How Do I Get My W2 from Public Partnership Form

How to obtain the public partnerships W-2

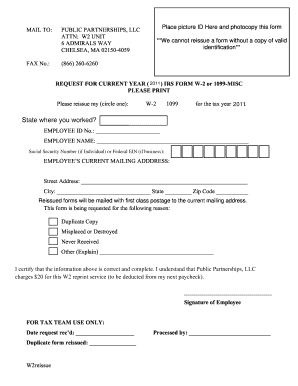

To obtain your public partnerships W-2, you typically need to follow a straightforward process. First, confirm your employment status with the public partnerships organization you worked for. They are responsible for issuing your W-2 form, which details your earnings and tax withholdings for the year. If you have not received your W-2 by the end of January, reach out to the payroll or human resources department of the organization. They can provide guidance on how to access your form, whether it is available online or needs to be mailed to you.

Steps to complete the public partnerships W-2

Completing the public partnerships W-2 involves several key steps. Start by gathering your personal information, including your Social Security number and address. Next, ensure you have your employer's details, such as their name and Employer Identification Number (EIN). When filling out the form, accurately report your total earnings and any taxes withheld. If you are completing this form digitally, use a reliable eSignature tool to sign the document securely. This ensures compliance with legal standards and protects your personal information.

IRS Guidelines for the public partnerships W-2

The IRS provides specific guidelines regarding the issuance and completion of the W-2 form. Employers must issue W-2s to employees by January 31 each year. The form must accurately reflect all income earned and taxes withheld during the previous year. Employees should review their W-2 forms for accuracy before filing their tax returns. If discrepancies are found, they should contact their employer immediately to resolve any issues. Understanding these guidelines helps ensure compliance with tax regulations and avoids potential penalties.

Form Submission Methods for the public partnerships W-2

When it comes to submitting your public partnerships W-2, you have several options. You can file your tax return electronically using tax software, which often allows for direct import of your W-2 information. Alternatively, you can mail your completed tax return along with a physical copy of your W-2 to the IRS. If you choose to file in person, ensure you bring your W-2 form along with any other necessary documentation. Each submission method has its advantages, so select the one that best fits your needs.

Who issues the public partnerships W-2

The public partnerships W-2 is issued by the organization you were employed by during the tax year. This could be a government entity or a private company involved in public partnerships. It is their responsibility to accurately report your earnings and withholdings to the IRS. If you have questions about your W-2 or need assistance, your employer's payroll or human resources department can provide the necessary support.

Penalties for Non-Compliance with the public partnerships W-2

Failing to comply with the requirements associated with the public partnerships W-2 can lead to penalties. If you do not receive your W-2 on time and fail to report your income accurately, you may face fines from the IRS. Additionally, if your employer does not issue W-2s as required, they could also incur penalties. It is essential to ensure that all forms are completed and submitted correctly to avoid these consequences.

Quick guide on how to complete how do i get my w2 from public partnership

Complete How Do I Get My W2 From Public Partnership seamlessly on any gadget

Digital document management has become widely accepted by businesses and individuals alike. It offers an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents quickly and efficiently. Handle How Do I Get My W2 From Public Partnership on any device with the airSlate SignNow Android or iOS applications and streamline any document-related procedure today.

The easiest method to modify and eSign How Do I Get My W2 From Public Partnership effortlessly

- Locate How Do I Get My W2 From Public Partnership and click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for this purpose.

- Formulate your eSignature with the Sign tool, which takes just moments and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to preserve your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your requirements in document management with just a few clicks from any device you prefer. Modify and eSign How Do I Get My W2 From Public Partnership and guarantee outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the how do i get my w2 from public partnership

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are public partnerships w2 and how do they work?

Public partnerships w2 refer to collaborative efforts between public sector entities and businesses to streamline processes like document management. These partnerships often utilize electronic signature solutions like airSlate SignNow to facilitate efficient and secure communication, simplifying workflows for all parties involved.

-

How can airSlate SignNow improve the management of public partnerships w2?

airSlate SignNow enhances public partnerships w2 by providing a user-friendly interface that allows for quick eSigning and document sharing. This ensures that all stakeholders can easily access essential documents, leading to faster decision-making and improved collaboration.

-

What features should I expect from airSlate SignNow when handling public partnerships w2?

When utilizing airSlate SignNow for public partnerships w2, you can expect features like customizable templates, automated workflows, and real-time tracking of document status. These tools help streamline the signing process and ensure compliance with legal standards.

-

Are there pricing options available for airSlate SignNow tailored for public partnerships w2?

Yes, airSlate SignNow offers various pricing plans that can accommodate the needs of public partnerships w2. By providing scalable options, businesses can choose a plan that fits their budget while still accessing essential eSigning features.

-

Can airSlate SignNow integrate with other tools used in public partnerships w2?

Absolutely! airSlate SignNow seamlessly integrates with a variety of applications commonly used in public partnerships w2, such as CRM systems and document storage services. This integration helps streamline processes and improve overall efficiency.

-

What are the benefits of using airSlate SignNow for public partnerships w2?

The primary benefits of using airSlate SignNow for public partnerships w2 include reduced turnaround times, enhanced security, and improved compliance with legal frameworks. By leveraging this eSigning solution, organizations can signNowly boost their productivity.

-

Is airSlate SignNow secure for public partnerships w2?

Yes, airSlate SignNow prioritizes security, ensuring that all documents involved in public partnerships w2 are protected with advanced encryption and secure access controls. You can trust that your sensitive information remains confidential throughout the signing process.

Get more for How Do I Get My W2 From Public Partnership

- New hampshire contract 497318487 form

- New hampshire contract 497318488 form

- New hampshire contract 497318489 form

- Plumbing contract for contractor new hampshire form

- Brick mason contract for contractor new hampshire form

- Roofing contract for contractor new hampshire form

- Electrical contract for contractor new hampshire form

- Sheetrock drywall contract for contractor new hampshire form

Find out other How Do I Get My W2 From Public Partnership

- Sign Wisconsin Applicant Appraisal Form Questions Easy

- Sign Alabama Deed of Indemnity Template Later

- Sign Alabama Articles of Incorporation Template Secure

- Can I Sign Nevada Articles of Incorporation Template

- Sign New Mexico Articles of Incorporation Template Safe

- Sign Ohio Articles of Incorporation Template Simple

- Can I Sign New Jersey Retainer Agreement Template

- Sign West Virginia Retainer Agreement Template Myself

- Sign Montana Car Lease Agreement Template Fast

- Can I Sign Illinois Attorney Approval

- Sign Mississippi Limited Power of Attorney Later

- How Can I Sign Kansas Attorney Approval

- How Do I Sign New Mexico Limited Power of Attorney

- Sign Pennsylvania Car Lease Agreement Template Simple

- Sign Rhode Island Car Lease Agreement Template Fast

- Sign Indiana Unlimited Power of Attorney Online

- Can I Sign Idaho Affidavit of No Lien

- Sign New York Affidavit of No Lien Online

- How To Sign Delaware Trademark License Agreement

- How To Sign Nevada Retainer for Attorney