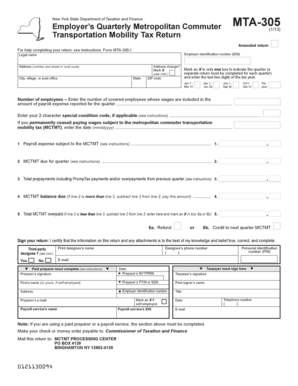

Mta 305 2013

What is the MTA 305?

The MTA 305 is a specific form used within the context of transportation and motor vehicle regulations in the United States. This form is essential for individuals or businesses involved in certain transportation activities, ensuring compliance with state and federal regulations. It typically pertains to the reporting of vehicle usage, maintenance, and operational details necessary for regulatory oversight.

How to Use the MTA 305

Using the MTA 305 involves filling out the form accurately to reflect the necessary information regarding vehicle operations. Users must ensure that all sections are completed, including details about the vehicle, the purpose of its use, and any relevant dates. Proper usage of the form helps in maintaining compliance with transportation regulations and avoiding potential penalties.

Steps to Complete the MTA 305

Completing the MTA 305 requires careful attention to detail. Follow these steps:

- Gather necessary information about the vehicle, including make, model, and registration details.

- Provide accurate descriptions of the vehicle's usage, including any relevant operational dates.

- Review the form for completeness, ensuring all required fields are filled out.

- Submit the form through the appropriate channels, whether online, by mail, or in person.

Legal Use of the MTA 305

The MTA 305 must be used in accordance with applicable laws and regulations governing transportation in the United States. Legal use includes submitting the form by the required deadlines and ensuring that all information provided is truthful and accurate. Non-compliance can result in penalties or legal repercussions.

Required Documents

When completing the MTA 305, certain documents may be necessary to support the information provided. These may include:

- Proof of vehicle ownership or registration.

- Documentation of vehicle usage, such as logs or records.

- Any relevant permits or licenses related to transportation activities.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the MTA 305. These deadlines may vary based on state regulations or specific transportation activities. Missing a deadline can lead to delays in processing or potential penalties, so it is advisable to stay informed about important dates related to the form.

Form Submission Methods

The MTA 305 can typically be submitted through various methods, including:

- Online submission via the designated state or federal platform.

- Mailing the completed form to the appropriate regulatory agency.

- In-person submission at designated offices or agencies.

Quick guide on how to complete mta 305 73498016

Complete Mta 305 effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly and without hassle. Manage Mta 305 on any device with airSlate SignNow’s Android or iOS applications and enhance any paper-based workflow today.

How to modify and electronically sign Mta 305 with ease

- Access Mta 305 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information with features that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to finalize your edits.

- Choose how you wish to submit your form, whether by email, SMS, or an invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from your preferred device. Modify and electronically sign Mta 305 and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct mta 305 73498016

Create this form in 5 minutes!

How to create an eSignature for the mta 305 73498016

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the mta 305 feature in airSlate SignNow?

The mta 305 feature in airSlate SignNow allows users to streamline their document signing process. It provides an intuitive interface for sending and eSigning documents, ensuring that businesses can operate efficiently. This feature is designed to enhance productivity and reduce turnaround times for important documents.

-

How much does airSlate SignNow cost for mta 305 users?

Pricing for airSlate SignNow varies based on the plan selected, but it remains cost-effective for mta 305 users. The platform offers flexible pricing tiers that cater to different business sizes and needs. You can choose a plan that best fits your budget while still accessing the powerful mta 305 features.

-

What are the key benefits of using mta 305 with airSlate SignNow?

Using mta 305 with airSlate SignNow provides numerous benefits, including enhanced document security and faster processing times. Users can easily track document status and receive notifications, ensuring a smooth workflow. Additionally, the mta 305 feature helps reduce paper usage, contributing to a more sustainable business practice.

-

Can I integrate mta 305 with other applications?

Yes, airSlate SignNow allows for seamless integrations with various applications, enhancing the functionality of the mta 305 feature. You can connect it with popular tools like Google Drive, Salesforce, and more. This integration capability ensures that your document management processes are streamlined across platforms.

-

Is mta 305 suitable for small businesses?

Absolutely! The mta 305 feature in airSlate SignNow is designed to cater to businesses of all sizes, including small businesses. Its user-friendly interface and cost-effective pricing make it an ideal choice for small teams looking to improve their document signing processes without breaking the bank.

-

How does mta 305 enhance document security?

The mta 305 feature in airSlate SignNow enhances document security through advanced encryption and authentication measures. Users can set permissions and access controls to ensure that only authorized individuals can view or sign documents. This level of security is crucial for businesses handling sensitive information.

-

What types of documents can I send using mta 305?

With mta 305 in airSlate SignNow, you can send a wide variety of documents, including contracts, agreements, and forms. The platform supports multiple file formats, making it versatile for different business needs. This flexibility allows users to manage all their document signing requirements in one place.

Get more for Mta 305

Find out other Mta 305

- eSignature North Dakota Guarantee Agreement Easy

- Can I Electronic signature Indiana Simple confidentiality agreement

- Can I eSignature Iowa Standstill Agreement

- How To Electronic signature Tennessee Standard residential lease agreement

- How To Electronic signature Alabama Tenant lease agreement

- Electronic signature Maine Contract for work Secure

- Electronic signature Utah Contract Myself

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract