Nyc Ext Instructions Form

What is the NYC Ext Instructions?

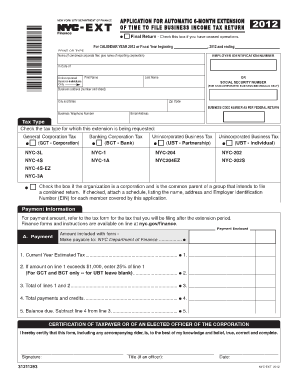

The NYC Ext instructions refer to the guidelines provided for filing an extension for New York City taxes. This form is essential for individuals and businesses seeking additional time to file their tax returns. The instructions outline the necessary steps to complete the extension request accurately, ensuring compliance with local tax regulations.

How to Use the NYC Ext Instructions

Using the NYC Ext instructions involves carefully following the outlined steps to ensure a successful extension application. First, gather all required information, including your tax identification number and any relevant financial documents. Next, complete the extension form by providing accurate details as specified in the instructions. Finally, submit the form electronically or via mail, depending on your preference, while keeping a copy for your records.

Steps to Complete the NYC Ext Instructions

Completing the NYC Ext instructions involves several key steps:

- Review the eligibility criteria to ensure you qualify for an extension.

- Gather all necessary documentation, including income statements and previous tax returns.

- Fill out the extension form accurately, following the guidelines provided.

- Double-check all information for accuracy before submission.

- Submit the completed form by the designated deadline to avoid penalties.

Legal Use of the NYC Ext Instructions

The NYC Ext instructions are legally binding when completed and submitted according to the guidelines set forth by the New York City Department of Finance. Following these instructions ensures that your request for an extension is valid, protecting you from potential penalties associated with late filing. It is crucial to adhere to all legal requirements specified in the instructions to maintain compliance with local tax laws.

Filing Deadlines / Important Dates

Understanding the filing deadlines associated with the NYC Ext instructions is vital for timely compliance. Typically, the extension request must be submitted by the original tax filing deadline. Failure to meet this deadline may result in automatic penalties. It is advisable to check the specific dates each tax year, as they may vary based on weekends or holidays.

Required Documents

To successfully complete the NYC Ext instructions, certain documents are required. These may include:

- Your tax identification number.

- Previous year’s tax returns for reference.

- Income statements, such as W-2s or 1099s.

- Any additional documentation relevant to your tax situation.

Form Submission Methods

The NYC Ext instructions allow for multiple submission methods to accommodate different preferences. You can submit your extension request electronically through the appropriate online portal, which often provides immediate confirmation. Alternatively, you may choose to mail your completed form to the designated address, ensuring it is postmarked by the filing deadline. In-person submissions may also be available at local tax offices.

Quick guide on how to complete nyc ext instructions

Complete Nyc Ext Instructions effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow provides you with all the tools needed to create, modify, and electronically sign your documents swiftly without delays. Handle Nyc Ext Instructions on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to alter and electronically sign Nyc Ext Instructions with ease

- Acquire Nyc Ext Instructions and click Get Form to initiate.

- Utilize the tools we offer to fill in your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you wish to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, cumbersome form navigation, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Alter and electronically sign Nyc Ext Instructions and ensure excellent communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nyc ext instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the NYC ext instructions for using airSlate SignNow?

The NYC ext instructions for airSlate SignNow provide clear guidelines on how to create, send, and eSign documents efficiently. By following these instructions, users can ensure compliance with local regulations and streamline their document workflows.

-

How much does airSlate SignNow cost, and what do the pricing tiers include?

The pricing for airSlate SignNow varies based on the plan you choose. Each tier includes specific features like unlimited document signing, templates, and integrations, which are essential for following the NYC ext instructions effectively.

-

What features should I look for in airSlate SignNow for effective eSigning?

Key features of airSlate SignNow include customizable templates, advanced workflow tools, and mobile compatibility. These features help you implement the NYC ext instructions seamlessly, making it easier to manage your eSigning processes.

-

How can airSlate SignNow benefit my NYC-based business?

airSlate SignNow enhances efficiency for NYC-based businesses by simplifying the eSigning process and helping you adhere to NYC ext instructions. This results in faster document turnaround times and improved compliance with local laws.

-

Does airSlate SignNow integrate with other tools I use?

Yes, airSlate SignNow offers integrations with many popular tools, including CRM systems and cloud storage solutions. These integrations support the NYC ext instructions by enabling seamless document management across multiple platforms.

-

Is airSlate SignNow mobile-friendly for users on the go?

Absolutely! airSlate SignNow is designed to be mobile-friendly, allowing users to access documents and complete NYC ext instructions from anywhere. This flexibility increases productivity, especially for teams who are often on the move.

-

Can I create custom templates in airSlate SignNow?

Yes, you can create custom templates in airSlate SignNow, which is particularly useful for streamlining repetitive tasks. This feature helps users adhere to the NYC ext instructions and saves time when sending out similar documents.

Get more for Nyc Ext Instructions

Find out other Nyc Ext Instructions

- eSignature Tennessee Residential lease agreement Easy

- Can I eSignature Washington Residential lease agreement

- How To eSignature Vermont Residential lease agreement form

- How To eSignature Rhode Island Standard residential lease agreement

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online

- eSignature Texas Contract of employment Online

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free