Sd Excise Tax Form

What is the Sd Excise Tax Form

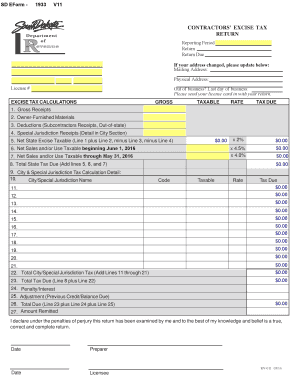

The South Dakota excise tax form is a document used by businesses and individuals to report and pay excise taxes imposed by the state of South Dakota. Excise taxes are specific taxes levied on certain goods, services, or activities, such as fuel, tobacco, and alcohol. This form is essential for ensuring compliance with state tax regulations and accurately reporting taxable transactions.

How to use the Sd Excise Tax Form

Using the South Dakota excise tax form involves several key steps. First, gather all necessary information regarding the transactions that may be subject to excise tax. This includes details about the type of goods or services, quantities, and applicable tax rates. Next, accurately fill out the form, ensuring all required fields are completed. After completing the form, review it for accuracy before submission. This process ensures that the tax obligations are met and helps avoid potential penalties.

Steps to complete the Sd Excise Tax Form

Completing the South Dakota excise tax form requires attention to detail. Follow these steps:

- Collect relevant transaction data, including product types and quantities.

- Determine the applicable excise tax rates for each item.

- Fill out the form with accurate information, including your business details and tax identification number.

- Calculate the total excise tax owed based on the collected data.

- Review the completed form for any errors or omissions.

- Submit the form through the appropriate method, whether online, by mail, or in person.

Legal use of the Sd Excise Tax Form

The South Dakota excise tax form is legally binding when completed and submitted according to state regulations. It serves as an official record of the taxes owed and paid. To ensure its legal validity, the form must be filled out accurately and submitted by the designated deadlines. Non-compliance with the requirements can lead to penalties, making it crucial for users to understand the legal implications of their submissions.

Form Submission Methods

The South Dakota excise tax form can be submitted through various methods, providing flexibility for users. Options include:

- Online Submission: Many users prefer to submit the form electronically through the South Dakota Department of Revenue's website, which may offer a streamlined process.

- Mail: Users can print the completed form and send it via postal service to the appropriate tax office.

- In-Person: For those who prefer face-to-face interaction, submitting the form in person at a local tax office is also an option.

Required Documents

When completing the South Dakota excise tax form, certain documents may be required to support the information provided. These documents can include:

- Invoices or receipts for taxable transactions.

- Records of previous tax payments.

- Any relevant licenses or permits associated with the sale of excise tax items.

Having these documents readily available can facilitate the completion of the form and ensure compliance with state regulations.

Quick guide on how to complete sd excise tax form

Complete Sd Excise Tax Form seamlessly on any gadget

Managing documents online has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the right template and securely store it online. airSlate SignNow equips you with all necessary tools to create, modify, and electronically sign your documents quickly without any hold-ups. Handle Sd Excise Tax Form on any gadget using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and eSign Sd Excise Tax Form with ease

- Locate Sd Excise Tax Form and click on Get Form to begin.

- Utilize the tools available to fill out your form.

- Select key sections of your documents or redact sensitive information with the specific tools airSlate SignNow provides for this purpose.

- Generate your signature using the Sign feature, which takes mere moments and carries the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your changes.

- Decide how you want to share your form, whether by email, SMS, invite link, or by downloading it to your computer.

Eliminate worries about lost or misplaced documents, tedious browsing through forms, or errors that necessitate the printing of new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Alter and eSign Sd Excise Tax Form and ensure excellent communication at every stage of your document preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sd excise tax form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an SD excise tax form?

The SD excise tax form is a document required for reporting excise taxes in South Dakota. It helps businesses comply with state tax regulations and ensures that all excise taxes owed are correctly calculated and submitted. Using airSlate SignNow, you can easily eSign and send these forms securely.

-

How can airSlate SignNow help with the SD excise tax form?

airSlate SignNow simplifies the process of handling the SD excise tax form by allowing users to eSign documents electronically. This saves time and increases efficiency, ensuring that your forms are submitted correctly and on time. Additionally, our user-friendly interface makes managing tax forms straightforward.

-

Is airSlate SignNow affordable for small businesses looking to manage their SD excise tax forms?

Yes, airSlate SignNow offers a cost-effective solution for small businesses needing to manage the SD excise tax form. Our pricing plans are designed to fit various budgets with user-friendly features that enhance productivity without breaking the bank. You can access all the necessary functions without incurring substantial costs.

-

Can I integrate airSlate SignNow with other software for handling SD excise tax forms?

Absolutely! airSlate SignNow integrates seamlessly with a variety of software applications to streamline your workflow around the SD excise tax form. Whether you’re using accounting software or CRM platforms, our integrations ensure that your eSigned documents are easily managed alongside your other business tools.

-

What features does airSlate SignNow offer for managing SD excise tax forms?

airSlate SignNow provides features specifically designed to assist with the SD excise tax form, including secure eSigning, document templates, and tracking capabilities. These tools help businesses streamline the process and ensure that all tax forms are handled correctly. Furthermore, our platform allows for easy collaboration among team members.

-

How does airSlate SignNow ensure the security of my SD excise tax form?

The security of your SD excise tax form is a top priority for airSlate SignNow. We implement industry-standard encryption and compliance measures to protect sensitive tax information. Additionally, our platform regularly undergoes security assessments to ensure your documents remain safe and secure throughout the signing process.

-

Can I track the status of my SD excise tax form once it’s sent for eSigning?

Yes, with airSlate SignNow, you can easily track the status of your SD excise tax form once it’s sent out for eSigning. Our tracking features provide real-time updates, allowing you to see who has signed the document and when. This transparency helps you manage your tax forms more effectively.

Get more for Sd Excise Tax Form

- Claim amp proposal forms religare religare health insurance

- Catholic schools week candy grams order form sppslex

- Form 2ta

- Application for ignition interlock permit hawaii state judiciary courts state hi form

- Mv 16a form

- Sensory profile questionnaire online form

- Publication order form complete and mail with payment to

- Music partnership agreement template form

Find out other Sd Excise Tax Form

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form