Rfc Forms for it Department

What is the RFC Application Form?

The RFC application form is a crucial document used by individuals and organizations to request a unique identification number, known as a RFC (Registro Federal de Contribuyentes), in the United States. This identification is essential for tax purposes, allowing entities to comply with federal tax regulations. The form captures important information about the applicant, including personal details, business structure, and tax obligations. Understanding the purpose and significance of the RFC application form is vital for ensuring compliance with tax laws and regulations.

Steps to Complete the RFC Application Form

Completing the RFC application form involves several key steps to ensure accuracy and compliance. First, gather all necessary personal and business information, including Social Security numbers, business names, and addresses. Next, fill out the form carefully, ensuring that all sections are completed accurately. It is essential to review the information for any errors before submission. Once the form is complete, submit it through the designated method, whether online, by mail, or in person, depending on the specific requirements set forth by the IRS.

Legal Use of the RFC Application Form

The RFC application form serves a legal purpose in the United States, as it establishes a taxpayer's identity for federal tax purposes. When completed correctly, the form becomes a legally binding document that enables individuals and businesses to fulfill their tax obligations. Compliance with IRS guidelines and regulations is essential to ensure that the RFC application is accepted and processed without issues. Understanding the legal implications of this form is crucial for avoiding potential penalties or complications with tax authorities.

Required Documents for the RFC Application Form

When preparing to submit the RFC application form, certain documents are required to support the application. These typically include proof of identity, such as a government-issued ID or Social Security card, and documentation that verifies the business structure, like articles of incorporation or partnership agreements. Additionally, any relevant tax documents that demonstrate prior compliance may also be necessary. Ensuring that all required documents are included with the application helps facilitate a smooth processing experience.

Form Submission Methods

The RFC application form can be submitted through various methods, allowing for flexibility based on the applicant's preferences. Common submission methods include online applications via the IRS website, mailing the completed form to the appropriate IRS office, or delivering it in person. Each method has its own timeline for processing, so it is important to choose the one that best suits your needs. Understanding these submission options can help streamline the application process.

Eligibility Criteria for the RFC Application Form

Eligibility for the RFC application form varies depending on the applicant's status. Generally, individuals, businesses, and organizations that are subject to federal tax obligations in the United States can apply for an RFC. Specific criteria may include being a resident or citizen of the U.S., having a valid Social Security number, or being registered as a business entity. Familiarizing yourself with the eligibility requirements ensures that your application is valid and increases the likelihood of approval.

Application Process & Approval Time

The application process for the RFC form involves several steps, starting from the initial submission to the final approval. After submitting the form, applicants can expect a processing time that typically ranges from a few days to several weeks, depending on the submission method and the volume of applications being processed by the IRS. Staying informed about the status of your application can help manage expectations and ensure timely compliance with tax obligations.

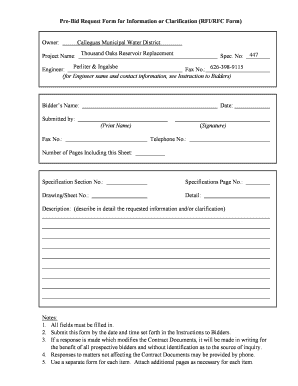

Quick guide on how to complete rfc forms for it department

Accomplish Rfc Forms For It Department effortlessly on any device

Managing documents online has gained increased popularity among companies and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to acquire the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly and without interruptions. Handle Rfc Forms For It Department on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

Ways to modify and electronically sign Rfc Forms For It Department effortlessly

- Find Rfc Forms For It Department and click Get Form to begin.

- Make use of the tools available to complete your form.

- Emphasize important parts of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from your preferred device. Modify and electronically sign Rfc Forms For It Department and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rfc forms for it department

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the RFC application form and how can airSlate SignNow help with it?

The RFC application form is a crucial document for many businesses seeking regulatory compliance. airSlate SignNow streamlines the process by allowing you to easily create, send, and eSign this form online, ensuring a smooth and efficient workflow.

-

How much does it cost to use airSlate SignNow for the RFC application form?

airSlate SignNow offers affordable pricing plans, enabling users to choose an option that best fits their budget. The cost-effectiveness of our solution makes it an ideal choice for businesses looking to handle their RFC application form without breaking the bank.

-

Can I integrate airSlate SignNow with other tools for managing the RFC application form?

Yes, airSlate SignNow seamlessly integrates with various business tools and platforms, making it easier to manage the RFC application form alongside your existing workflows. This integration capability enhances productivity and simplifies document management for your team.

-

What features does airSlate SignNow offer for handling the RFC application form?

airSlate SignNow provides a range of features for the RFC application form, including document templates, custom branding, secure eSigning, and audit trails. These features ensure that your documents are professional, secure, and compliant with legal standards.

-

Is there a free trial available for airSlate SignNow to test the RFC application form capabilities?

Yes, airSlate SignNow offers a free trial that allows users to explore its features for handling the RFC application form without any commitment. This trial gives you an opportunity to assess how our solution can meet your business needs effectively.

-

What are the benefits of using airSlate SignNow for the RFC application form?

Using airSlate SignNow for your RFC application form brings numerous benefits, including increased efficiency, reduced paperwork, and faster turnaround times. Additionally, the ease of eSigning helps expedite approvals, allowing your business to operate more smoothly.

-

How does airSlate SignNow ensure the security of the RFC application form?

airSlate SignNow implements robust security measures for the RFC application form, including encryption and secure access controls. This ensures that your sensitive information remains protected throughout the signing process, maintaining compliance with industry standards.

Get more for Rfc Forms For It Department

- Check bad form 497313914

- Ms trust form

- Mississippi certificate trust form

- Mutual wills containing last will and testaments for man and woman living together not married with no children mississippi form

- Mutual wills package of last wills and testaments for man and woman living together not married with adult children mississippi form

- Mutual wills or last will and testaments for man and woman living together not married with minor children mississippi form

- Non marital cohabitation living together agreement mississippi form

- Paternity case package establishment of paternity mississippi form

Find out other Rfc Forms For It Department

- Help Me With eSign Kansas Business Operations PPT

- How Can I eSign Mississippi Car Dealer Form

- Can I eSign Nebraska Car Dealer Document

- Help Me With eSign Ohio Car Dealer Document

- How To eSign Ohio Car Dealer Document

- How Do I eSign Oregon Car Dealer Document

- Can I eSign Oklahoma Car Dealer PDF

- How Can I eSign Oklahoma Car Dealer PPT

- Help Me With eSign South Carolina Car Dealer Document

- How To eSign Texas Car Dealer Document

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation