Sales Tax Form Durangogovorg

What is the Sales Tax Form Durangogovorg

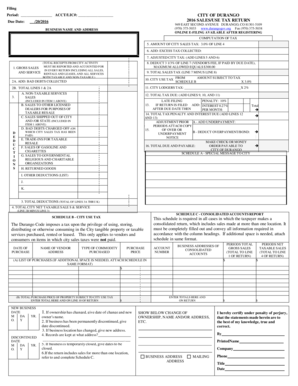

The Sales Tax Form Durangogovorg is a specific document used by businesses and individuals in Durango to report and remit sales tax collected on taxable sales. This form is essential for ensuring compliance with local tax regulations and is typically required by the state or local tax authority. It captures vital information such as the total sales amount, the sales tax collected, and any deductions or exemptions applicable. Understanding this form is crucial for accurate tax reporting and avoiding potential penalties.

Steps to Complete the Sales Tax Form Durangogovorg

Completing the Sales Tax Form Durangogovorg involves several key steps to ensure accuracy and compliance. First, gather all necessary sales records for the reporting period. Next, calculate the total sales and the corresponding sales tax collected. Fill in the required fields on the form, including your business information and sales figures. It is important to double-check all entries for errors. Finally, submit the completed form by the designated deadline, ensuring that you retain a copy for your records.

How to Obtain the Sales Tax Form Durangogovorg

The Sales Tax Form Durangogovorg can typically be obtained through the official website of the Durango tax authority or the state’s department of revenue. Many jurisdictions provide downloadable versions of the form in PDF format, which can be printed and filled out manually. Alternatively, some local offices may offer physical copies upon request. It is advisable to ensure that you are using the most current version of the form to comply with any recent updates in tax regulations.

Legal Use of the Sales Tax Form Durangogovorg

The legal use of the Sales Tax Form Durangogovorg is governed by state tax laws, which outline the requirements for accurate reporting and timely submission. When properly filled out and submitted, this form serves as a legal document that demonstrates compliance with sales tax obligations. It is important to ensure that all information provided is truthful and complete, as inaccuracies can lead to audits, penalties, or legal repercussions.

Key Elements of the Sales Tax Form Durangogovorg

Key elements of the Sales Tax Form Durangogovorg include the taxpayer's identification information, total sales amount, sales tax collected, and any applicable exemptions or deductions. Additionally, the form may require details about the reporting period and the signature of the person responsible for the business's tax compliance. Understanding these elements is vital for accurately completing the form and ensuring that all necessary information is included.

Filing Deadlines / Important Dates

Filing deadlines for the Sales Tax Form Durangogovorg are typically set by the local tax authority and can vary based on the frequency of tax reporting (monthly, quarterly, or annually). It is essential to be aware of these deadlines to avoid late fees or penalties. Marking these important dates on a calendar can help ensure timely submissions and maintain compliance with tax obligations.

Quick guide on how to complete sales tax form durangogovorg

Accomplish Sales Tax Form Durangogovorg seamlessly on any gadget

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents efficiently without delays. Manage Sales Tax Form Durangogovorg on any gadget using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

Steps to modify and eSign Sales Tax Form Durangogovorg effortlessly

- Find Sales Tax Form Durangogovorg and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes only seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from whichever device you choose. Modify and eSign Sales Tax Form Durangogovorg to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sales tax form durangogovorg

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Sales Tax Form Durangogovorg and how can airSlate SignNow help?

The Sales Tax Form Durangogovorg is a specific document required for businesses operating in Durango. With airSlate SignNow, you can easily create, send, and eSign this form, ensuring compliance and saving time in the process.

-

How much does airSlate SignNow cost for eSigning the Sales Tax Form Durangogovorg?

airSlate SignNow offers a range of pricing plans to fit different business needs, starting at a competitive rate. This makes eSigning the Sales Tax Form Durangogovorg not only simple but also cost-effective for businesses of all sizes.

-

Can I customize the Sales Tax Form Durangogovorg using airSlate SignNow?

Yes, airSlate SignNow allows you to easily customize the Sales Tax Form Durangogovorg to meet your specific requirements. You can add fields, adjust formatting, and include branding to ensure that the form aligns with your company's identity.

-

What features does airSlate SignNow offer for managing the Sales Tax Form Durangogovorg?

airSlate SignNow provides features like document templates, real-time collaboration, and automatic reminders for the Sales Tax Form Durangogovorg. These tools streamline the eSigning process, making it efficient and user-friendly.

-

Is my data secure when using airSlate SignNow for the Sales Tax Form Durangogovorg?

Absolutely. airSlate SignNow prioritizes data security and uses advanced encryption to protect your documents, including the Sales Tax Form Durangogovorg. You can trust that your sensitive business information is safeguarded.

-

Does airSlate SignNow integrate with other software for the Sales Tax Form Durangogovorg?

Yes, airSlate SignNow offers seamless integrations with popular applications like Google Drive and Microsoft Office. This allows you to easily manage and send the Sales Tax Form Durangogovorg alongside your other business tools.

-

Can I track the status of my Sales Tax Form Durangogovorg with airSlate SignNow?

Yes, you can track the status of your Sales Tax Form Durangogovorg in real time. airSlate SignNow provides notification updates when the document is viewed, signed, or completed, allowing for better management of your workflow.

Get more for Sales Tax Form Durangogovorg

- Final draft fy 09 frsgp faqs 3 30 09 mp doc fema form

- Fy regional catastrophic preparedness grant fema fema form

- Home schooling participating in school programs philosophy rsu16 form

- In arlington county govdelivery form

- Cdss ca form

- Beneficiary designation for vehicle or vessel title instructions form

- Dss 5096c form

- Rva stay gap grant program application form

Find out other Sales Tax Form Durangogovorg

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed