Section 568 Final K 1 Form

What is the Section 568 Final K 1 Form

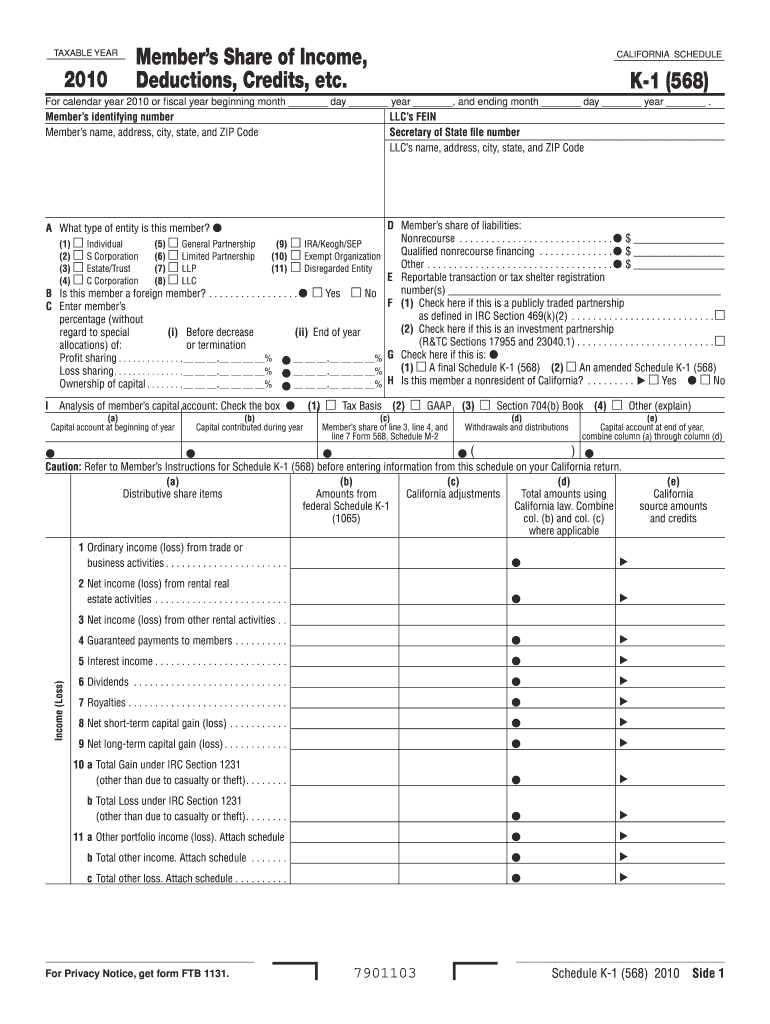

The Section 568 Final K-1 form is a tax document used primarily in the United States for reporting income, deductions, and credits from partnerships and limited liability companies (LLCs). This form is essential for individuals who are partners in a business entity that is classified as a partnership or an LLC. The information provided on the K-1 helps partners report their share of the entity's income on their personal tax returns. It is a crucial component of the tax filing process, ensuring that all income and deductions are accurately reported to the IRS.

How to use the Section 568 Final K 1 Form

Using the Section 568 Final K-1 form involves several steps. First, partners must receive their individual K-1 from the partnership or LLC. This document outlines each partner's share of the entity's income, losses, and other tax-related items. Once received, partners should review the information for accuracy and then use it to complete their personal tax returns. The data from the K-1 is typically reported on IRS Form 1040, Schedule E, which is used for supplemental income and loss. It is important for partners to keep a copy of the K-1 for their records, as it may be needed for future reference or audits.

Steps to complete the Section 568 Final K 1 Form

Completing the Section 568 Final K-1 form requires careful attention to detail. Here are the steps involved:

- Obtain the K-1 from the partnership or LLC, ensuring all necessary information is included.

- Verify the accuracy of the reported income, deductions, and credits.

- Fill out your personal tax return using the information from the K-1, particularly on Schedule E of Form 1040.

- Double-check for any discrepancies and ensure all calculations are correct.

- File your tax return by the deadline, including the K-1 information.

Legal use of the Section 568 Final K 1 Form

The legal use of the Section 568 Final K-1 form is governed by IRS regulations. This form must be completed accurately to reflect each partner's share of the entity's income and deductions. Failure to report this information correctly can lead to penalties or audits by the IRS. It is important for partnerships and LLCs to issue K-1s to all partners in a timely manner, as this ensures compliance with tax laws and provides partners with the necessary information to fulfill their tax obligations.

Key elements of the Section 568 Final K 1 Form

Key elements of the Section 568 Final K-1 form include:

- Partner's name and address

- Partnership's name and tax identification number

- Partner's share of income, deductions, and credits

- Information regarding the partner's capital account

- Any other relevant tax information that may affect the partner's tax return

Filing Deadlines / Important Dates

Filing deadlines for the Section 568 Final K-1 form are critical for compliance. Generally, partnerships and LLCs must provide K-1s to their partners by March 15 for the previous tax year. Partners must then use this information to file their personal tax returns by April 15. It is essential for all parties involved to adhere to these deadlines to avoid penalties and ensure accurate reporting of income and deductions.

Quick guide on how to complete section 568 final k 1 form

Manage Section 568 Final K 1 Form effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed paperwork, allowing you to find the right form and securely keep it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents quickly without delays. Handle Section 568 Final K 1 Form on any device using airSlate SignNow's Android or iOS apps and simplify any document-related task today.

How to modify and eSign Section 568 Final K 1 Form easily

- Obtain Section 568 Final K 1 Form and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of the documents or obscure sensitive information with features that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you wish to send your form—by email, SMS, or invite link, or download it to your PC.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your preference. Modify and eSign Section 568 Final K 1 Form and guarantee outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Are final year students eligible to fill out the Railway Recruitment Board (RRB) Senior Section Engineer form?

you have to complete your Degree first to give Railway Recruitment Board (RRB) Senior Section Engineer Exam.As the Indian Railways is one known to be as one of the biggest employers in India. It releases it a high number of vacancies every year for a various number of fields. One amongst them is the RRB Senior Section Engineer.Eligibility CriteriaMust be in age between 20-34 years.Educational Qualification RequiredDegree in Civil Engineering from a recognized university or Institution.For more information you can also read here, RRB Recruitment Notification, Jobs, ExamsCheck Here, RRB(Railway Recruitment Board) latest Notification.

-

What will be the appropriate section to choose while filling out the ITR 1 form online?

Please find details of return filed under sectionSection 139(1) – Original return filed before the last due date for filing returnOriginal returnfiling for the first time in an assessment yearSection 139(4) – Belated returnOriginal returnFiling for the first time after the due date of filing the return for the assessment yearSection 139(5) – Revised returnRevised return filed subsequent to original returnThis will be revised returnVoluntarily filing the revised returnInfo needed is:Acknowledgement numberdate of filing originalSection 139(9) – Defective returnWhen due to an error, the return is considered as defective (as if no return has been filed)The department may issue notice to correct the errors and file the returnSo the return filed subsequent to the intimation u/s 139(9) will be original returnYou have to provide following info while filing the return in response to noticeReceipt No: i.e Acknowledgement number of Original (Defective in this case) returnDate of filing the original (Defective in this case) returnNotice no. (Eg. CPC/1415/G5/1421417689)Date of NoticeSection 142(1) – Notice to assessee for filing the returnWhen a person has not filed the return, he may receive notice u/s 142(1) asking him to file the returnThis will be the original returnYou need to mention the notice date only while filing the return subsequent to the notice u/s 142(1)Section 148 – Issue of notice for reassessment (Income escaping assessment)Department can issue a notice to a person for filing the income tax return u/s 148This will be the original returnYou need to mention the notice date only while filing the return subsequent to the notice u/s 148Section 153A – Fresh assessment pursuance of an orderDepartment can issue a notice u/s 153A to a person for filing the income tax returnThis will be the original returnYou need to mention the notice date only while filing the return subsequent to the notice u/s 153ASection 153C – Fresh assessment pursuance of an orderDepartment can issue a notice u/s 153C to a person for filing the income tax returnThis will be the original returnYou need to mention the notice date only while filing the return subsequent to the notice u/s 153CBe Peaceful !!!

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

Can a final year student of B.Tech fill the form of SSC SI CAPF?

Yes, if your final semester result is declared on or before 1 august 2018.

Create this form in 5 minutes!

How to create an eSignature for the section 568 final k 1 form

How to make an eSignature for the Section 568 Final K 1 Form in the online mode

How to generate an electronic signature for your Section 568 Final K 1 Form in Google Chrome

How to create an electronic signature for signing the Section 568 Final K 1 Form in Gmail

How to make an eSignature for the Section 568 Final K 1 Form right from your mobile device

How to make an electronic signature for the Section 568 Final K 1 Form on iOS

How to make an electronic signature for the Section 568 Final K 1 Form on Android devices

People also ask

-

What is the Section 568 Final K 1 Form and why is it important?

The Section 568 Final K 1 Form is a critical tax document used by partnerships to report income, deductions, and credits allocated to partners. It is essential for ensuring accurate tax reporting and compliance with the IRS. By utilizing airSlate SignNow, businesses can streamline the signing and distribution of the Section 568 Final K 1 Form, making tax season much more manageable.

-

How can airSlate SignNow help me with the Section 568 Final K 1 Form?

airSlate SignNow simplifies the process of preparing and signing the Section 568 Final K 1 Form by providing an intuitive platform for eSigning. This allows you to quickly gather signatures from partners and ensure that the form is submitted on time. Moreover, our solution offers secure storage and easy access to all your important documents.

-

Is there a cost associated with using airSlate SignNow for the Section 568 Final K 1 Form?

Yes, there is a cost associated with using airSlate SignNow, but our pricing plans are designed to be cost-effective for businesses of all sizes. We offer various subscription options that can accommodate your needs, ensuring you get the best value for managing documents like the Section 568 Final K 1 Form. You can explore our pricing page for detailed information.

-

What features does airSlate SignNow offer for managing the Section 568 Final K 1 Form?

airSlate SignNow provides several features specifically beneficial for managing the Section 568 Final K 1 Form, such as customizable templates, real-time tracking of document status, and secure electronic signatures. These features enhance efficiency and ensure that your documents are completed accurately and promptly. Plus, our user-friendly interface makes it easy to navigate.

-

Can I integrate airSlate SignNow with other software for the Section 568 Final K 1 Form?

Absolutely! airSlate SignNow offers integrations with various accounting and document management software, making it easy to incorporate the Section 568 Final K 1 Form into your existing workflows. This seamless integration allows for a more efficient process when preparing and submitting your tax documents.

-

What benefits do I gain by using airSlate SignNow for the Section 568 Final K 1 Form?

Using airSlate SignNow for the Section 568 Final K 1 Form provides numerous benefits, including time savings, enhanced compliance, and improved collaboration among partners. Our platform ensures that your documents are securely signed and stored, reducing the risk of errors and delays. This ultimately leads to a smoother tax filing process.

-

How secure is airSlate SignNow when handling the Section 568 Final K 1 Form?

Security is a top priority at airSlate SignNow. We utilize advanced encryption technologies and comply with industry standards to protect sensitive information, including the Section 568 Final K 1 Form. You can rest assured that your documents are safe and accessible only to authorized users.

Get more for Section 568 Final K 1 Form

- Seasonal lawn care contract form

- Georgia death certificate pdf form

- Cct102 form

- Argumentation keeping faith with reason pdf link no no download needed needed form

- Amino acid worksheet form

- Form t1236 fillable

- Docslib orgdoc9174077state of south dakota in the circuit court ss county of form

- Marketing statement of work template form

Find out other Section 568 Final K 1 Form

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement