Kentucky Application Form

What is the Kentucky Application Form

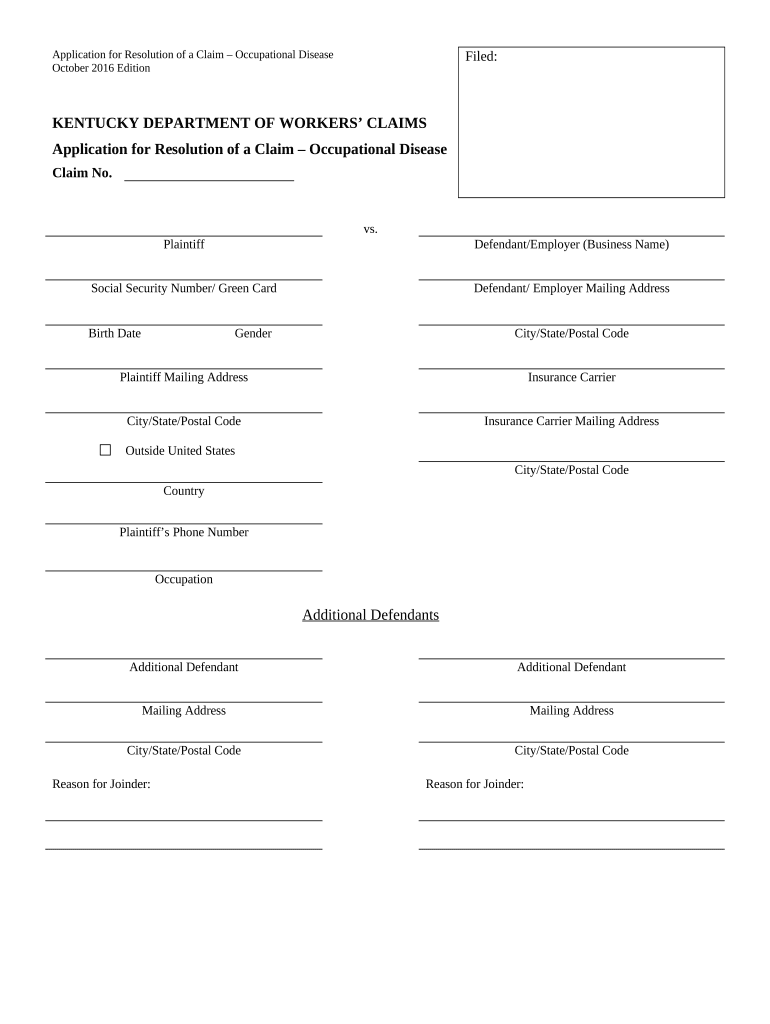

The Kentucky application form is a crucial document used for various purposes, including tax filings, legal applications, and other official requests within the state. This form serves as a standardized method for individuals and businesses to submit necessary information to state agencies. Depending on the specific type of application, the form may require details such as personal identification, financial information, and relevant supporting documents.

Steps to Complete the Kentucky Application Form

Completing the Kentucky application form involves several key steps to ensure accuracy and compliance. First, gather all necessary information and documents, including identification and any required financial records. Next, carefully fill out the form, ensuring that all sections are completed accurately. It is important to review the form for any errors or missing information before submission. Finally, choose your submission method, whether online, by mail, or in person, and follow the specific instructions for that method.

Legal Use of the Kentucky Application Form

The Kentucky application form is legally binding when completed and submitted according to state regulations. To ensure its legal standing, it is essential to adhere to the requirements set forth by relevant laws, such as the ESIGN Act and UETA, which govern electronic signatures. This means that when using digital methods to complete the form, the signatures must be verifiable and compliant with these legal standards.

How to Obtain the Kentucky Application Form

The Kentucky application form can be obtained through various channels. Most commonly, individuals can access the form online through the official state website or specific agency portals. Additionally, physical copies may be available at local government offices or designated public service centers. It is advisable to ensure that you are using the most current version of the form to avoid any issues during the application process.

Key Elements of the Kentucky Application Form

Understanding the key elements of the Kentucky application form is essential for successful completion. Typically, the form includes sections for personal information, purpose of the application, supporting documentation requirements, and signature fields. Each section must be filled out accurately, as incomplete or incorrect information may lead to delays or rejections in processing the application.

Form Submission Methods

There are several methods available for submitting the Kentucky application form. Individuals can choose to submit the form online through designated platforms, which often provide a streamlined process. Alternatively, the form can be mailed to the appropriate agency or submitted in person at local offices. Each submission method may have specific guidelines and processing times, so it is important to follow the instructions carefully to ensure timely handling of the application.

Quick guide on how to complete kentucky application form

Complete Kentucky Application Form seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents promptly without delays. Manage Kentucky Application Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign Kentucky Application Form effortlessly

- Obtain Kentucky Application Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Modify and eSign Kentucky Application Form and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Kentucky application form and how can airSlate SignNow help?

The Kentucky application form is a crucial document used for various official processes in the state. airSlate SignNow simplifies the completion and submission of the Kentucky application form by providing an easy-to-use platform for e-signatures and document management, making the process faster and more efficient.

-

Is there a cost associated with using airSlate SignNow for the Kentucky application form?

Yes, airSlate SignNow offers various pricing plans that cater to different needs and budgets. The cost is competitive, especially considering the benefits and features that enhance the process of managing Kentucky application forms efficiently.

-

What features does airSlate SignNow offer for the Kentucky application form?

airSlate SignNow provides a range of features including e-signatures, document templates, and a user-friendly interface for filling out the Kentucky application form. These features streamline the document workflow, ensuring a hassle-free experience for users.

-

How secure is airSlate SignNow for handling the Kentucky application form?

Security is a top priority for airSlate SignNow. The platform employs advanced encryption and compliance measures to protect sensitive information contained in the Kentucky application form, ensuring that your data remains confidential and secure.

-

Can I integrate airSlate SignNow with other applications for the Kentucky application form?

Absolutely! airSlate SignNow supports integrations with various third-party applications, facilitating seamless management of the Kentucky application form alongside your existing tools. This enhances efficiency and saves time during the application process.

-

How can airSlate SignNow benefit my business with the Kentucky application form?

By using airSlate SignNow for the Kentucky application form, your business can reduce paperwork, improve turnaround times, and minimize errors. This results in a more streamlined workflow, allowing you to focus on more critical tasks while ensuring compliance with state requirements.

-

Is it easy to use airSlate SignNow for the Kentucky application form?

Yes, airSlate SignNow is designed to be user-friendly, making it easy for anyone to fill out and e-sign the Kentucky application form without any technical knowledge. The intuitive interface guides you through each step, enhancing the overall user experience.

Get more for Kentucky Application Form

- Form 44 48974084

- Board paper sample pdf form

- The hippocrates code pdf form

- Western union form 453714552

- Michigan dept of state disability placard application form

- Rackham affidavit of financial support form

- Straightforward pre intermediate progress test 1 form

- New inside out upper intermediate review a flashcards form

Find out other Kentucky Application Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors