National Tax and Customs Administration of Hungary List of Form

Understanding the AFA Visszaigénylés Külföldi

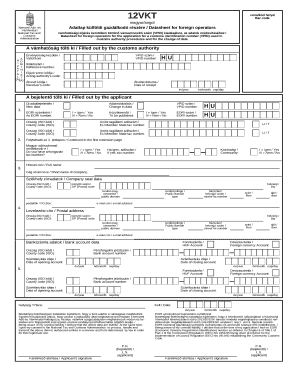

The AFA visszaigénylés külföldi is a specific form used for reclaiming VAT (Value Added Tax) for foreign entities operating within Hungary. This form is crucial for businesses that have incurred VAT expenses while conducting transactions in Hungary but are not registered for VAT in the country. Understanding the nuances of this form is essential for ensuring compliance and maximizing potential refunds.

Steps to Complete the AFA Visszaigénylés Külföldi

Completing the AFA visszaigénylés külföldi involves several important steps:

- Gather Required Documentation: Collect all invoices and receipts that demonstrate the VAT paid during transactions in Hungary.

- Fill Out the Form: Accurately complete the form, ensuring all fields are filled out as required.

- Submit the Form: Send the completed form along with supporting documents to the National Tax and Customs Administration of Hungary.

- Follow Up: Monitor the status of your application to ensure that it is processed in a timely manner.

Legal Use of the AFA Visszaigénylés Külföldi

The AFA visszaigénylés külföldi is legally binding when completed correctly. To ensure its validity, the form must comply with the relevant regulations set forth by the Hungarian tax authorities. This includes providing accurate information and necessary documentation to support the claim. It is advisable to consult with a tax professional if there are uncertainties regarding the legal requirements.

Eligibility Criteria for Submitting the AFA Visszaigénylés Külföldi

To be eligible to submit the AFA visszaigénylés külföldi, applicants must meet specific criteria:

- The applicant must be a foreign business entity that has incurred VAT in Hungary.

- The transactions for which the VAT is being reclaimed must be directly related to business activities.

- The applicant must not be registered for VAT in Hungary.

Required Documents for the AFA Visszaigénylés Külföldi

When submitting the AFA visszaigénylés külföldi, it is essential to include the following documents:

- Original invoices or receipts showing the VAT charged.

- Proof of payment for the VAT incurred.

- Any additional documentation that may support the claim, such as contracts or agreements.

Form Submission Methods for the AFA Visszaigénylés Külföldi

The AFA visszaigénylés külföldi can be submitted through various methods:

- Online Submission: Many businesses prefer to submit the form electronically via the National Tax and Customs Administration's online portal.

- Mail Submission: The form can also be printed and sent via postal service to the appropriate tax office.

- In-Person Submission: For those who prefer face-to-face interaction, submitting the form in person at a local tax office is an option.

Quick guide on how to complete national tax and customs administration of hungary list of

Effortlessly Prepare National Tax And Customs Administration Of Hungary List Of on Any Device

The management of online documents has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the right template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without any holdups. Manage National Tax And Customs Administration Of Hungary List Of on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

The easiest way to modify and electronically sign National Tax And Customs Administration Of Hungary List Of effortlessly

- Find National Tax And Customs Administration Of Hungary List Of and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize signNow sections of the documents or redact sensitive information using the tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Modify and electronically sign National Tax And Customs Administration Of Hungary List Of and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the national tax and customs administration of hungary list of

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is afa visszaigenyles külföldi?

Afa visszaigenyles külföldi refers to the process of reclaiming VAT paid on purchases made abroad. It is essential for businesses operating across borders to understand this process to maximize their financial efficiency.

-

How can airSlate SignNow assist with afa visszaigenyles külföldi?

airSlate SignNow offers a streamlined solution for managing the documentation involved in afa visszaigenyles külföldi. With our easy-to-use platform, you can prepare, send, and sign necessary documents efficiently, making reclaiming VAT less cumbersome.

-

What are the pricing options for airSlate SignNow?

AirSlate SignNow provides affordable pricing plans tailored to suit various business needs. By investing in our service, businesses can effectively manage their documents related to afa visszaigenyles külföldi while saving on administrative costs.

-

What features does airSlate SignNow offer for document signing?

With airSlate SignNow, users can access features such as customizable templates, in-person signing, and secure cloud storage. These features greatly support the process of afa visszaigenyles külföldi, enabling easy document preparation and management.

-

Is airSlate SignNow easy to integrate with other tools?

Yes, airSlate SignNow seamlessly integrates with various business applications, enhancing your workflow. This capability is crucial for handling documents related to afa visszaigenyles külföldi efficiently.

-

What are the benefits of using airSlate SignNow for business?

Using airSlate SignNow can lead to improved efficiency and time savings for businesses, especially in processes like afa visszaigenyles külföldi. Our platform helps reduce paperwork and minimizes mistakes, allowing for quicker VAT reclaim processes.

-

Can airSlate SignNow help with compliance for afa visszaigenyles külföldi?

Absolutely, airSlate SignNow ensures that all documents are compliant with legal standards, crucial for the afa visszaigenyles külföldi process. This compliance reduces the risk of issues that could arise during VAT claims.

Get more for National Tax And Customs Administration Of Hungary List Of

- Legal last will and testament form for married person with adult and minor children from prior marriage illinois

- Civil marriage form

- Legal last will and testament form for married person with adult and minor children illinois

- Legal last will and testament form for civil union partner with adult and minor children illinois

- Mutual wills package with last wills and testaments for married couple with adult and minor children illinois form

- Illinois widow 497306610 form

- Legal last will and testament form for widow or widower with minor children illinois

- Legal last will form for a widow or widower with no children illinois

Find out other National Tax And Customs Administration Of Hungary List Of

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast