Formulario 1040 En Espa Ol PDF

What is the Formulario 1040 En Español Pdf

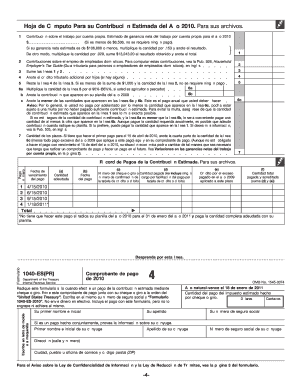

The Formulario 1040 en español is the Spanish version of the U.S. Individual Income Tax Return, used by taxpayers to report their annual income to the Internal Revenue Service (IRS). This form is essential for individuals who need to file their taxes in Spanish, ensuring that language barriers do not hinder compliance with tax laws. The formulario 1040 en español 2020 pdf includes various sections where taxpayers can detail their income, deductions, and credits, ultimately determining their tax liability or refund.

How to use the Formulario 1040 En Español Pdf

Using the Formulario 1040 en español pdf is straightforward. Taxpayers can download the form from the IRS website or other authorized sources. Once downloaded, users can fill out the form electronically or print it for manual completion. It is crucial to follow the instructions provided in the form carefully, as they guide users through each section. After filling out the form, taxpayers can submit it either electronically or by mailing it to the appropriate IRS address.

Steps to complete the Formulario 1040 En Español Pdf

Completing the Formulario 1040 en español involves several key steps:

- Gather necessary documents: Collect all relevant financial documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information: Enter your name, address, and Social Security number at the top of the form.

- Report income: Complete the income section by listing all sources of income, including wages, dividends, and self-employment income.

- Claim deductions: Identify and claim any eligible deductions to reduce taxable income.

- Calculate tax liability: Use the tax tables provided to determine the amount of tax owed or refund due.

- Sign and date the form: Ensure that you sign the form, as an unsigned return is considered invalid.

Legal use of the Formulario 1040 En Español Pdf

The Formulario 1040 en español is legally binding when completed and submitted according to IRS regulations. To ensure its legality, taxpayers must follow the guidelines set forth by the IRS, including accurate reporting of income and deductions. Additionally, electronic signatures are accepted, provided they comply with the eSignature laws, such as the ESIGN Act and UETA. This ensures that the form holds the same legal weight as a paper submission.

Filing Deadlines / Important Dates

Filing deadlines for the Formulario 1040 en español align with standard tax deadlines in the United States. Typically, individual tax returns must be filed by April 15 of each year. If this date falls on a weekend or holiday, the deadline is extended to the next business day. Taxpayers can request an extension, allowing them additional time to file, but any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Required Documents

To successfully complete the Formulario 1040 en español, taxpayers should gather the following documents:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Records of other income, such as interest or dividends

- Documentation for deductions, such as mortgage interest statements or medical expenses

- Social Security numbers for dependents

Quick guide on how to complete formulario 1040 en espaol pdf

Complete Formulario 1040 En Espa ol Pdf effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers a suitable eco-friendly substitute for traditional printed and signed documents, as you can locate the right form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle Formulario 1040 En Espa ol Pdf on any device with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign Formulario 1040 En Espa ol Pdf without hassle

- Locate Formulario 1040 En Espa ol Pdf and click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, text message (SMS), invitation link, or download it to your PC.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Alter and eSign Formulario 1040 En Espa ol Pdf ensuring excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the formulario 1040 en espaol pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the formulario 1040 en español and how does it work?

The formulario 1040 en español is the Spanish version of the IRS Form 1040, used for individual income tax returns. It allows Spanish-speaking taxpayers to report their income and claim deductions in a familiar language. With airSlate SignNow, you can easily fill out, sign, and submit your formulario 1040 en español electronically.

-

Is there a cost to use the formulario 1040 en español feature?

Using the formulario 1040 en español with airSlate SignNow is part of our affordable pricing plans. We offer flexible subscription options that allow businesses to eSign documents without breaking the bank. Check our pricing page to see which plan suits your needs best.

-

What features does airSlate SignNow offer for the formulario 1040 en español?

airSlate SignNow provides several features for filling out the formulario 1040 en español, including easy document preparation, eSignature capabilities, and customizable templates. Our platform ensures all your documents are securely stored and easily accessible. Plus, we offer integration with other tools to enhance your workflow.

-

Can I track the status of my formulario 1040 en español submissions?

Yes, airSlate SignNow allows you to track the status of your formulario 1040 en español submissions in real-time. You will receive notifications when the document is viewed, signed, or completed. This feature helps you stay informed and manage your important tax documents efficiently.

-

Are there any integrations available for managing the formulario 1040 en español?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to manage your formulario 1040 en español alongside other software you use daily. Popular integrations include cloud storage services and project management tools to streamline your document workflow.

-

What are the benefits of using airSlate SignNow for the formulario 1040 en español?

Leveraging airSlate SignNow for the formulario 1040 en español simplifies the tax filing process. Our user-friendly platform reduces paperwork and enhances accuracy with built-in validation features. Additionally, you can save time and ensure compliance, making tax season less daunting.

-

Is the formulario 1040 en español compliant with IRS regulations?

Yes, the formulario 1040 en español provided through airSlate SignNow is compliant with IRS regulations. We ensure that all documentation adheres to the latest tax laws, providing you with peace of mind when filing your taxes. You can trust our platform to keep your information secure and accurate.

Get more for Formulario 1040 En Espa ol Pdf

Find out other Formulario 1040 En Espa ol Pdf

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free