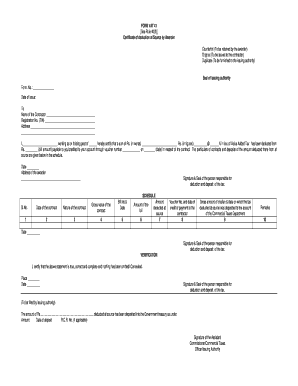

Vat 41 Form

What is the VAT 41 Form

The VAT 41 form is a document used primarily for tax purposes, specifically related to the Value Added Tax (VAT) in the United States. This form is essential for businesses that need to report their VAT transactions accurately. It serves as a declaration of VAT collected and paid, ensuring compliance with federal tax regulations. Understanding the VAT 41 form is crucial for businesses to maintain proper financial records and avoid potential penalties.

How to Use the VAT 41 Form

Using the VAT 41 form involves several steps to ensure accurate completion. First, gather all necessary information regarding your VAT transactions, including sales and purchases. Next, fill out the form by entering the required details, such as your business identification information and the amounts of VAT collected and paid. After completing the form, review it for accuracy before submission. This careful approach helps maintain compliance with tax regulations and reduces the risk of errors.

Steps to Complete the VAT 41 Form

Completing the VAT 41 form requires attention to detail. Here are the steps to follow:

- Gather your business information, including your tax identification number.

- Collect data on your VAT transactions for the reporting period.

- Fill in the form with accurate figures for VAT collected and VAT paid.

- Review the completed form for any discrepancies or errors.

- Submit the form by the designated deadline to ensure compliance.

Legal Use of the VAT 41 Form

The VAT 41 form is legally binding when completed accurately and submitted on time. It must adhere to the guidelines established by the Internal Revenue Service (IRS) to be considered valid. Failure to comply with these regulations can result in penalties, including fines or audits. Therefore, it is essential for businesses to understand the legal implications of using the VAT 41 form and to ensure that all information provided is truthful and complete.

Key Elements of the VAT 41 Form

Several key elements are crucial for the proper completion of the VAT 41 form. These include:

- Business Information: This section requires your business name, address, and tax identification number.

- Transaction Details: Accurate reporting of VAT collected and paid during the reporting period.

- Signature: A signature is often required to attest to the accuracy of the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the VAT 41 form are critical for compliance. Typically, businesses must submit the form on a quarterly or annual basis, depending on their VAT reporting requirements. It is essential to keep track of these deadlines to avoid late fees or penalties. Marking your calendar with these important dates can help ensure timely submission and adherence to tax regulations.

Quick guide on how to complete vat 41 form

Effortlessly Prepare Vat 41 Form on Any Device

Digital document management has gained traction among organizations and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed forms since you can obtain the right document and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Vat 41 Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to modify and electronically sign Vat 41 Form with ease

- Find Vat 41 Form and then select Get Form to begin.

- Leverage the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information using tools specifically designed by airSlate SignNow for that function.

- Create your electronic signature with the Sign tool, which takes only seconds and carries the same legal legitimacy as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Select your preferred method of delivering your form: via email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Vat 41 Form to guarantee clear communication throughout your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vat 41 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is VAT 41 and how does it relate to eSigning documents?

VAT 41 is a VAT exemption that can apply to specific transactions. Understanding how VAT 41 interacts with electronic signatures is crucial for businesses to ensure compliance while eSigning documents. airSlate SignNow simplifies the process by providing clear guidelines on handling VAT-related documents electronically.

-

How can airSlate SignNow help with VAT 41 compliance?

airSlate SignNow offers features that ensure your signed documents meet VAT 41 compliance requirements. With audit trails and secure storage, businesses can easily manage their VAT-exempt transactions, ensuring that all relevant information is captured and easily accessible. This helps avoid potential issues with VAT authorities.

-

What pricing options does airSlate SignNow offer for VAT-related services?

airSlate SignNow provides flexible pricing plans that cater to businesses of all sizes looking to manage VAT 41 documentation efficiently. Our plans are cost-effective and scale based on the number of users and features needed. Thus, using airSlate SignNow can help businesses maximize their VAT exemptions while minimizing costs.

-

What features of airSlate SignNow support managing VAT 41 documents?

Key features of airSlate SignNow include document templates, customizable workflows, and secure cloud storage, which are essential for handling VAT 41 documents. These tools simplify the creation and management of VAT-exempt documents by automating repetitive tasks and ensuring that all signatures are legally binding and compliant.

-

Can airSlate SignNow integrate with accounting software to manage VAT 41 transactions?

Yes, airSlate SignNow integrates seamlessly with various accounting software that can track VAT 41 transactions. This integration makes it easy for businesses to create, sign, and store VAT-compliant documents while keeping their financial records aligned. This allows for a more streamlined approach to accounting and financial reporting.

-

What are the benefits of using airSlate SignNow for VAT 41 document management?

Using airSlate SignNow for VAT 41 document management provides enhanced efficiency, security, and compliance. Companies can reduce processing times, minimize errors, and maintain an organized system for VAT-exempt documents. The solution also provides real-time updates and tracking features that facilitate better management of VAT-related processes.

-

Is airSlate SignNow secure for handling VAT 41 sensitive documents?

Absolutely, airSlate SignNow prioritizes security, implementing stringent measures such as encryption and multi-factor authentication to protect VAT 41 sensitive documents. Our platform ensures that only authorized personnel can access or sign the documents, thereby maintaining confidentiality and compliance with regulatory standards.

Get more for Vat 41 Form

- Temporary order injunction form

- Judicial review form

- Complaint for alienation of affections mississippi form

- Mississippi probate will form

- Petition for forfeiture of auto 41 29 101 mississippi form

- Dismissal without prejudice mississippi form

- Dismissal without form

- Mississippi mechanics 497314030 form

Find out other Vat 41 Form

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile

- eSignature North Carolina Proforma Invoice Template Easy