Nc Employers Quarterly Tax and Wage Report Form

What is the Nc Employers Quarterly Tax And Wage Report

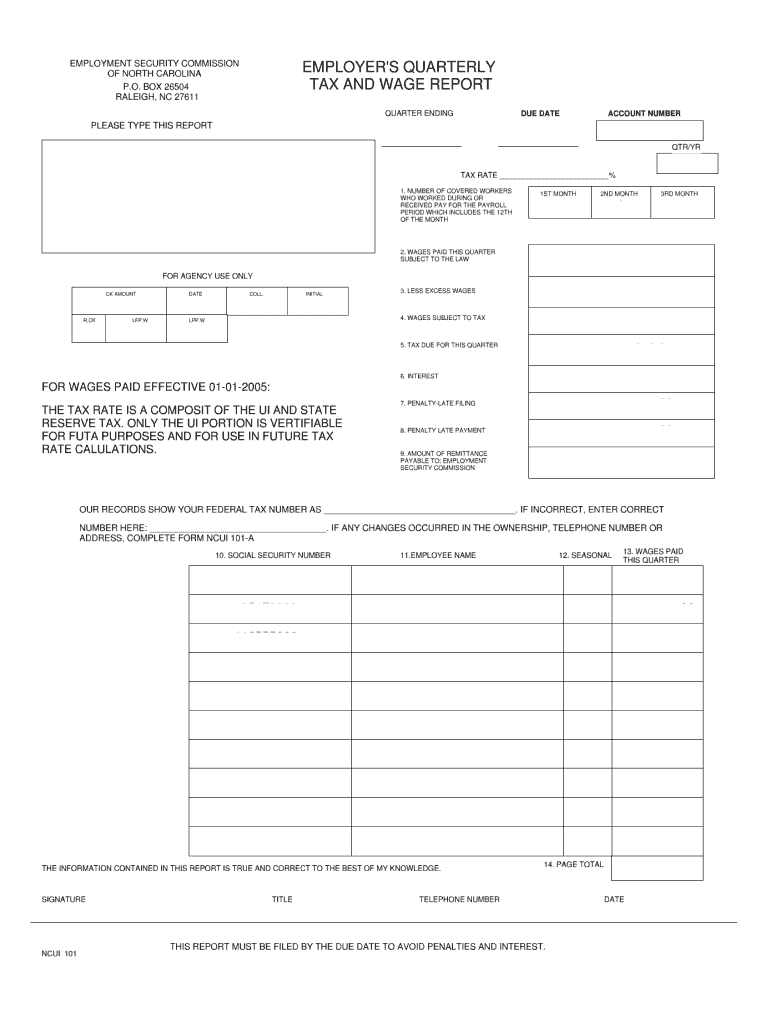

The Nc Employers Quarterly Tax And Wage Report, commonly referred to as the NCUI 101, is a crucial document for employers in North Carolina. This form is used to report wages paid to employees and the corresponding unemployment insurance taxes withheld during each quarter. Accurate completion of this form is essential for maintaining compliance with state regulations and ensuring that unemployment benefits are properly funded.

Steps to complete the Nc Employers Quarterly Tax And Wage Report

Completing the NCUI 101 involves several key steps to ensure accuracy and compliance:

- Gather necessary information, including employee wages, hours worked, and any deductions.

- Access the NCUI 101 form through the appropriate state resources or platforms.

- Fill out the form, ensuring all sections are completed accurately, including employer information and employee wage details.

- Review the completed form for any errors or omissions before submission.

- Submit the form by the designated deadline, either electronically or by mail.

Legal use of the Nc Employers Quarterly Tax And Wage Report

The NCUI 101 is legally binding and must be completed in accordance with North Carolina state laws. Employers are required to submit this form quarterly to report wages and taxes accurately. Failure to comply with submission requirements can result in penalties, including fines and potential legal action. It is important for employers to understand their obligations under the law to avoid any issues related to unemployment insurance compliance.

Form Submission Methods (Online / Mail / In-Person)

Employers have multiple options for submitting the NCUI 101. The form can be submitted online through the North Carolina Division of Employment Security's website, which is the most efficient method. Alternatively, employers can mail the completed form to the designated address provided by the state. In-person submissions may also be possible at local employment offices, though this method is less common. Each submission method has its own requirements and deadlines, so employers should choose the one that best fits their needs.

Filing Deadlines / Important Dates

Timely submission of the NCUI 101 is critical. Employers must file the form by the last day of the month following the end of each quarter. This means that for the first quarter (January to March), the deadline is April 30; for the second quarter (April to June), it is July 31; for the third quarter (July to September), it is October 31; and for the fourth quarter (October to December), it is January 31 of the following year. Missing these deadlines can result in penalties and interest charges.

Key elements of the Nc Employers Quarterly Tax And Wage Report

Several key elements must be included in the NCUI 101 to ensure its validity:

- Employer identification information, including name, address, and unemployment insurance account number.

- Total wages paid to employees during the reporting period.

- Number of employees covered by the report.

- Amount of unemployment insurance tax withheld.

- Signature of the employer or authorized representative, certifying the accuracy of the information provided.

Quick guide on how to complete nc employers quarterly tax and wage report form

Complete Nc Employers Quarterly Tax And Wage Report seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the right form and securely save it online. airSlate SignNow equips you with everything necessary to create, modify, and electronically sign your documents quickly and without interruptions. Manage Nc Employers Quarterly Tax And Wage Report on any device with airSlate SignNow apps for Android or iOS and simplify any document-related task today.

The easiest way to adjust and electronically sign Nc Employers Quarterly Tax And Wage Report effortlessly

- Find Nc Employers Quarterly Tax And Wage Report and click on Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools designated by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign feature, which takes mere seconds and holds the same legal significance as a physical ink signature.

- Review the information and hit the Done button to save your changes.

- Select how you wish to send your form: via email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Nc Employers Quarterly Tax And Wage Report to ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

What tax forms do I need to fill out for reporting bitcoin gains and loses?

IRS1040 and 1099 forms.“For instance, there is no long-term capital gains tax to pay if you are in the lower two tax brackets (less than $36,900 single income or less than $73,800 married income). The capital gains rate is only 15% for other tax brackets (less than $405,100 single income) with 20% for the final bracket.”Reference: Filing Bitcoin Taxes Capital Gains Losses 1040 Schedule DOther References:IRS Virtual Currency Guidance : Virtual Currency Is Treated as Property for U.S. Federal Tax Purposes; General Rules for Property Transactions ApplyHow do I report taxes?Filing Bitcoin Taxes Capital Gains Losses 1040 Schedule Dhttps://www.irs.gov/pub/irs-drop...

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

As an employer, what legal and tax forms am I required to have a new employee to fill out?

I-9, W-4, state W-4, and some sort of state new hire form. The New hire form is for dead beat parents. Don’t inform the state in time and guess what? You become personally liable for what should have been garnished from their wages.From the sound of your question I infer that you are trying to make this a DIY project. DO NOT. There are just too many things that you can F up. Seek yea a CPA or at least a payroll service YESTERDAY.

-

I started teaching piano lessons this year, how do I pay quarterly taxes in California? What form should I fill out?

Go to https://www.irs.gov/pub/irs-pdf/... You will file a form 1040ES each quarter. The website will tell you the due dates for each quarterly payment. Get a similar form from your state tax board website if you pay state taxes.Note: If this is your first year filing, ever, then you can get away without sending in estimated payments because you owe the LESSER of what you owe this year or last year. Having been self-employed most of my life, I always filed quarterly estimated taxes, using the amount I had owed the year before, because I had to to avoid fines, and because I didn't want to get to April of the next year and not have the money. As for the amount you should pay to the IRS and your state, you might be able to figure this out using worksheets available on the IRS and state websites. If you chose to deal in cash and not report it, that's your business. Your students are not going to send you a 1099 at the end of the year. But if you teach at an institution which pays you more than a few thousand dollars a year, they WILL file a 1099 stating how much they paid you in miscellaneous income, with the IRS and state.

-

How can my employer charge me taxes when I didn't fill out any form (like W2, W4, or W9)?

**UPDATE** After my answer was viewed over 4,100 times without a single upvote, I revisited it to see where I might have gone wrong with it. Honestly, it seems like a reasonable answer: I explained what each of the forms asked about is for and even suggested getting further information from a licensed tax preparer. BUT, I’m thinking I missed the underlying concern of the querent with my answer. Now I’m reading that they don’t care so much about the forms as they do about the right or, more accurately, the obligation of their employer to withhold taxes at all.So let me revise my answer a bit…Your employer doesn’t charge you taxes - the government does. The government forces employers to withhold (or charge, as you put it) taxes from the earnings of their employees by threatening fines and even jail time for failing to do so (or for reclassifying them as independent contractors in order to avoid the withholding and matching requirements). Whether you fill out any forms or not, employers will withhold taxes because they don’t want to be fined or go to jail.Now the meta-question in the question is how can the government tax its citizen’s income? Well, that’s a big debate in America. Tax is the only way governments make money and they use that money to provide services for their constituency. Without funding, no federal or state or county program, or employee, would exist. But still, some people believe taxation is illegal, unjustified, and flat out wrong. They believe that free market forces should fund the military, the Coast Guard, Department of Defense, Veterans Affairs, Border Patrol, the FBI, CIA, DEA, FDA, USDA, USPS, the Federal Prison Complex, the National Park Service, the Interstate Highway System, air traffic control, and the Judiciary (just to name a few things). They even believe paying politicians for the work they do, like the President and Congress, is wrong.Others (luckily, most of us) appreciate paying taxes, even if they seem a bit steep at times. We’re happy to benefit from all the things our tax dollars buy us and we feel what we pay gives us back returns far greater than our investment. If you’re on the fence about this issue, consider how expensive health care is and how much you’re getting out of paying for it privately (out of your own paycheck). Same with your education or that of your children. Do you pay for private schools? Private colleges? Do you pay for private child care too? All expensive, right?Well what if we had to pay for private fire fighting? Or all mail had to be shipped via FedEx or UPS? Or if the cost of a plane ticket to anywhere doubled because we had to pay out-of-pocket for air traffic control? What about the military, border control and veterans? How much are you willing to pay out of every paycheck DIRECTLY to the department of defense AND veterans affairs? If we privatized the military, would we still be able to afford $30 billion dollar fighter jets? Who would pay to defend us?I bet people living paycheck to paycheck would be hard pressed to find extra money to pay for the military, when they’re already spending so much for teachers, schools, health care, local emergency response, food safety inspections, social workers, the criminal justice system, road repairs and construction, bridge inspection and maintenance, and natural disaster remediation (just to name a few things).Think about if all the national and local parks were privatized. Visiting one would cost as much or more than it does to go to Disneyland. Think about how much more food would cost if farmers weren’t subsidized and food wasn’t inspected for safety. Imagine how devastating a pandemic would be without the Center for Disease Control to monitor and mitigate illness outbreaks.We all take for granted the myriad of benefits we get from paying taxes. We may like to gripe and moan but taxes aren’t just for the public good, they’re for our own. (That rhymes!)**END OF UPDATE**W-9 forms are what you fill out to verify your identification, or citizenship status, for your employers. They have nothing to do with payroll taxes other than being the primary tool to from which to glean the correct spelling of your name and your Social Security number.W-2 forms are issued by employers to employees for whom they paid the required payroll taxes to the government on their behalf. The W-2 also details the amount of a person’s pay was sent to the government to fund their Social Security and Medicare accounts. W-2 forms are necessary for people when filing their personal income taxes so they can calculate if they under or overpaid.W-4 forms are filled out by employees to assure that the appropriate amount of pay is being withheld (and transferred on their behalf) by their employers to the government. If you don’t fill out a W-4 then your employer withholds the standard default amount for a single individual. You can update your W-4 at any time with your employer and you may want to when the size of your household changes.Even if you aren’t an employee (like you get paid without taxes being withheld for you) and are issued a 1099-MISC form instead of a W-2, you’re STILL responsible for paying your taxes as you earn that money - in no greater than quarterly installments. If you go over three months without paying taxes when you’re making money - whether your employer is withholding it and paying it on your behalf or you just made the money and no one took any taxes out for you - you’ll be fined and charged interest on your late tax payments.Talk with a licensed tax preparer and they can help you better understand what it all means. Good luck and happy tax season!

-

Do you have to fill out form 1099 (for tax reporting) if you send over $600 in bitcoin to company for a product?

Among the numerous tax forms, the IRS will be expecting you to fill out a 1099-MISC form in two cases:you made payments to freelancers or independent contractors for business-related services totaling at least $600 within the year;or you paid minimum $10 in royalties or broker payments in lieu of dividends or tax-exempt interest.However, if you made any payments for personal or household services, there is no need to submit a 1099-MISC form.This site has a lot of information about it - http://bit.ly/2Nkf48f

-

For taxes, does one have to fill out a federal IRS form and a state IRS form?

No, taxes are handled separately between state and federal governments in the United States.The IRS (Internal Revenue Service) is a federal, not state agency.You will be required to fill out the the necessary tax documentation for your federal income annually and submit them to the IRS by April 15th of that year. You can receive extensions for this; but you have to apply for those extensions.As far as state taxes go, 41 states require you to fill out an income tax return annually. They can either mail you those forms or they be downloaded from online. They are also available for free at various locations around the state.Nine states have no tax on personal income, so there is no need to fill out a state tax return unless you are a business owner.Reference:www.irs.gov

Create this form in 5 minutes!

How to create an eSignature for the nc employers quarterly tax and wage report form

How to make an electronic signature for your Nc Employers Quarterly Tax And Wage Report Form online

How to create an electronic signature for your Nc Employers Quarterly Tax And Wage Report Form in Chrome

How to create an electronic signature for putting it on the Nc Employers Quarterly Tax And Wage Report Form in Gmail

How to generate an eSignature for the Nc Employers Quarterly Tax And Wage Report Form from your smart phone

How to generate an eSignature for the Nc Employers Quarterly Tax And Wage Report Form on iOS

How to make an eSignature for the Nc Employers Quarterly Tax And Wage Report Form on Android OS

People also ask

-

What is the nc quarterly tax and wage report?

The nc quarterly tax and wage report is a document that businesses in North Carolina must file quarterly to report taxes and wages paid to employees. This report ensures compliance with state tax requirements and helps maintain accurate records of employee earnings.

-

How does airSlate SignNow assist with the nc quarterly tax and wage report?

airSlate SignNow streamlines the process of creating, signing, and submitting the nc quarterly tax and wage report. Our platform enables you to complete these documents electronically, saving time and ensuring compliance with tax regulations.

-

Are there any costs associated with using airSlate SignNow for the nc quarterly tax and wage report?

airSlate SignNow offers various pricing plans tailored for businesses of all sizes. With our cost-effective solutions, you can prepare, sign, and manage the nc quarterly tax and wage report without breaking your budget.

-

What features does airSlate SignNow provide for managing the nc quarterly tax and wage report?

Our platform provides robust features like document templates, e-signature capabilities, and automated workflows. These features simplify the preparation and submission of the nc quarterly tax and wage report, making it faster and more efficient.

-

Can I integrate airSlate SignNow with my existing accounting software when handling the nc quarterly tax and wage report?

Yes, airSlate SignNow offers integrations with various accounting and payroll software. This allows you to seamlessly manage your nc quarterly tax and wage report alongside your other financial documents and processes.

-

What benefits does airSlate SignNow offer for small businesses filing the nc quarterly tax and wage report?

For small businesses, airSlate SignNow provides an easy-to-use platform that minimizes paperwork and reduces errors when filing the nc quarterly tax and wage report. By automating the process, you can focus on what matters most—growing your business.

-

Is airSlate SignNow compliant with North Carolina tax regulations for the nc quarterly tax and wage report?

Absolutely! airSlate SignNow stays up to date with North Carolina's tax regulations, ensuring that your nc quarterly tax and wage report meets all compliance requirements. Our platform helps you avoid penalties and maintain accurate records.

Get more for Nc Employers Quarterly Tax And Wage Report

Find out other Nc Employers Quarterly Tax And Wage Report

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online