Morton Grove Transfer Declaration Form

What is the Morton Grove Transfer Declaration Form

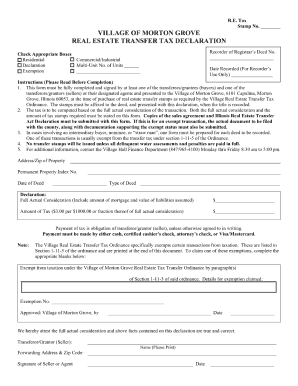

The Morton Grove Transfer Declaration Form is a legal document used primarily for the transfer of property ownership within Morton Grove, Illinois. This form serves as an official record of the transfer, detailing the parties involved, the property description, and the terms of the transfer. It is essential for ensuring that all legal requirements are met during the property transfer process, making it a crucial step for both buyers and sellers.

How to use the Morton Grove Transfer Declaration Form

Using the Morton Grove Transfer Declaration Form involves several key steps. First, ensure you have the correct version of the form, which can typically be obtained from local government offices or online resources. Next, fill out the form with accurate information regarding the property and the parties involved in the transaction. It is important to review the completed form for any errors before submission. Once filled out, the form must be signed by all parties involved to validate the transfer.

Steps to complete the Morton Grove Transfer Declaration Form

Completing the Morton Grove Transfer Declaration Form requires careful attention to detail. Follow these steps:

- Obtain the form from a reliable source.

- Provide the full names and addresses of the buyer and seller.

- Include a detailed description of the property being transferred, including its address and parcel number.

- Clearly outline the terms of the transfer, including any financial considerations.

- Ensure all parties sign the form, as required by local regulations.

- Submit the completed form to the appropriate local authority for processing.

Legal use of the Morton Grove Transfer Declaration Form

The Morton Grove Transfer Declaration Form is legally binding when properly executed. It must comply with local laws and regulations governing property transfers. This includes ensuring that all necessary disclosures are made and that the form is signed by all relevant parties. Failure to adhere to these legal requirements may result in complications during the property transfer process, including potential disputes or challenges to the validity of the transfer.

Key elements of the Morton Grove Transfer Declaration Form

Several key elements must be included in the Morton Grove Transfer Declaration Form to ensure its validity:

- Property Description: A clear and detailed description of the property being transferred.

- Parties Involved: Full names and contact information of the buyer and seller.

- Transfer Terms: Specific terms of the transfer, including any financial arrangements.

- Signatures: Signatures of all parties involved, indicating their agreement to the terms.

How to obtain the Morton Grove Transfer Declaration Form

The Morton Grove Transfer Declaration Form can be obtained through various channels. Local government offices, such as the county recorder's office or the assessor's office, often provide copies of the form. Additionally, many municipal websites offer downloadable versions of the form for convenience. It is important to ensure that the version you are using is current and compliant with local regulations.

Quick guide on how to complete morton grove transfer declaration form

Manage Morton Grove Transfer Declaration Form with ease on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the necessary forms and securely keep them online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents quickly and efficiently. Handle Morton Grove Transfer Declaration Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and electronically sign Morton Grove Transfer Declaration Form effortlessly

- Obtain Morton Grove Transfer Declaration Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize key sections of the documents or redact sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Verify all the details and click on the Done button to save your modifications.

- Select how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and electronically sign Morton Grove Transfer Declaration Form and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the morton grove transfer declaration form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Morton Grove Transfer Declaration Form?

The Morton Grove Transfer Declaration Form is a crucial document used in property transfers within Morton Grove. It helps to declare the full consideration for the sale and establishes the eligibility for exemptions. Understanding this form is essential for homeowners and real estate agents alike.

-

How can I access the Morton Grove Transfer Declaration Form?

You can easily access the Morton Grove Transfer Declaration Form through airSlate SignNow's platform. Our user-friendly interface allows you to quickly find and prepare this form digitally. This ensures a hassle-free process for all your real estate transactions.

-

Is there a cost associated with using the Morton Grove Transfer Declaration Form on airSlate SignNow?

airSlate SignNow offers a cost-effective solution for managing the Morton Grove Transfer Declaration Form. We have flexible pricing plans that cater to different business needs. You can choose the one that best fits your requirements without compromising on features.

-

What features does airSlate SignNow provide for managing the Morton Grove Transfer Declaration Form?

When using airSlate SignNow for the Morton Grove Transfer Declaration Form, you benefit from features such as eSigning, document tracking, and secure storage. These features streamline the signing process and enhance efficiency. This means you can focus more on what matters most - closing your real estate deals.

-

Can I integrate airSlate SignNow with other tools for the Morton Grove Transfer Declaration Form?

Yes, airSlate SignNow supports various integrations to enhance your workflow with the Morton Grove Transfer Declaration Form. You can connect it with popular CRM and business management tools. This integration allows for seamless data transfer and improved productivity.

-

What are the benefits of using airSlate SignNow for the Morton Grove Transfer Declaration Form?

Using airSlate SignNow for the Morton Grove Transfer Declaration Form offers numerous benefits, including faster turnaround times and reduced paperwork. With our platform, you can send and sign documents from anywhere, making the process more convenient. Additionally, our platform ensures that your documents remain secure and compliant.

-

How secure is the Morton Grove Transfer Declaration Form when using airSlate SignNow?

airSlate SignNow prioritizes the security of your documents, including the Morton Grove Transfer Declaration Form. We utilize advanced encryption methods and compliance protocols to keep your data safe. Rest assured that your sensitive information is protected at all times.

Get more for Morton Grove Transfer Declaration Form

Find out other Morton Grove Transfer Declaration Form

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now