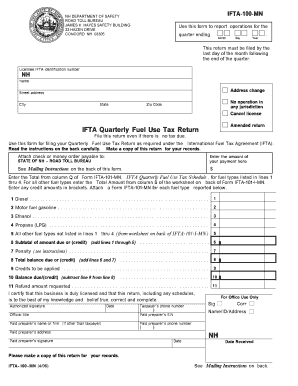

Ifta 100 Form

What is the IFTA 100?

The IFTA 100 form, also known as the International Fuel Tax Agreement (IFTA) report, is a crucial document for commercial vehicle operators in the United States and Canada. This form is used to report fuel usage and calculate the taxes owed to various jurisdictions based on miles traveled and fuel consumed. The IFTA 100 simplifies the process of tax reporting for interstate commercial vehicle operators by allowing them to file a single quarterly report instead of separate reports for each state or province. This form is essential for maintaining compliance with state tax regulations and ensuring that fuel taxes are accurately allocated among the jurisdictions where the vehicle operates.

Steps to Complete the IFTA 100

Completing the IFTA 100 form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including total miles driven in each jurisdiction and the amount of fuel purchased. Next, calculate the total miles and fuel for each state. This information will help determine the fuel tax owed or any potential refunds. After filling in the required fields on the form, review the calculations for accuracy. Finally, submit the completed IFTA 100 form to the designated state authority by the filing deadline. Utilizing digital tools can streamline this process, making it easier to track and manage your data.

Legal Use of the IFTA 100

The IFTA 100 form is legally binding when completed and submitted according to the regulations set forth by the International Fuel Tax Agreement. To ensure its legal validity, the form must be filled out accurately, reflecting true and complete information regarding fuel consumption and mileage. Electronic signatures, when used with compliant eSignature solutions, can provide an additional layer of authenticity and security. Compliance with local, state, and federal tax laws is essential, as inaccuracies or omissions can lead to penalties or audits.

Filing Deadlines / Important Dates

Filing deadlines for the IFTA 100 form are typically set on a quarterly basis. Operators must submit their reports by the last day of the month following the end of each quarter. For example, the deadlines are usually January 31, April 30, July 31, and October 31. It is crucial for operators to adhere to these deadlines to avoid late fees and potential penalties. Keeping a calendar or reminder system can help ensure timely submissions and maintain compliance with IFTA regulations.

Required Documents

To complete the IFTA 100 form accurately, several documents are typically required. These include records of total miles driven in each jurisdiction, receipts for fuel purchases, and any previous IFTA reports. Maintaining organized records can facilitate the completion of the form and ensure that all necessary information is readily available. Accurate documentation is essential for verifying the data reported and for compliance with tax regulations.

Form Submission Methods

The IFTA 100 form can be submitted through various methods, including online, by mail, or in person, depending on the requirements of the state where the vehicle is registered. Many states offer online portals that allow for electronic submission, which can expedite the process and reduce paperwork. If submitting by mail, ensure that the form is sent to the correct address and that it is postmarked by the filing deadline. In-person submissions may also be available at designated tax offices.

Penalties for Non-Compliance

Failure to comply with IFTA regulations and deadlines can result in significant penalties. Late submissions may incur fines, and inaccuracies in reporting can lead to audits or additional tax assessments. In severe cases, repeated non-compliance may result in the suspension of IFTA privileges. It is essential for commercial vehicle operators to understand the importance of timely and accurate reporting to avoid these consequences and maintain good standing with tax authorities.

Quick guide on how to complete ifta 100

Complete Ifta 100 effortlessly on any device

Digital document management has gained prominence among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, edit, and eSign your documents swiftly without delays. Manage Ifta 100 on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

The easiest way to modify and eSign Ifta 100 effortlessly

- Find Ifta 100 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review all information and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your preference. Edit and eSign Ifta 100 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ifta 100

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an IFTA 100 form and why is it important?

The IFTA 100 form is a crucial document for ensuring compliance with the International Fuel Tax Agreement. It simplifies the reporting of fuel use by motor carriers operating in multiple jurisdictions, making it essential for businesses that want to avoid audits and penalties.

-

How can airSlate SignNow help with IFTA 100 submissions?

airSlate SignNow streamlines the process of submitting your IFTA 100 forms by allowing you to eSign and securely send documents online. This not only saves time but also ensures your submissions are accurate and compliant with regulations.

-

What features does airSlate SignNow offer for managing IFTA 100 forms?

With airSlate SignNow, you get features like templates for IFTA 100 forms, automated reminders, and easy collaboration. These tools make it easier for businesses to manage their fuel tax reports efficiently.

-

What are the pricing options for using airSlate SignNow for IFTA 100?

airSlate SignNow offers flexible pricing plans to accommodate different business sizes and needs. You can choose a plan that fits your budget while getting the essential tools for managing your IFTA 100 forms effectively.

-

Can airSlate SignNow integrate with accounting software for IFTA 100 management?

Yes, airSlate SignNow can seamlessly integrate with various accounting software platforms to facilitate better management of your IFTA 100 forms. This ensures that all your data is synchronized and reduces the chances of errors.

-

What are the benefits of using airSlate SignNow for IFTA 100 over traditional methods?

Using airSlate SignNow for your IFTA 100 submissions offers numerous benefits, such as faster turnaround times, reduced paperwork, and improved accuracy. With eSigning capabilities, your documents can be signed from anywhere, making the process stress-free.

-

Is there customer support available for questions about IFTA 100 using airSlate SignNow?

Absolutely! airSlate SignNow provides dedicated customer support to assist you with any questions related to your IFTA 100 forms. Whether you need help with submissions or troubleshooting, our team is ready to help you.

Get more for Ifta 100

- Warranty deed from husband and wife to corporation new jersey form

- Divorce worksheet and law summary for contested or uncontested case of over 25 pages ideal client interview form new jersey

- Limited liability company 497319193 form

- New jersey lien 497319194 form

- New jersey lien 497319195 form

- New jersey release claim form

- Quitclaim deed from husband and wife to llc new jersey form

- Warranty deed from husband and wife to llc new jersey form

Find out other Ifta 100

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile