Deductions Withholding Form

Understanding Deductions Withholding

Deductions withholding refers to the amount of money that an employer withholds from an employee's paycheck for various tax obligations. This includes federal income tax, state income tax, Social Security, and Medicare taxes. The purpose of withholding is to ensure that employees pay their tax liabilities gradually throughout the year, rather than in a lump sum at tax time. Understanding how deductions work is essential for managing personal finances and ensuring compliance with tax regulations.

Steps to Complete the Deductions Withholding

Completing the deductions withholding process involves several key steps:

- Gather necessary information, including your Social Security number and filing status.

- Obtain the appropriate withholding form, such as the W-4, which allows you to specify your withholding preferences.

- Fill out the form accurately, indicating the number of allowances you are claiming and any additional amounts you want withheld.

- Submit the completed form to your employer's payroll department for processing.

- Review your pay stubs regularly to ensure that the correct amounts are being withheld.

IRS Guidelines for Deductions Withholding

The Internal Revenue Service (IRS) provides specific guidelines regarding deductions withholding to ensure compliance with federal tax laws. Employers are required to withhold a certain percentage of an employee's earnings based on the information provided on the withholding form. The IRS updates its withholding tables periodically, so it is important for both employers and employees to stay informed about any changes that may affect their tax obligations. Employees can use the IRS withholding calculator to determine if their current withholding is appropriate based on their personal tax situation.

Required Documents for Deductions Withholding

To complete the deductions withholding process, several documents may be required:

- W-4 form: This form is essential for indicating your withholding preferences.

- Social Security card: Required for verifying your identity.

- Pay stubs: Useful for tracking your withholding amounts and ensuring accuracy.

- Previous tax returns: Helpful for understanding your tax situation and making informed decisions about withholding.

Penalties for Non-Compliance with Deductions Withholding

Failure to comply with deductions withholding regulations can result in significant penalties for both employers and employees. Employers who do not withhold the correct amounts may face fines and interest on unpaid taxes. Employees who underpay their taxes due to insufficient withholding may incur penalties when filing their tax returns. It is crucial to regularly review and adjust withholding amounts to avoid potential issues with the IRS.

Eligibility Criteria for Deductions Withholding

Eligibility for deductions withholding generally applies to all employees who receive wages or salaries from an employer. However, specific criteria may vary based on factors such as employment status, income level, and filing status. Employees who are self-employed or have multiple sources of income may need to consider additional factors when determining their withholding amounts. It is advisable to consult with a tax professional if there are uncertainties regarding eligibility or withholding requirements.

Quick guide on how to complete deductions withholding

Effortlessly prepare Deductions Withholding on any device

Digital document management has become favored by businesses and individuals alike. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to easily locate the necessary form and securely keep it online. airSlate SignNow provides all the resources you require to create, modify, and electronically sign your documents promptly without delays. Manage Deductions Withholding on any device using the airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to modify and electronically sign Deductions Withholding with ease

- Locate Deductions Withholding and then click Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as an old-fashioned handwritten signature.

- Review all the details and then press the Done button to preserve your changes.

- Choose how you wish to send your form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Deductions Withholding to ensure exceptional communication throughout every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the deductions withholding

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

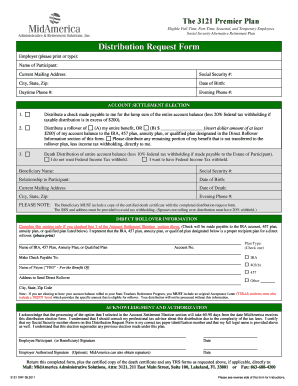

What is the 3121 distribution election form mid america?

The 3121 distribution election form mid america is a crucial document that allows employees to elect how they would like to receive their retirement benefits after leaving employment. Accurately completing this form ensures that your retirement funds are managed according to your preferences. It is essential for all employees considering their retirement options.

-

How can I complete the 3121 distribution election form mid america online?

You can easily complete the 3121 distribution election form mid america online using airSlate SignNow’s user-friendly interface. Simply upload the form, fill in your details, and eSign it to ensure a secure and efficient process. This digital solution eliminates the need for paper forms and enhances your experience for filing retirement documents.

-

Is there a fee to use airSlate SignNow for the 3121 distribution election form mid america?

airSlate SignNow offers competitive pricing plans that include access to essential features for completing the 3121 distribution election form mid america. There are different subscription options available, allowing you to choose a plan that best fits your needs and budget. You can start with a free trial to explore the features without any costs.

-

What features does airSlate SignNow offer for the 3121 distribution election form mid america?

airSlate SignNow provides a range of features for the 3121 distribution election form mid america, including customizable templates, secure eSigning, and document storage. Additionally, you can track the status of your documents in real-time, ensuring that the process is smooth and efficient. These features help streamline your workflow and enhance productivity.

-

How does airSlate SignNow ensure security for the 3121 distribution election form mid america?

Security is a top priority for airSlate SignNow, especially when handling sensitive documents like the 3121 distribution election form mid america. The platform employs industry-standard encryption and compliance measures to protect your data. Additionally, authentication features prevent unauthorized access, providing you with peace of mind when submitting important forms.

-

Can I integrate airSlate SignNow with other platforms for the 3121 distribution election form mid america?

Yes, airSlate SignNow can seamlessly integrate with various other platforms, enhancing your ability to manage the 3121 distribution election form mid america. These integrations with CRM systems, cloud storage, and other applications streamline your workflow and enhance the overall efficiency. This feature reduces time spent on document management and enables you to work more effectively.

-

What are the benefits of using airSlate SignNow for the 3121 distribution election form mid america?

Using airSlate SignNow for the 3121 distribution election form mid america provides numerous benefits, including speed, efficiency, and ease of use. The electronic signature process accelerates document turnaround times, and the straightforward interface makes it simple for users of all tech levels. Its cost-effective nature allows businesses to save time and resources while ensuring compliance with retirement document regulations.

Get more for Deductions Withholding

Find out other Deductions Withholding

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors