Wisconsin Dqa Form F 62495

What is the Wisconsin Dqa Form F 62495

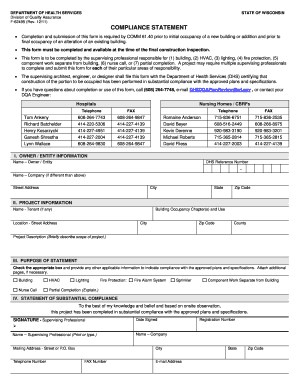

The Wisconsin DQA Form F 62495 is a document used within the state of Wisconsin for specific regulatory purposes related to healthcare services. It is primarily utilized by providers to report essential information about their services, ensuring compliance with state regulations. This form plays a critical role in maintaining the quality and accountability of healthcare services in Wisconsin.

How to use the Wisconsin Dqa Form F 62495

Using the Wisconsin DQA Form F 62495 involves several key steps. First, ensure that you have the most current version of the form, which can typically be obtained from the Wisconsin Department of Health Services website. Next, carefully read the instructions provided with the form to understand the information required. Complete the form accurately, providing all necessary details about your services, and ensure that it is signed and dated appropriately before submission.

Steps to complete the Wisconsin Dqa Form F 62495

Completing the Wisconsin DQA Form F 62495 involves a systematic approach:

- Gather necessary information, including provider details and service descriptions.

- Download or request the latest version of the form from the appropriate state agency.

- Fill out the form, ensuring all sections are completed accurately.

- Review the completed form for any errors or omissions.

- Sign and date the form as required.

- Submit the form according to the instructions provided, whether online, by mail, or in person.

Legal use of the Wisconsin Dqa Form F 62495

The Wisconsin DQA Form F 62495 is legally binding when completed and submitted according to state regulations. It is essential for providers to understand that the information provided must be truthful and accurate, as any discrepancies may lead to legal repercussions or penalties. Compliance with the form's requirements ensures that providers maintain their licensing and are held accountable for the services they offer.

Key elements of the Wisconsin Dqa Form F 62495

Key elements of the Wisconsin DQA Form F 62495 include:

- Provider Information: Details about the healthcare provider, including name, address, and contact information.

- Service Description: A comprehensive overview of the services being provided, including any specialties.

- Compliance Statements: Affirmations regarding adherence to state regulations and standards.

- Signature Section: A designated area for the provider's signature and date, confirming the accuracy of the information.

Form Submission Methods

The Wisconsin DQA Form F 62495 can be submitted through various methods, depending on the guidelines set by the Wisconsin Department of Health Services. Common submission methods include:

- Online Submission: Many forms can be submitted electronically through designated state portals.

- Mail: The completed form can be sent via postal service to the appropriate department.

- In-Person Submission: Providers may also have the option to deliver the form directly to a state office.

Quick guide on how to complete wisconsin dqa form f 62495

Effortlessly prepare Wisconsin Dqa Form F 62495 on any device

Online document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct template and securely keep it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents quickly and without delays. Manage Wisconsin Dqa Form F 62495 on any platform with the airSlate SignNow apps for Android or iOS, and simplify any document-related task today.

How to modify and electronically sign Wisconsin Dqa Form F 62495 effortlessly

- Find Wisconsin Dqa Form F 62495 and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign tool, which takes just a few seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Wisconsin Dqa Form F 62495 to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wisconsin dqa form f 62495

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Wisconsin DQA Form F 62495?

The Wisconsin DQA Form F 62495 is a document used to assess eligibility for certain state programs. It allows users to submit necessary information for review and approval efficiently. Using airSlate SignNow, you can easily complete and eSign this form, streamlining your submission process.

-

How can airSlate SignNow help with the Wisconsin DQA Form F 62495?

airSlate SignNow simplifies the process of completing the Wisconsin DQA Form F 62495 by providing an intuitive interface for filling and signing. The platform allows users to electronically sign documents, reducing the need for paper and in-person submissions. This increases efficiency and speeds up the overall review process.

-

Is there a cost associated with using airSlate SignNow for the Wisconsin DQA Form F 62495?

Yes, airSlate SignNow offers affordable pricing plans tailored to different business needs, including those who frequently handle the Wisconsin DQA Form F 62495. Users can choose from various subscription models that suit their budget and usage requirements. The investment pays off in terms of time saved and improved compliance.

-

What features does airSlate SignNow provide for handling forms like the Wisconsin DQA Form F 62495?

airSlate SignNow provides features such as templates, automated workflows, and tracking capabilities for documents like the Wisconsin DQA Form F 62495. These features enable users to manage their forms effectively, ensuring all necessary signatures are obtained, and deadlines are met. Automation enhances overall productivity.

-

Can I integrate airSlate SignNow with other tools for processing the Wisconsin DQA Form F 62495?

Absolutely! airSlate SignNow offers seamless integrations with various applications to enhance your workflow when managing the Wisconsin DQA Form F 62495. This includes integrations with CRM systems, document management software, and more, allowing for a cohesive and efficient process.

-

What are the benefits of using airSlate SignNow for the Wisconsin DQA Form F 62495?

Using airSlate SignNow for the Wisconsin DQA Form F 62495 provides several benefits, including faster processing, reduced paper usage, and a user-friendly experience. The platform enhances collaboration by allowing multiple users to sign and share documents in real-time. This leads to quicker approvals and improved operational efficiency.

-

Is airSlate SignNow secure for submitting the Wisconsin DQA Form F 62495?

Yes, airSlate SignNow prioritizes security and offers advanced features to protect sensitive information included in the Wisconsin DQA Form F 62495. The platform uses encryption, secure access controls, and compliance with industry standards to ensure your documents are safe during the entire signing process.

Get more for Wisconsin Dqa Form F 62495

- Instructions for filing mass transit system provider fuel tax form

- Mw506nrs49 010423 b mw506nrs49 010423 b form

- Motor fuel terminal operator west virginia tax division form

- Instructions for filing blender fuel tax return form

- Wv it 104 employees withholding exemption certificate form

- Supplier of diesel fuel tax return cdtfa form

- Mw506a49 011123 a form

- April mf 001 instr instructions fuel tax refund claim form

Find out other Wisconsin Dqa Form F 62495

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast