St108nr 2014

What is the St108nr

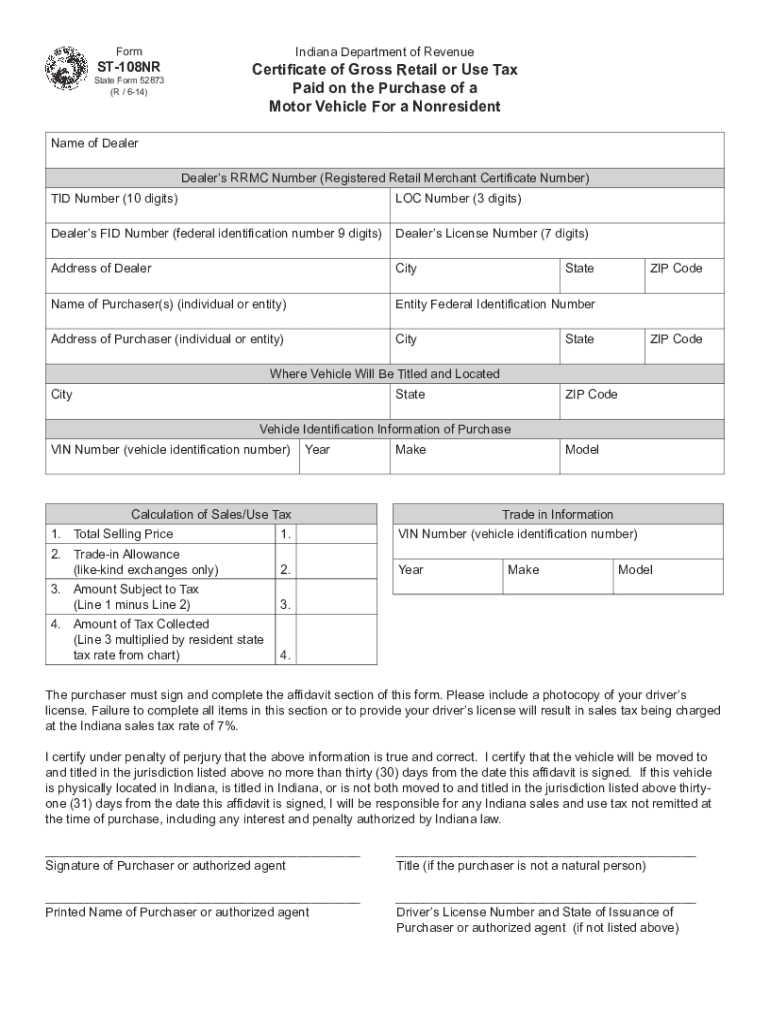

The St108nr is a specific form used in Indiana for reporting sales tax exemptions. It allows businesses to claim exemptions on certain purchases made for resale or other qualifying purposes. Understanding the purpose and requirements of the St108nr is essential for businesses aiming to comply with Indiana tax regulations while maximizing their financial efficiency.

How to use the St108nr

To effectively use the St108nr, businesses must first ensure they qualify for the exemptions outlined in the form. The process involves accurately completing the form with the necessary information, including the purchaser's details, the seller's information, and a description of the items being purchased. It is crucial to retain a copy of the completed form for record-keeping and compliance purposes.

Steps to complete the St108nr

Completing the St108nr involves several straightforward steps:

- Gather necessary information, including business identification and details of the purchase.

- Fill out the St108nr form, ensuring all fields are accurately completed.

- Review the form for any errors or omissions.

- Submit the form to the appropriate seller to validate the exemption.

Legal use of the St108nr

The legal use of the St108nr is governed by Indiana state tax laws. Businesses must ensure that they are using the form in accordance with the regulations to avoid penalties. The form must be presented to sellers at the time of purchase to qualify for the tax exemption, and it should only be used for eligible transactions as defined by state law.

Key elements of the St108nr

Key elements of the St108nr include:

- Purchaser Information: Details about the business or individual claiming the exemption.

- Seller Information: The name and address of the seller providing the goods or services.

- Description of Items: A clear description of the items being purchased under the exemption.

- Signature: The form must be signed by an authorized representative of the purchaser.

Who Issues the Form

The St108nr form is issued by the Indiana Department of Revenue. It is essential for businesses to obtain the most current version of the form directly from the department to ensure compliance with any updates or changes in tax law.

Quick guide on how to complete st108nr

Complete St108nr effortlessly on any device

Web-based document management has gained popularity among organizations and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, enabling you to acquire the correct format and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage St108nr on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign St108nr seamlessly

- Locate St108nr and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign feature, which only takes seconds and possesses the same legal validity as a conventional ink signature.

- Verify the details and then click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about missing or lost files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign St108nr and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct st108nr

Create this form in 5 minutes!

How to create an eSignature for the st108nr

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is st108nr and how does it work with airSlate SignNow?

The st108nr is a specific document type that can be efficiently managed using airSlate SignNow. Our platform allows you to create, send, and eSign the st108nr quickly, ensuring that your documents are signed securely and efficiently.

-

What are the pricing options for using airSlate SignNow for st108nr?

airSlate SignNow offers flexible pricing plans that cater to different business needs when managing st108nr documents. You can choose from options that fit small teams to larger enterprises, allowing you to pay only for the features you need.

-

What features does airSlate SignNow offer for managing st108nr documents?

With airSlate SignNow, you can take advantage of features like templates, customizable workflows, and real-time collaboration specifically for st108nr documents. These tools streamline the signing process, making document management more efficient.

-

How does airSlate SignNow ensure the security of st108nr documents?

Security is a top priority at airSlate SignNow, especially for sensitive documents like st108nr. We implement advanced encryption standards and ensure all data is stored securely to protect your information throughout the signing process.

-

Can I integrate airSlate SignNow with other tools for st108nr management?

Yes, airSlate SignNow integrates seamlessly with a variety of third-party apps to enhance the management of st108nr documents. Whether it's CRM systems or cloud storage solutions, our integrations ensure a smooth workflow.

-

What are the benefits of using airSlate SignNow for st108nr?

Using airSlate SignNow for st108nr brings multiple benefits, including improved efficiency, reduced paper usage, and faster turnaround times on document signing. Our user-friendly interface ensures that clients can easily manage their documents.

-

Is there a mobile app for managing st108nr documents with airSlate SignNow?

Yes, airSlate SignNow provides a mobile app that allows users to manage and eSign st108nr documents on the go. This flexibility enables you to handle your business needs anywhere and anytime, ensuring you never miss a crucial signing opportunity.

Get more for St108nr

- Buy sell agreement package rhode island form

- Option to purchase package rhode island form

- Amendment of lease package rhode island form

- Annual financial checkup package rhode island form

- Rhode island bill sale form

- Living wills and health care package rhode island form

- Last will and testament package rhode island form

- Subcontractors package rhode island form

Find out other St108nr

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT