Pa Sales Tax Exemption Form Fill in Sample

What is the Pennsylvania Sales Tax Exemption Form?

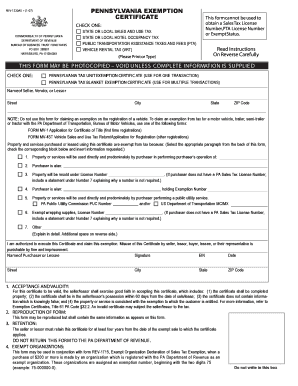

The Pennsylvania sales tax exemption form is a document that allows eligible buyers to purchase certain items without paying sales tax. This form is essential for businesses and individuals who qualify for tax-exempt status, such as non-profit organizations, government entities, and certain educational institutions. By submitting the form, buyers can legally avoid sales tax on qualifying purchases, which can lead to significant savings over time. Understanding the purpose and requirements of this form is crucial for maintaining compliance with state tax regulations.

Key Elements of the Pennsylvania Sales Tax Exemption Form

The Pennsylvania sales tax exemption form includes several key elements that must be filled out accurately to ensure its validity. These elements typically include:

- Purchaser Information: This section requires the name, address, and contact details of the buyer.

- Seller Information: The name and address of the seller from whom the items are being purchased must be provided.

- Reason for Exemption: The form requires a clear explanation of why the purchase is exempt from sales tax, such as being for a non-profit purpose.

- Signature: A signature from an authorized representative of the purchasing entity is necessary to validate the form.

Completing these elements accurately is essential to avoid any issues with tax compliance.

Steps to Complete the Pennsylvania Sales Tax Exemption Form

Filling out the Pennsylvania sales tax exemption form involves several straightforward steps:

- Gather Required Information: Collect all necessary information about the purchaser and seller, including addresses and contact details.

- Fill Out the Form: Carefully complete each section of the form, ensuring that all information is accurate and complete.

- Provide Justification: Clearly state the reason for the exemption in the designated section of the form.

- Sign the Form: An authorized representative must sign the form to certify its accuracy and validity.

- Submit the Form: Provide the completed form to the seller at the time of purchase to ensure the exemption is applied.

Following these steps will help ensure that the form is completed correctly and accepted by the seller.

Legal Use of the Pennsylvania Sales Tax Exemption Form

The legal use of the Pennsylvania sales tax exemption form is governed by state tax laws. To be valid, the form must be completed accurately and submitted at the time of purchase. Misuse of the form, such as using it for ineligible purchases, can result in penalties, including fines and back taxes owed. It is important for users to understand the specific criteria that qualify them for tax exemption and to maintain proper records of exempt purchases for audit purposes.

Eligibility Criteria for the Pennsylvania Sales Tax Exemption Form

Eligibility for using the Pennsylvania sales tax exemption form is determined by specific criteria set forth by the state. Common eligible entities include:

- Non-profit organizations that are recognized under IRS regulations.

- Government agencies at the federal, state, or local level.

- Educational institutions that meet certain qualifications.

- Certain medical facilities and organizations that provide healthcare services.

Entities must ensure that they meet these criteria before using the form to avoid any compliance issues.

Obtaining the Pennsylvania Sales Tax Exemption Form

The Pennsylvania sales tax exemption form can be obtained through various channels. It is typically available on the official Pennsylvania Department of Revenue website. Users can download the form in a printable format, making it easy to fill out and submit. Additionally, some businesses may provide copies of the form upon request. Ensuring that the most current version of the form is used is important for compliance with state regulations.

Quick guide on how to complete pa sales tax exemption form fill in sample

Accomplish Pa Sales Tax Exemption Form Fill In Sample effortlessly on any gadget

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly and without delays. Manage Pa Sales Tax Exemption Form Fill In Sample on any device through airSlate SignNow's Android or iOS applications and enhance any document-driven task today.

The simplest way to modify and electronically sign Pa Sales Tax Exemption Form Fill In Sample with ease

- Locate Pa Sales Tax Exemption Form Fill In Sample and click on Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that aim.

- Generate your electronic signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to preserve your changes.

- Choose your preferred method to deliver your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

No more worrying about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your choice. Edit and electronically sign Pa Sales Tax Exemption Form Fill In Sample and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pa sales tax exemption form fill in sample

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the PA sales tax exemption form and who needs it?

The PA sales tax exemption form is a document that allows qualifying organizations to make purchases without paying sales tax. Non-profit organizations, educational institutions, and government entities in Pennsylvania typically need this form to facilitate tax-exempt transactions.

-

How can airSlate SignNow help me with the PA sales tax exemption form?

AirSlate SignNow provides an efficient way to fill out and eSign the PA sales tax exemption form digitally. With its user-friendly interface, you can streamline the process of obtaining and managing your sales tax exemption documents, reducing time and effort.

-

Is there a cost associated with using airSlate SignNow for the PA sales tax exemption form?

AirSlate SignNow offers competitive pricing plans that accommodate different business needs. Most plans include features to manage the PA sales tax exemption form, allowing you to leverage eSigning solutions while keeping costs manageable.

-

What features does airSlate SignNow offer for managing the PA sales tax exemption form?

AirSlate SignNow offers features like customizable templates, secure cloud storage, and seamless eSignature capabilities to simplify the management of the PA sales tax exemption form. These features ensure that you can handle your documents effortlessly and securely.

-

Can I integrate airSlate SignNow with other software for processing the PA sales tax exemption form?

Yes, airSlate SignNow supports integrations with various platforms such as Google Drive, Dropbox, and CRM systems. This allows you to easily access and manage the PA sales tax exemption form alongside your other business applications.

-

How secure is the process of submitting the PA sales tax exemption form through airSlate SignNow?

AirSlate SignNow prioritizes security with measures like data encryption and secure access protocols. When you submit the PA sales tax exemption form through the platform, you can be confident that your information is protected and compliant.

-

What benefits can I expect when using airSlate SignNow for my PA sales tax exemption form needs?

By using airSlate SignNow for your PA sales tax exemption form, you benefit from faster processing, enhanced accuracy, and reduced paperwork. This digital solution allows you to manage your documents more efficiently, saving you valuable time and resources.

Get more for Pa Sales Tax Exemption Form Fill In Sample

- Corporate records maintenance package for existing corporations new hampshire form

- Nh llc form

- Limited liability company llc operating agreement new hampshire form

- Single member limited liability company llc operating agreement new hampshire form

- Nh pllc form

- Nh joint tenancy form

- Notice to owner of furnishing of labor or materials individual new hampshire form

- Quitclaim deed from individual to husband and wife new hampshire form

Find out other Pa Sales Tax Exemption Form Fill In Sample

- Sign Indiana Software Development Proposal Template Easy

- Sign South Dakota Working Time Control Form Now

- Sign Hawaii IT Project Proposal Template Online

- Sign Nebraska Operating Agreement Now

- Can I Sign Montana IT Project Proposal Template

- Sign Delaware Software Development Agreement Template Now

- How To Sign Delaware Software Development Agreement Template

- How Can I Sign Illinois Software Development Agreement Template

- Sign Arkansas IT Consulting Agreement Computer

- Can I Sign Arkansas IT Consulting Agreement

- Sign Iowa Agile Software Development Contract Template Free

- How To Sign Oregon IT Consulting Agreement

- Sign Arizona Web Hosting Agreement Easy

- How Can I Sign Arizona Web Hosting Agreement

- Help Me With Sign Alaska Web Hosting Agreement

- Sign Alaska Web Hosting Agreement Easy

- Sign Arkansas Web Hosting Agreement Simple

- Sign Indiana Web Hosting Agreement Online

- Sign Indiana Web Hosting Agreement Easy

- How To Sign Louisiana Web Hosting Agreement