W9 Indiana 2001-2026

What is the W-9 Indiana?

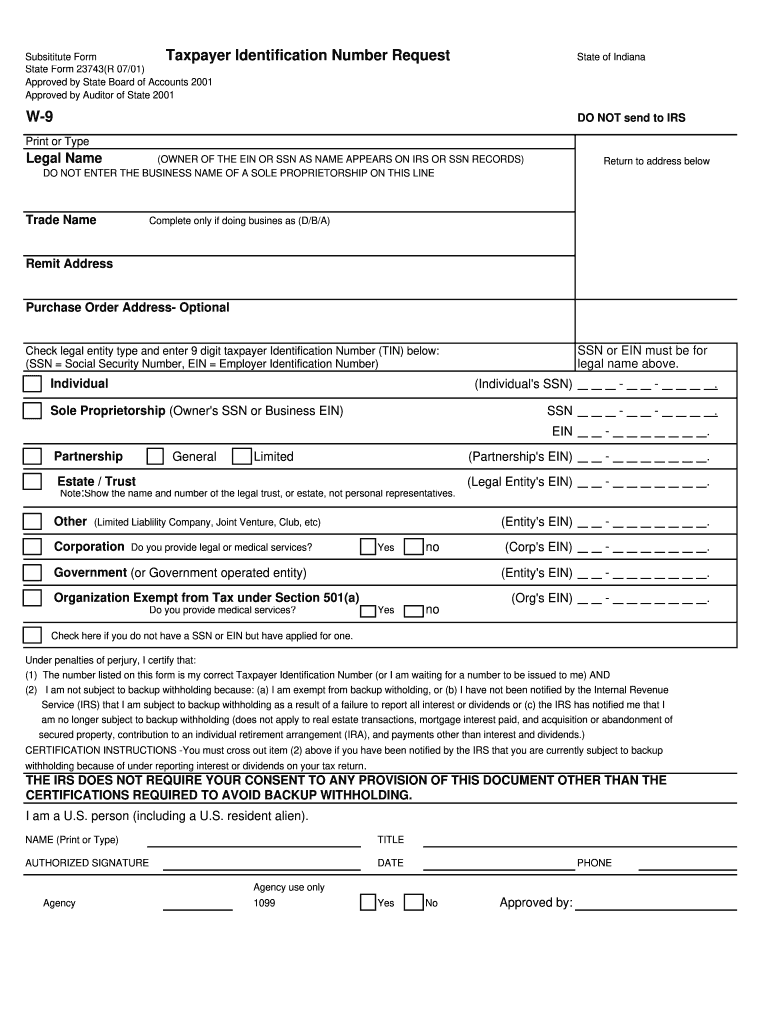

The W-9 Indiana form is a tax document used by individuals and businesses to provide their taxpayer identification number to another party. This form is essential for reporting income to the Internal Revenue Service (IRS) and is commonly utilized by independent contractors, freelancers, and businesses that need to report payments made to individuals. The W-9 Indiana form collects important information, such as the name, address, and taxpayer identification number, which can be an individual’s Social Security number or an Employer Identification Number (EIN).

How to Obtain the W-9 Indiana

Obtaining the W-9 Indiana form is straightforward. Individuals can download the form directly from the IRS website or access it through various tax preparation software. Additionally, many businesses provide their own versions of the W-9 form for contractors and vendors. It is important to ensure that the version being used is up-to-date and complies with the latest IRS requirements.

Steps to Complete the W-9 Indiana

Completing the W-9 Indiana form involves several key steps:

- Provide your name as it appears on your tax return.

- Enter your business name if applicable.

- Fill in your address, including city, state, and ZIP code.

- Indicate your taxpayer identification number, which may be your Social Security number or EIN.

- Sign and date the form to certify the information provided is accurate.

After completing the form, it should be submitted to the requester, not the IRS.

Legal Use of the W-9 Indiana

The W-9 Indiana form is legally recognized for tax reporting purposes. It is crucial for ensuring compliance with IRS regulations. By providing accurate information, individuals and businesses can avoid potential penalties for misreporting income. The form also serves as a declaration of taxpayer status, which can be important for determining withholding requirements for certain types of payments.

IRS Guidelines

The IRS has specific guidelines regarding the use of the W-9 Indiana form. It is essential to ensure that the information provided is correct and that the form is signed to validate the details. The IRS may request this form from payers to verify taxpayer identification and ensure that income is reported correctly. Additionally, the IRS updates its forms periodically, so it is important to use the most current version of the W-9 Indiana form.

Filing Deadlines / Important Dates

While the W-9 Indiana form itself does not have a specific filing deadline, it is important to submit it promptly to the requester to avoid delays in payment processing. For individuals and businesses that rely on timely payments, submitting the W-9 form as soon as requested can help ensure compliance with tax reporting deadlines. Additionally, taxpayers should be aware of the overall tax filing deadlines that may affect their reporting obligations.

Quick guide on how to complete printable w 9 form indiana

Your assistance manual on how to prepare your W9 Indiana

If you’re looking to understand how to finalize and submit your W9 Indiana, here are some brief instructions on how to simplify tax submission signNowly.

To begin, you only need to create your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is a highly intuitive and powerful document solution that enables you to modify, draft, and finalize your income tax forms with ease. With its editor, you can toggle between text, checkboxes, and electronic signatures, returning to update information as needed. Streamline your tax handling with advanced PDF editing, eSigning, and user-friendly sharing.

Follow the instructions below to complete your W9 Indiana in just a few minutes:

- Establish your account and begin working on PDFs in moments.

- Utilize our directory to locate any IRS tax form; examine various versions and schedules.

- Hit Get form to launch your W9 Indiana in our editor.

- Input the necessary fillable fields with your details (text, numbers, checkmarks).

- Employ the Sign Tool to add your legally-recognized eSignature (if required).

- Examine your document and correct any errors.

- Preserve changes, print your copy, send it to your recipient, and download it to your device.

Refer to this manual to submit your taxes electronically with airSlate SignNow. Please be aware that filing on paper can lead to increased return errors and slower refunds. Naturally, before e-filing your taxes, consult the IRS website for declaration regulations in your state.

Create this form in 5 minutes or less

FAQs

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

-

Why did my employer give me a W-9 Form to fill out instead of a W-4 Form?

I wrote about the independent-contractor-vs-employee issue last year, see http://nctaxpro.wordpress.com/20...Broadly speaking, you are an employee when someone else - AKA the employer - has control over when and where you work and the processes by which you perform the work that you do for that individual. A DJ or bartender under some circumstances, I suppose, might qualify as an independent contractor at a restaurant, but the waitstaff, bus help, hosts, kitchen aides, etc. almost certainly would not.There's always risk in confronting an employer when faced with a situation like yours - my experience is that most employers know full well that they are violating the law when they treat employees as independent contractors, and for that reason they don't tolerate questions about that policy very well - so you definitely should tread cautiously if you want to keep this position. Nonetheless, I think you owe it to yourself to ask whether or not the restaurant intends to withhold federal taxes from your checks - if for no other reason than you don't want to get caught short when it comes to filing your own return, even if you don't intend to challenge the policy.

-

I received my late husband's W-9 form to fill out for what I believe were our stocks. How am I supposed to fill this out or am I even supposed to?

You do not sound as a person who handles intricasies of finances on daily basis, this is why you should redirect the qustion to your family’s tax professional who does hte filings for you.The form itself, W-9 form, is a form created and approved by the IRS, if that’s your only inquiry.Whether the form applies to you or to your husband’s estate - that’s something only a person familiar with the situation would tell you about; there is no generic answer to this.

-

Why does my property management ask me to fill out a W-9 form?

To collect data on you in case they want to sue you and enforce a judgment.If the management co is required to pay inerest on security deposits then they need to account to ou for that interest income.If you are in a coop or condo they may apportion tax benefits or capital costs to you for tax purposes.

-

Do I need to fill out a W-9?

An employer will request a W-9 form of Independent Contractors so they can report the payments to the IRS at year-end. Generally, a 1099-MISC is completed by the employer and submitted to the IRS and State tax agencies only if the amount of payments made to that contractor exceeds $600 for services on an annual basis. It is common to request the W9 in advance, just in case you break that minimum threshold in the future. You will know if they reported $45 to the IRS because you will also receive a copy of the 1099 and can act accordingly. Hope this helps!

-

Do I need to fill out Form W-9 (US non-resident alien with an LLC in the US)?

A single-member LLC is by default a disregarded entity. Assuming you have not made a “check-the-box” election to have it treated as a corporation, this means for tax purposes, you are a sole proprietor.As a non-resident alien, you would not complete form W-9. You would likely provide form W-8ECI; possibly W-8BEN.

-

Why do you need to fill out a W-9 form to get back a broker fee from renting an apartment?

Is the person requesting that you fill out this form going to be cutting you a check for this fee? In other words, is this broker fee a payment to you for services you rendered? Money that you need to declare as income and thus pay income taxes to the IRS?If not, if this check is for some other reason, then I don’t believe that you should complete this form.I’m not a lawyer, so there could very well be something that I am unaware of, but it looks suspicious to me. I sure would like to know more about this issue.

Create this form in 5 minutes!

How to create an eSignature for the printable w 9 form indiana

How to make an eSignature for the Printable W 9 Form Indiana online

How to generate an eSignature for your Printable W 9 Form Indiana in Chrome

How to generate an electronic signature for putting it on the Printable W 9 Form Indiana in Gmail

How to make an electronic signature for the Printable W 9 Form Indiana from your mobile device

How to generate an eSignature for the Printable W 9 Form Indiana on iOS devices

How to generate an eSignature for the Printable W 9 Form Indiana on Android OS

People also ask

-

What is a W9 Indiana form and why do I need it?

The W9 Indiana form is a crucial document used for tax purposes in the state of Indiana. It allows businesses to request the Taxpayer Identification Number (TIN) from contractors or vendors for reporting income to the IRS. By using the W9 Indiana form, you ensure compliance with state and federal tax regulations.

-

How can airSlate SignNow help me manage W9 Indiana forms efficiently?

AirSlate SignNow provides an easy-to-use platform for sending and electronically signing W9 Indiana forms. With our solution, you can streamline the process of collecting W9 forms from contractors, ensuring that all documents are securely signed and stored. This helps enhance your business's efficiency and organization.

-

Is there a cost associated with using airSlate SignNow for W9 Indiana forms?

Yes, airSlate SignNow offers various pricing plans to accommodate businesses of all sizes. Our pricing is transparent, with options that allow you to manage W9 Indiana forms along with other document types at a cost-effective rate. You can choose a plan that best fits your business needs.

-

What features does airSlate SignNow offer for handling W9 Indiana documents?

AirSlate SignNow includes features tailored for managing W9 Indiana documents, such as customizable templates, automated reminders, and secure cloud storage. Additionally, our platform supports multi-party signing, which simplifies the process of obtaining signatures on W9 forms. These features enhance productivity and reduce errors.

-

Can I integrate airSlate SignNow with other applications for managing W9 Indiana forms?

Absolutely! AirSlate SignNow seamlessly integrates with various applications, allowing you to manage W9 Indiana forms alongside your existing software tools. This integration ensures a smooth workflow and helps maintain all your documents in one centralized location.

-

How secure is my data when using airSlate SignNow for W9 Indiana forms?

Security is a top priority for airSlate SignNow, especially when handling sensitive documents like W9 Indiana forms. Our platform utilizes advanced encryption protocols and complies with industry standards to protect your data. You can trust that your information is safe with us.

-

What are the benefits of using airSlate SignNow for W9 Indiana forms?

Using airSlate SignNow for W9 Indiana forms offers numerous benefits, including improved efficiency, reduced paperwork, and enhanced security. Our platform simplifies the signing process, allowing you to collect signed forms quickly and easily, which saves you time and resources.

Get more for W9 Indiana

Find out other W9 Indiana

- Sign Hawaii Non-Profit Limited Power Of Attorney Myself

- Sign Hawaii Non-Profit Limited Power Of Attorney Free

- Sign Idaho Non-Profit Lease Agreement Template Safe

- Help Me With Sign Illinois Non-Profit Business Plan Template

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online