Sample Vat Invoice Ghana Form

What is the Sample Vat Invoice Ghana

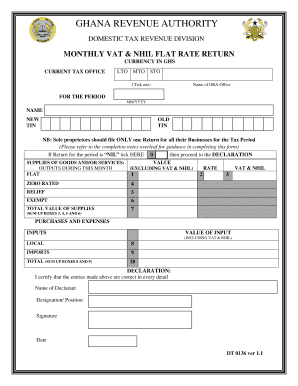

The sample VAT invoice Ghana is a standardized document used for transactions that involve Value Added Tax (VAT) in Ghana. It serves as proof of purchase and is essential for both buyers and sellers. This invoice includes critical information such as the seller's VAT number, the buyer's details, a description of the goods or services provided, the total amount charged, and the VAT amount. It is crucial for businesses to issue a VAT invoice to comply with the regulations set forth by the Ghana Revenue Authority.

Key Elements of the Sample Vat Invoice Ghana

A proper sample VAT invoice Ghana includes several key elements that ensure it meets legal requirements. These elements are:

- Seller's Information: Name, address, and VAT registration number.

- Buyer's Information: Name and address of the buyer.

- Invoice Number: A unique identifier for the invoice.

- Date of Issue: The date when the invoice is issued.

- Description of Goods/Services: Detailed information about what is being sold.

- Total Amount: The total cost of goods/services, including VAT.

- VAT Amount: The specific amount of VAT charged.

Steps to Complete the Sample Vat Invoice Ghana

Completing a sample VAT invoice Ghana involves several straightforward steps:

- Gather necessary information, including seller and buyer details.

- Assign a unique invoice number for tracking purposes.

- Clearly describe the goods or services provided.

- Calculate the total amount and the VAT amount.

- Ensure all information is accurate and complete.

- Sign the invoice if required, or use an electronic signature for digital submissions.

Legal Use of the Sample Vat Invoice Ghana

The sample VAT invoice Ghana is legally binding when it meets the requirements set by the Ghana Revenue Authority. It must accurately reflect the transaction details and comply with VAT regulations. Businesses are required to issue these invoices for sales transactions that involve VAT, and they must retain copies for their records. Failure to issue proper VAT invoices can result in penalties and compliance issues.

How to Obtain the Sample Vat Invoice Ghana

Businesses can obtain a sample VAT invoice Ghana through various means. Many accounting software solutions provide templates that comply with VAT regulations. Additionally, the Ghana Revenue Authority offers guidelines and sample templates on their official website. It is important to ensure that any template used includes all necessary elements to be considered valid.

Examples of Using the Sample Vat Invoice Ghana

Using a sample VAT invoice Ghana can vary depending on the nature of the business. For instance, a retailer selling goods will issue a VAT invoice to customers at the point of sale, detailing the items purchased and the VAT charged. Conversely, a service provider, such as a consultant, will issue a VAT invoice after services are rendered, outlining the service details and applicable VAT. These examples illustrate the versatility and necessity of the VAT invoice in different business contexts.

Quick guide on how to complete sample vat invoice ghana 33001475

Effortlessly Prepare Sample Vat Invoice Ghana on Any Device

Digital document management has gained immense popularity among businesses and individuals alike. It offers an excellent eco-friendly option to traditional printed and signed papers, as you can easily access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Sample Vat Invoice Ghana on any device using the airSlate SignNow apps for Android or iOS and enhance any document-related task today.

How to Modify and Electronically Sign Sample Vat Invoice Ghana with Ease

- Find Sample Vat Invoice Ghana and click on Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize important sections of the documents or redact sensitive information using the tools designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Sample Vat Invoice Ghana and ensure seamless communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sample vat invoice ghana 33001475

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Ghana invoice sample?

A Ghana invoice sample is a standardized document used by businesses in Ghana to request payment for goods or services provided. It typically includes details such as the date, buyer and seller information, item descriptions, prices, and payment terms. Using a Ghana invoice sample helps ensure compliance with local regulations and enhances professionalism.

-

How can airSlate SignNow help with creating a Ghana invoice sample?

airSlate SignNow provides customizable templates that allow you to easily create a Ghana invoice sample tailored to your business needs. With its user-friendly interface, you can input your data and generate invoices quickly. Additionally, it facilitates eSigning, streamlining the approval process with your clients.

-

Are there any costs associated with using airSlate SignNow for Ghana invoice samples?

Yes, airSlate SignNow offers various pricing plans based on the features you need. These plans are designed to be cost-effective, especially for businesses looking to produce professional Ghana invoice samples without incurring high costs. You can choose a plan that fits your budget and usage requirements.

-

What are the benefits of using a Ghana invoice sample?

Using a Ghana invoice sample helps streamline your billing process, ensure compliance with local taxation laws, and improve cash flow by clearly outlining payment terms. By having a professional template, you project credibility to your clients, which can lead to timely payments. Furthermore, integrating these samples with eSignature tools can enhance efficiency and reduce paperwork.

-

Can I integrate airSlate SignNow with other applications for invoicing?

Yes, airSlate SignNow can integrate with various applications and platforms, enhancing your workflow for invoice management. This allows you to streamline processes by connecting your accounting software with tools that handle Ghana invoice samples. Such integration ensures that your invoicing system is efficient, error-free, and organized.

-

Is it easy to customize a Ghana invoice sample with airSlate SignNow?

Absolutely! airSlate SignNow offers an intuitive editor that makes customizing a Ghana invoice sample straightforward. You can edit text, add your logo, and modify any fields to suit your business requirements, ensuring that your invoices are both compliant and professional.

-

Are there any specific legal requirements for creating a Ghana invoice sample?

Yes, there are legal requirements for invoices in Ghana, such as including a tax identification number and adhering to VAT regulations. A Ghana invoice sample from airSlate SignNow can help ensure that you meet these legal requirements while providing a clear and professional document to your clients.

Get more for Sample Vat Invoice Ghana

Find out other Sample Vat Invoice Ghana

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form