing and filing Form 945 without any interruptions.

-

What are the benefits of using airSlate SignNow for Form 945?

By using airSlate SignNow for Form 945, businesses benefit from faster processing times, enhanced security, and improved collaboration. The platform ensures that documents are signed and returned quickly, allowing for timely reporting to the IRS.

Get more for Form 945

Find out other Form 945

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement