Form 1040 V

What is the Form 1040 V

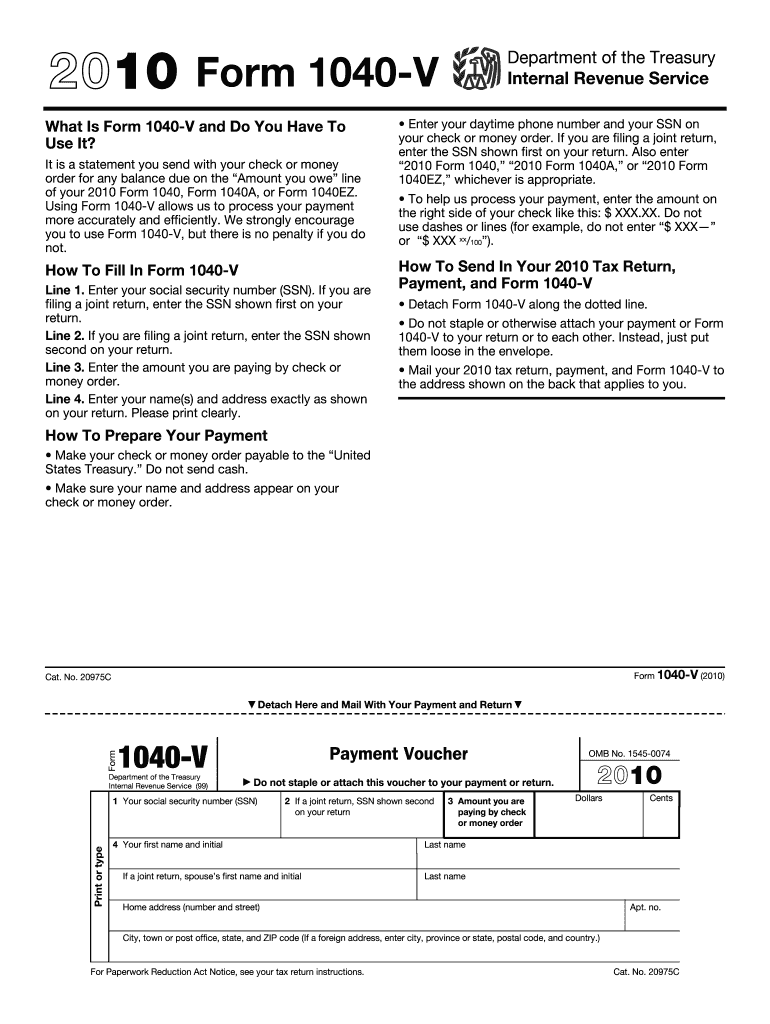

The Form 1040 V, also known as the Payment Voucher, is a document used by taxpayers in the United States to submit payments for their federal income tax returns. This form is specifically designed for individuals who are filing their tax returns using Form 1040 or its variants. The primary purpose of the Form 1040 V is to ensure that payments are accurately processed and credited to the correct tax account.

How to use the Form 1040 V

Using the Form 1040 V involves a few straightforward steps. First, complete your federal income tax return and determine the amount owed. After calculating your tax liability, fill out the Form 1040 V with your personal information, including your name, address, and Social Security number. Next, indicate the amount you are paying. Finally, attach your payment, such as a check or money order, to the completed voucher and mail it to the appropriate IRS address specified in the form's instructions.

Steps to complete the Form 1040 V

Completing the Form 1040 V requires careful attention to detail. Follow these steps:

- Obtain the Form 1040 V from the IRS website or your tax preparer.

- Fill in your name, address, and Social Security number accurately.

- Enter the amount you are submitting as payment.

- Attach your payment method securely to the voucher.

- Mail the completed Form 1040 V to the IRS at the designated address.

Legal use of the Form 1040 V

The Form 1040 V is legally recognized as a valid method for submitting tax payments to the IRS. To ensure compliance, taxpayers must adhere to the guidelines set forth by the IRS regarding the completion and submission of this form. Proper use of the Form 1040 V helps avoid penalties and ensures that payments are processed correctly, contributing to the overall accuracy of tax records.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Form 1040 V. Typically, the deadline for submitting your federal income tax return, along with the Form 1040 V, is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also consider any extensions that may apply to their specific situation, ensuring timely compliance with all tax obligations.

Form Submission Methods (Online / Mail / In-Person)

The Form 1040 V can be submitted through various methods. Taxpayers may choose to mail the completed voucher along with their payment to the IRS. Alternatively, if filing electronically, some tax software may allow for direct payment submissions without the need for a paper voucher. It is important to follow the IRS guidelines for each submission method to ensure proper processing of payments.

Quick guide on how to complete form 1040 v

Effortlessly Prepare Form 1040 V on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents promptly without holdups. Handle Form 1040 V on any device with the airSlate SignNow Android or iOS applications and streamline your document-driven tasks today.

Easily Modify and eSign Form 1040 V

- Obtain Form 1040 V and click Get Form to begin.

- Utilize the tools available to fill out your document.

- Emphasize crucial sections of your documents or redact sensitive information using the tools that airSlate SignNow specifically offers for this purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select how you would like to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Alter and eSign Form 1040 V to ensure seamless communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1040 v

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 1040 V and how is it used?

Form 1040 V is a payment voucher that taxpayers attach to their income tax returns when making a payment. It ensures clarity in payment processing by linking the payment to the correct return. Using airSlate SignNow can help you conveniently eSign and send Form 1040 V digitally, streamlining your tax filing process.

-

How can airSlate SignNow help in eSigning Form 1040 V?

airSlate SignNow offers a user-friendly platform to eSign Form 1040 V securely and efficiently. With its intuitive interface, you can easily add your signature and send it electronically, reducing the need for paper forms. Plus, it ensures compliance with all legal standards for digital signatures.

-

Is there a cost associated with using airSlate SignNow for Form 1040 V?

Yes, airSlate SignNow provides various pricing plans that are cost-effective for businesses of all sizes. By utilizing airSlate SignNow for Form 1040 V, you can save on printing and mailing costs while ensuring faster processing times. Sign up for a trial to explore the features before committing.

-

Can I integrate airSlate SignNow with other applications while handling Form 1040 V?

Absolutely! airSlate SignNow supports integrations with numerous applications, allowing for seamless management of Form 1040 V alongside your existing workflows. This integration capability enhances productivity and helps in consolidating your business operations.

-

What are the benefits of using airSlate SignNow for Form 1040 V?

Using airSlate SignNow for Form 1040 V offers benefits such as enhanced security, speed, and ease of use. The platform allows you to track document status in real-time, ensuring you never miss a payment deadline. Additionally, it reduces the hassle of paperwork, making tax season more manageable.

-

How does airSlate SignNow ensure the security of my Form 1040 V?

airSlate SignNow prioritizes the security of your documents, including Form 1040 V. The platform implements advanced encryption and complies with industry standards to protect your sensitive information. You can confidently use eSigning without concerns over data bsignNowes.

-

Can I access my completed Form 1040 V from anywhere?

Yes! airSlate SignNow provides cloud-based access to your completed Form 1040 V, allowing you to retrieve it securely from any device, anywhere. This flexibility ensures you have your important documents at your fingertips when you need them.

Get more for Form 1040 V

- Self employed septic system services contract form

- Motion for temporary restraining order and preliminary injunction to prevent vehicle loss form

- Change of venue motion form

- Motion to compel and for attorneys fees and expenses form

- Motion for summary judgment form

- Hourly fee agreement form

- Medical records form

- Law summary judgment form

Find out other Form 1040 V

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word