Verification of Mortgage Form Word

What is the verification of mortgage form?

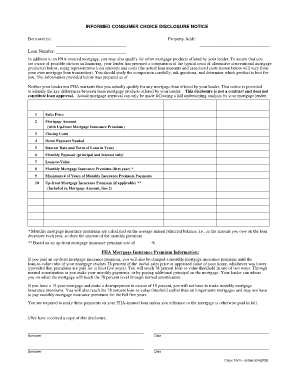

The verification of mortgage form is a critical document used primarily by lenders to confirm the details of a mortgage loan. This form typically includes essential information such as the borrower’s name, the property address, loan amount, and payment history. It serves as an official statement from the lender verifying that the mortgage exists and is in good standing. This form is often required during refinancing, loan applications, or when a borrower needs to prove their mortgage status to another financial institution.

Key elements of the verification of mortgage form

Understanding the key elements of the verification of mortgage form is essential for both borrowers and lenders. The primary components usually include:

- Borrower Information: Full name and contact details of the borrower.

- Property Details: Address of the property securing the mortgage.

- Loan Information: Original loan amount, current balance, and interest rate.

- Payment History: A record of the borrower’s payment history, including any late payments.

- Lender Information: Name and contact details of the lending institution.

Steps to complete the verification of mortgage form

Completing the verification of mortgage form involves several straightforward steps. Here’s a guide to ensure accuracy:

- Gather necessary documents, including your mortgage statement and identification.

- Fill in your personal information accurately, ensuring all details match official records.

- Provide property information, including the full address and any relevant identifiers.

- Detail the loan information, including the original amount and current balance.

- Review the payment history section to ensure it reflects your payment behavior accurately.

- Sign and date the form, ensuring it is submitted to the appropriate lender or institution.

Legal use of the verification of mortgage form

The legal use of the verification of mortgage form is governed by various regulations and standards. For the form to be legally binding, it must be completed accurately and submitted to the appropriate parties. Compliance with federal and state laws regarding mortgage documentation is essential. The form may also serve as evidence in legal proceedings, confirming the existence and status of a mortgage. It is crucial for borrowers to understand their rights and obligations when using this form, particularly in scenarios involving foreclosure or refinancing.

Examples of using the verification of mortgage form

There are several scenarios where the verification of mortgage form is utilized:

- Refinancing: When a borrower seeks to refinance their mortgage, lenders often require this form to assess the current mortgage status.

- Loan Applications: Financial institutions may request this form to verify existing mortgage obligations before approving new loans.

- Property Sales: Sellers may need to provide this form to potential buyers or their lenders to confirm the mortgage details.

How to obtain the verification of mortgage form

Obtaining the verification of mortgage form is a straightforward process. Borrowers can typically request this form directly from their lender. Many lenders provide the form online through their customer portals, making it easy to access. If the lender does not have an online option, borrowers can contact customer service to request a physical copy. It is advisable to have all relevant mortgage details on hand when making the request to expedite the process.

Quick guide on how to complete verification of mortgage form word

Prepare Verification Of Mortgage Form Word effortlessly on any device

Online document organization has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools essential for creating, modifying, and eSigning your documents quickly without delays. Manage Verification Of Mortgage Form Word on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

The simplest way to modify and eSign Verification Of Mortgage Form Word with ease

- Find Verification Of Mortgage Form Word and click on Get Form to begin.

- Make use of the tools we provide to complete your document.

- Highlight signNow sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your revisions.

- Select your preferred method to send your form, via email, text (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign Verification Of Mortgage Form Word to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the verification of mortgage form word

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a verification of mortgage form?

A verification of mortgage form is a document used by lenders to confirm the details of a borrower's mortgage. This form provides essential information regarding the mortgage balance, payment history, and any specific terms of the loan. airSlate SignNow makes it easy to create and manage this form for quick verification.

-

How does airSlate SignNow simplify the verification of mortgage form process?

airSlate SignNow streamlines the entire process of creating and sending a verification of mortgage form. With its intuitive interface, you can quickly design the form, add necessary fields, and send it to recipients for eSignature, minimizing the time and effort traditionally required.

-

Is there a cost associated with using the verification of mortgage form feature?

While airSlate SignNow offers various pricing plans, the feature for creating and managing a verification of mortgage form is integrated into these plans. You can choose a plan that suits your business needs and benefit from a cost-effective solution for document management and eSignature.

-

Can the verification of mortgage form be customized to meet our needs?

Yes, the verification of mortgage form can be fully customized within airSlate SignNow. You can add your company branding, adjust the layout, and include specific fields and clauses that reflect your requirements, ensuring the form fits perfectly for your business use.

-

What are the benefits of using airSlate SignNow for the verification of mortgage form?

Using airSlate SignNow for your verification of mortgage form offers numerous benefits, including enhanced security features, efficient workflow management, and real-time tracking of document status. Additionally, it saves time and reduces paperwork, allowing you to focus on more critical tasks.

-

Does airSlate SignNow integrate with other software for the verification of mortgage form?

Absolutely! airSlate SignNow supports integrations with various software applications, such as CRM systems and cloud storage services. This allows you to easily manage and access your verification of mortgage form alongside other essential business tools.

-

How can I ensure the security of my verification of mortgage form with airSlate SignNow?

airSlate SignNow employs stringent security measures to protect your verification of mortgage form. With features like encryption, two-factor authentication, and secure cloud storage, you can trust that your sensitive information is well protected throughout the eSignature process.

Get more for Verification Of Mortgage Form Word

- Limited warranty deed from individual to individual ohio form

- Oh deed form

- Balance garnishment form

- Life estate ohio form

- Discovery interrogatories from plaintiff to defendant with production requests ohio form

- Entry satisfaction form

- Ohio defendant 497322149 form

- Discovery interrogatories for divorce proceeding for either plaintiff or defendant ohio form

Find out other Verification Of Mortgage Form Word

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online

- eSignature Wyoming Landlord tenant lease agreement Online

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online

- Can I eSignature Utah Non-disclosure agreement PDF

- eSignature Rhode Island Rental agreement lease Easy

- eSignature New Hampshire Rental lease agreement Simple

- eSignature Nebraska Rental lease agreement forms Fast

- eSignature Delaware Rental lease agreement template Fast

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online