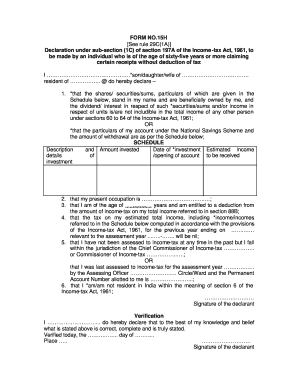

Form No 15h See Rule 29c 1a

What is the Form No 15h See Rule 29c 1a

The Form No 15h, as referenced in Rule 29c 1a, is a crucial document used in the United States for specific tax purposes. This form is primarily utilized by individuals who wish to declare that their income is below the taxable threshold, thereby requesting that no tax be deducted at source. It serves as a formal declaration to the payer, ensuring compliance with tax regulations while protecting the taxpayer's rights. Understanding its purpose is essential for anyone seeking to manage their tax liabilities effectively.

How to use the Form No 15h See Rule 29c 1a

Using the Form No 15h involves several key steps to ensure proper completion and submission. First, gather all necessary personal information, including your Social Security number and details about your income sources. Next, accurately fill out the form, ensuring that all sections are completed to avoid delays. Once completed, submit the form to the appropriate payer, such as an employer or financial institution, to inform them of your tax-exempt status. It is advisable to keep a copy for your records.

Steps to complete the Form No 15h See Rule 29c 1a

Completing the Form No 15h requires careful attention to detail. Follow these steps:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Indicate the type of income for which you are submitting the form.

- Clearly state that your total income is below the taxable threshold.

- Sign and date the form to validate your declaration.

- Submit the form to the payer, ensuring you retain a copy for your records.

Legal use of the Form No 15h See Rule 29c 1a

The legal use of the Form No 15h is governed by tax laws that dictate its applicability. It is essential for taxpayers to understand that submitting this form does not exempt them from tax obligations if their income exceeds the declared threshold. The form must be used in good faith, and any misrepresentation can lead to penalties. It is advisable to consult with a tax professional to ensure compliance with all relevant regulations.

Eligibility Criteria

To be eligible to use the Form No 15h, individuals must meet specific criteria. Primarily, the taxpayer's total income must fall below the taxable threshold set by the IRS. Additionally, the form is typically applicable to individuals who receive income from sources such as pensions, dividends, or interest. It is important to review IRS guidelines to confirm eligibility and ensure that the form is used correctly.

Form Submission Methods (Online / Mail / In-Person)

The Form No 15h can be submitted through various methods, depending on the payer's requirements. Common submission methods include:

- Online: Some payers may allow electronic submission through their platforms.

- Mail: Print the completed form and send it via postal service to the payer's designated address.

- In-Person: Deliver the form directly to the payer's office, if applicable.

Quick guide on how to complete form no 15h see rule 29c 1a

Complete Form No 15h See Rule 29c 1a effortlessly on any device

Digital document management has gained traction among companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, enabling you to find the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without interruptions. Manage Form No 15h See Rule 29c 1a on any device with the airSlate SignNow apps for Android or iOS and streamline any document-related task today.

The easiest way to edit and eSign Form No 15h See Rule 29c 1a with minimal effort

- Locate Form No 15h See Rule 29c 1a and click on Get Form to begin.

- Utilize the tools provided to finish your form.

- Emphasize relevant parts of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for submitting your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors requiring new printed copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you choose. Edit and eSign Form No 15h See Rule 29c 1a and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form no 15h see rule 29c 1a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form no 15h see rule 29c 1a?

Form no 15h see rule 29c 1a is a declaration by an individual for non-deduction of tax at source on interest income under specified conditions. It is often used by taxpayers to avoid unnecessary tax deductions when their income is below the taxable limit. Understanding this form is essential for efficient financial management and compliance.

-

How can airSlate SignNow facilitate the use of form no 15h see rule 29c 1a?

With airSlate SignNow, you can easily create, send, and electronically sign your form no 15h see rule 29c 1a documents. Our platform allows for quick modifications and retrieval of this form to ensure timely submissions. This user-friendly solution enhances efficiency and reduces paperwork.

-

Are there any costs associated with using airSlate SignNow for form no 15h see rule 29c 1a?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs when handling documents like form no 15h see rule 29c 1a. These plans are designed to be cost-effective, ensuring that all users can access essential eSigning features without overspending. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing form no 15h see rule 29c 1a?

airSlate SignNow provides features such as custom templates, secure eSigning, document tracking, and collaboration tools for managing form no 15h see rule 29c 1a. These features simplify the process of document management and ensure compliance with tax regulations. Users can streamline their workflow and save valuable time.

-

Can I integrate airSlate SignNow with other tools for form no 15h see rule 29c 1a?

Absolutely, airSlate SignNow supports integrations with various tools and services to enhance the workflow for documents like form no 15h see rule 29c 1a. This includes popular CRMs, storage services, and other business applications. Integrating these tools allows for a seamless experience without disrupting existing processes.

-

What are the benefits of using airSlate SignNow for form no 15h see rule 29c 1a submissions?

The benefits of using airSlate SignNow for form no 15h see rule 29c 1a include increased efficiency, reduced paper waste, and improved compliance. Users can quickly prepare and send their declarations for non-deduction of tax without the hassle of traditional methods. This leads to faster processing times and a more organized approach to tax management.

-

Is airSlate SignNow secure for handling sensitive information like form no 15h see rule 29c 1a?

Yes, airSlate SignNow prioritizes security and uses advanced encryption methods to protect sensitive information, including form no 15h see rule 29c 1a. All documents are securely stored and can only be accessed by authorized users. This commitment to security ensures that your data remains confidential and protected.

Get more for Form No 15h See Rule 29c 1a

Find out other Form No 15h See Rule 29c 1a

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT